Why After-Hours Demos Drive 30% Higher Revenue: The Demo Conversion Data

Executive Summary

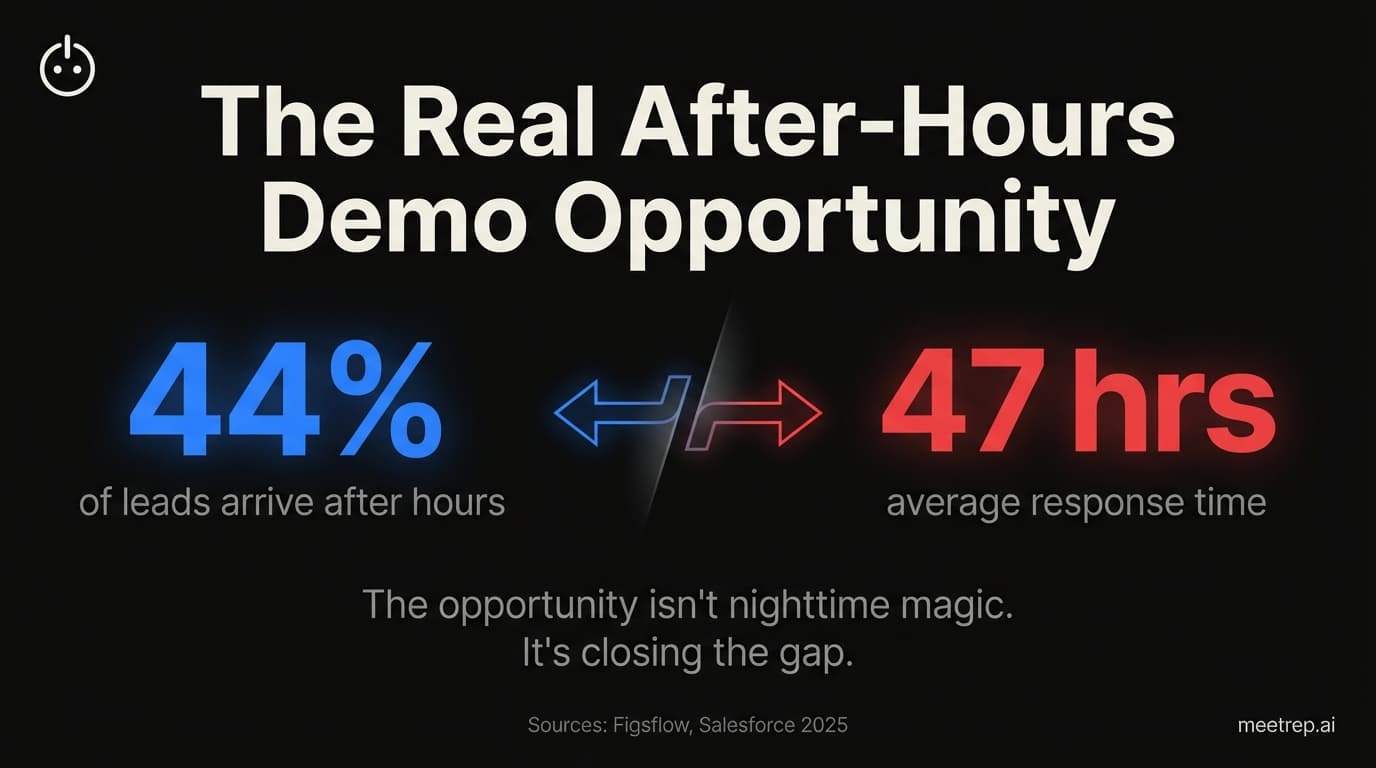

- 44% of B2B leads arrive outside business hours, but average response time is 38-47 hours

- Companies enabling 24/7 demo access see 30% higher revenue growth

- Speed matters more than timing: responding in 5 minutes makes leads 21x more likely to qualify

- The "30% nighttime" claim is misleading—it's about eliminating delays, not magic hours

- 61% of buyers now prefer a rep-free experience anyway

I need to be honest with you upfront. The "nighttime demos convert 30% higher" claim that's floating around LinkedIn? It's misleading. I spent weeks digging through demo conversion data from 2024-2025, and I couldn't find a single verified study proving that nighttime demos outperform daytime ones.

But here's what I did find—and it's actually more useful.

The real story isn't about magic nighttime hours. It's about a massive gap in how B2B companies handle the 44% of leads that arrive outside business hours. Companies that close this gap see up to 30% higher revenue growth. That's not nighttime conversion magic. That's math.

Having built sales automation tools at GoCustomer.ai and now at Rep, I've seen this gap destroy pipeline for years. Let me show you what the data actually says—and what to do about it.

What Does the Demo Conversion Data Actually Show?

Demo conversion data refers to the metrics tracking how prospects move from requesting a demo to becoming customers—including response times, completion rates, and close rates by segment and timing. And the data tells a different story than most people expect.

There's no evidence that demos conducted at 10 PM convert better than demos at 2 PM. In fact, ZoomInfo's analysis of 130,000+ sales meetings shows the opposite: evening scheduled demos (6-8 PM) have only a 45% completion rate, compared to 82% for Thursday afternoon slots.

So where does the "30% higher" claim come from?

It comes from companies that enable any demo access outside business hours—not from the specific timing of those demos. According to AgentiveAIQ's research citing SuperAGI data, companies using 24/7 AI sales agents report up to 30% higher revenue growth compared to those without round-the-clock coverage.

The difference isn't nighttime versus daytime. It's availability versus unavailability.

The Data: According to Figsflow's 2025 analysis, 44% of business leads are generated outside standard business hours. Yet the average B2B response time remains 38-47 hours. That's not a timing optimization problem. That's a black hole.

The 44% Problem: Where Your After-Hours Demos Should Be Happening

Here's what keeps me up at night. Nearly half of your inbound interest arrives when nobody's there to catch it.

Let me put some numbers to this. Figsflow's research shows 44% of business leads generate outside business hours. Multiple sources confirm that 35% of B2B website traffic occurs outside standard hours. And in one case study from CRTX Agent, 60% of high-value inquiries—we're talking $10K-$30K deals—arrived after 5 PM or on weekends.

Your highest-intent buyers are researching when you're offline.

I remember a conversation with a VP of Sales during the GoCustomer days. He pulled up his CRM and showed me the timestamps. A prospect had visited the pricing page at 9:47 PM, filled out a demo request at 9:52 PM, and... his team responded at 2:14 PM the next day. Seventeen hours later.

"We lost that deal," he said. "They went with a competitor who had a chatbot that booked a meeting instantly."

That story repeated itself dozens of times. Not because his reps were lazy—they were great. The model was broken.

Speed-to-Lead: The Data That Should Make You Angry

This is the part that genuinely shocked me when I dug into the demo scheduling data. The speed-to-lead research is brutal.

According to LeanData's 2025 analysis, leads contacted within 5 minutes are 21x more likely to qualify than those contacted after 30 minutes. Twenty-one times. That's not a rounding error.

And it gets worse.

Kixie's 2025 research citing Velocify found that responding within 1 minute can boost conversions by 391%. One minute. Who responds in one minute at 10 PM? Nobody with a human sales team.

But here's the stat that should make every sales leader angry: according to Salesforce's State of Sales 2025 data, the average B2B lead response time is 38 to 47 hours.

Forty-seven hours.

The 5-minute window closes. The 21x advantage disappears. And then, two days later, someone emails back.

Key Insight: The speed-to-lead multipliers are staggering:

- 5 minutes: 21x more likely to qualify (vs. 30 min)

- 1 minute: 391% conversion boost (vs. delayed response)

- First responder: 78% of customers buy from the first company to respond

- After 30 minutes: Qualification odds drop by 80%

- Industry average: 38-47 hours (you're giving deals away)

This is why the "nighttime demos" framing misses the point. It's not that 9 PM is magic. It's that 9 PM is when your prospect is researching, and nobody's there.

Demo Conversion Rates by Segment: The 2025 Benchmarks

Before we talk about solutions, let's establish baselines. What are normal demo conversion rates?

Optifai's 2025 Sales Ops Benchmark, analyzing 939 B2B companies, provides the clearest picture I've found:

| Segment | Demo-to-Close Rate | Notes |

|---|---|---|

| B2B Overall | 25% | Baseline across all segments |

| SaaS | 30% | Shorter cycles, higher conversion |

| SMB | 32% | Fastest decision cycles |

| Mid-Market | 25% | Matches overall average |

| Enterprise | 18% | Longer cycles, more stakeholders |

| Professional Services | 22% | Varies by complexity |

| Manufacturing | 20% | Longer evaluation periods |

Here's what's interesting: demo format matters more than most timing variables.

The same Optifai research found that interactive, prospect-driven demos convert at 38%—compared to just 18% for generic screen shares. That's a 111% improvement from changing the format, not the time slot.

Walnut's internal benchmarking confirms this pattern: interactive demos achieve 32% higher conversion rates and 67% completion rates compared to traditional static demos.

My take? Most companies are optimizing the wrong variable. They're debating whether to schedule demos for Tuesday or Thursday when the bigger opportunity is changing how demos happen—and when they're available.

What the Buyer Preference Data Says (And Why It Matters)

Here's something that might make traditional sales leaders uncomfortable. Buyers don't want to wait for your calendar.

According to Gartner's June 2025 Sales Survey of 632 B2B buyers, 61% now prefer a rep-free buying experience. Let that sink in. The majority of your prospects would rather explore your product alone than schedule a call with a rep.

This doesn't mean they don't want guidance. They don't want friction.

Sana Commerce's research backs this up: 73% of B2B buyers prefer to buy online. And 6sense's 2025 Buyer Experience Report shows that buying cycles have compressed from 11.3 months to 10.1 months, with buyers engaging sellers 6-7 weeks earlier than previous years.

Buyers want to move faster. They want access when they want it. And they want to explore before they commit to a conversation.

What we learned building Rep: When we started building Rep, we assumed people wanted better scheduled demos. We were wrong. What they wanted was demos available right now—when the prospect is engaged, regardless of time zone or business hours. The 61% rep-free preference isn't about avoiding humans. It's about avoiding delays.

The Best Time for B2B Demos (When You Still Need to Schedule Them)

Not every demo can be automated or self-serve. For complex enterprise deals or late-stage evaluations, you'll still schedule human-led demos. So what does the demo scheduling data say about optimal timing?

ZoomInfo's analysis of 130,000+ meetings in the Americas provides the clearest answer:

| Time Slot | Completion Rate |

|---|---|

| Thursday 2-4 PM | 82% |

| Tuesday-Wednesday 2-4 PM | 77% |

| Friday 10 AM-12 PM | 68% |

| Weekday 4-6 PM | 66% |

| Weekday 10 AM-12 PM | 63% |

| Evening 6-8 PM | 45% |

| Early 8-10 AM | 27% |

Thursday afternoon wins. And notice how evening slots (45%) underperform afternoon slots (82%). This contradicts the simplistic "nighttime is better" narrative completely.

Brian Vital, ZoomInfo's SVP of Sales Development, noted: "Anything outside of five working days is almost not worth booking, because the completion rate just drops so dramatically."

But here's what people miss. The 45% evening completion rate for scheduled human meetings doesn't contradict the 44% after-hours lead generation rate. They're measuring different things.

Scheduled evening meetings perform poorly because people don't want to sit on a video call at 7 PM. But those same people absolutely want to explore your product at 7 PM—on their own terms, when they're doing research.

Different behavior. Different solution.

How Companies Are Capturing the After-Hours Opportunity

So what actually works? Let me walk through what the data supports.

Instant booking tools boost conversion. Chili Piper's analysis of 4 million demo form submissions found that the industry average form-to-meeting conversion is just 30%. With immediate calendar booking, it jumps to 66.7%—a 122% improvement.

Interactive self-service demos capture high-intent visitors at any hour. GetContrast's study of 110,257 web sessions found interactive demos achieve 24.35% conversion versus 3.05% for traditional approaches—a 7.9x improvement. And sales cycles shortened from 33 days to 27 days.

AI sales agents enable true 24/7 coverage. The AgentiveAIQ research citing SuperAGI shows companies with 24/7 AI coverage see up to 30% higher revenue growth. One B2B SaaS company reduced response time from 12 hours to 9 seconds and saw a 40% conversion boost in three months.

The Data:Navattic's 2025 State of Interactive Product Demo Report, analyzing 28,000+ demos across 5,000 B2B websites, found 80% growth in interactive demos since 2022. Top performers achieve 84.4% engagement rates and 54% CTR. And ungated demos have 10% higher engagement than gated versions.

This is where we've focused with Rep. Rather than building another scheduling tool or static demo builder, we built for 24/7 demo availability—giving prospects access to product information and conversations whenever they're ready to engage. Because the data kept pointing us to the same conclusion: prospects want demo access now, not a calendar invite for next Tuesday.

Look, here's my honest take on all this demo conversion data: the opportunity is real, but it's been framed wrong.

Stop debating which hour to schedule demos. Start asking why prospects can't access your product the moment they're interested. The data shows that 44% of your leads arrive after hours, 78% of buyers choose the first responder, and 61% would prefer to explore without waiting for a rep's calendar.

At Rep, we built for 24/7 demo availability precisely because of this research. Not because 10 PM is magic—but because your prospect's interest at 10 PM is real, and making them wait until tomorrow means losing them to someone who didn't.

The 30% revenue growth is there for companies that figure this out. The data's pretty clear about that.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- What Does the Demo Conversion Data Actually Show?

- The 44% Problem: Where Your After-Hours Demos Should Be Happening

- Speed-to-Lead: The Data That Should Make You Angry

- Demo Conversion Rates by Segment: The 2025 Benchmarks

- What the Buyer Preference Data Says (And Why It Matters)

- The Best Time for B2B Demos (When You Still Need to Schedule Them)

- How Companies Are Capturing the After-Hours Opportunity

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.