The True Sales Engineer Cost: An ROI Calculator for 2025

Executive Summary

- A Sales Engineer costs $167,283 OTE on average—but the fully-loaded Year 1 cost is $210K-$250K

- 35% of SE demos go to unqualified prospects, wasting $58K+ annually

- Demo automation costs 5-10% of an SE at entry tier ($10K-$25K/year)

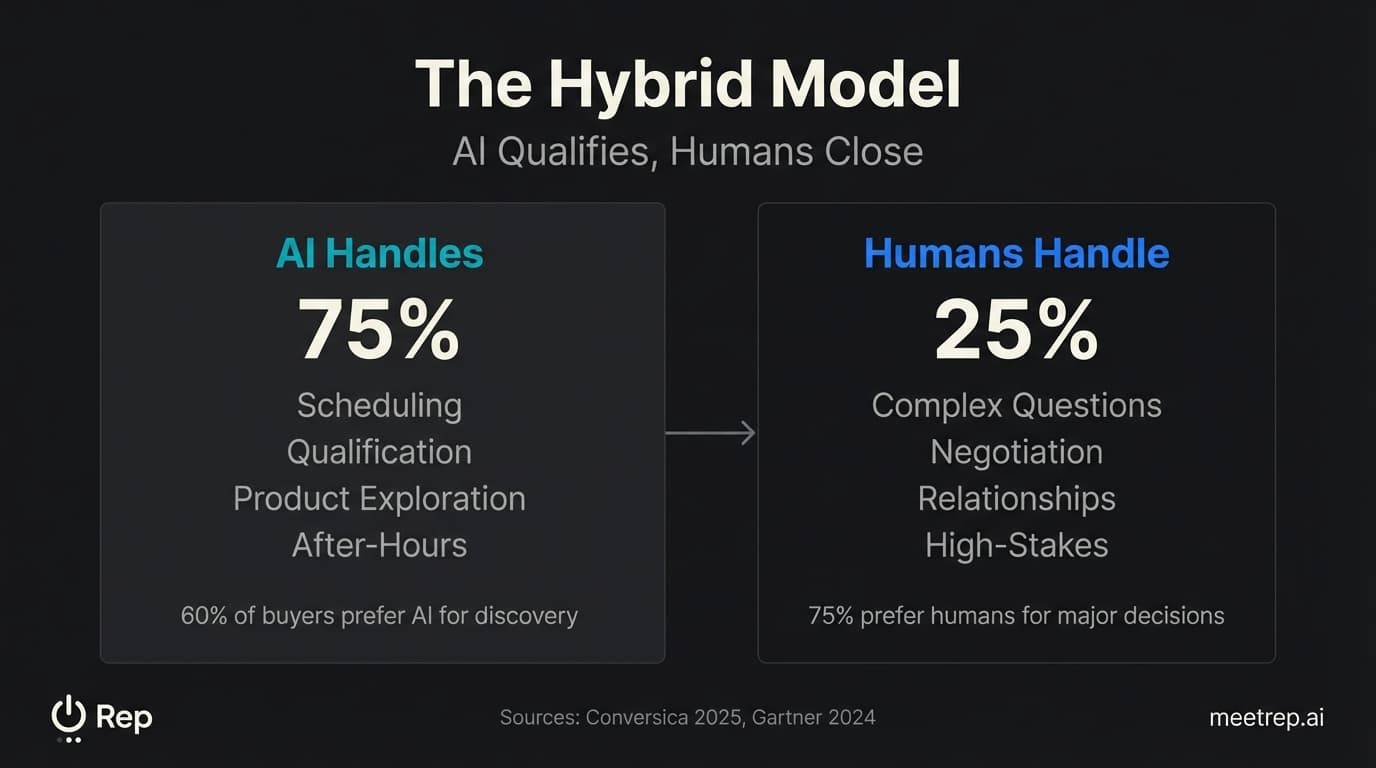

- The answer usually isn't "either/or"—it's a hybrid model most teams miss

Here's a number that should make you uncomfortable: $58,450.

That's what most companies burn annually on wasted SE time—demos delivered to prospects who were never going to buy. And that's before we talk about the real sales engineer cost, which runs $210,000 to $250,000 fully loaded in Year 1.

I've been building sales automation tools for years—first GoCustomer.ai, now Rep. And the question I hear constantly is: "Should I hire an SE or invest in demo automation?" Most content on this topic comes from vendors trying to sell you something. This isn't that. I'm going to show you the actual math, the hidden costs nobody mentions, and a framework for making this decision based on your specific situation.

How Much Does a Sales Engineer Actually Cost?

The true sales engineer cost goes far beyond base salary. The average SE earns $123,946 in base pay plus $43,337 in commission, totaling $167,283 OTE according to Consensus's 2025 SE Report. But that number is deceptive. It's not what you'll actually pay in Year 1.

Here's what the real math looks like:

| Cost Component | Amount | Source |

|---|---|---|

| Base + Commission (OTE) | $167,283 | Consensus 2025 |

| Benefits (30% of salary) | ~$50,185 | U.S. Bureau of Labor Statistics |

| Recruiting Fees (20% of Year 1) | ~$33,457 | Industry standard |

| Demo Tools & Tech Stack | $5,000-$10,000 | Market estimate |

| Subtotal Before Ramp | $255,925-$260,925 |

And we haven't even touched opportunity cost yet.

The Data:The average ramp-up time for sales roles is 5.7 months according to Salesso's October 2025 analysis. That's nearly half a year of salary before your SE is fully productive.

So what's the real number? When you factor in benefits, recruiting, tools, and the dead time during ramp, a single SE hire commits you to $210,000-$250,000 in Year 1. And that's assuming everything goes well.

It doesn't always go well.

The Hidden Cost Nobody Talks About: SE Replacement Risk

Sales turnover runs about 35% annually—roughly three times the average across other industries. When an SE leaves, you're not just losing a person. You're losing institutional knowledge, customer relationships, and months of training.

The Data:The cost to replace a sales employee ranges from 30% to 200% of their annual salary according to TekRecruiter and SHRM analysis from January 2026. For an SE earning $167K OTE, that's $50,000 to $334,000.

I've seen this destroy momentum at early-stage companies. You invest six months ramping someone, they hit their stride, and then they leave for a 15% raise. Now you're back to zero. And the recruiting cycle starts again.

The math gets ugly fast. A single bad hire—or even a good hire who leaves—can burn through $300K+ when you add up sunk recruiting costs, salary during ramp, replacement costs, and lost deals.

The 35% Problem: Where Your SE Budget Actually Goes

Here's the stat that changed how I think about this: 35% of presales demos are delivered to unqualified or underqualified prospects according to Consensus's September 2025 report.

More than one-third. Let that sink in.

Your SE making $167K OTE spends over a third of their time presenting to people who aren't going to buy. That's not their fault. It's a qualification problem, a process problem, and—honestly—a resource allocation problem.

Common mistake: Companies treat all demo requests equally. A Fortune 500 VP evaluating a $200K contract gets the same process as a solo founder kicking tires on a free trial. That's expensive.

Quick math: If 35% of your SE's capacity goes to junk demos, you're burning roughly $58,450 annually per SE on prospects who shouldn't be seeing a human yet.

And here's what makes it worse: 67% of SEs take at least 5 business days to deliver a demo according to research from Dock and Consensus. So while your SE is spending a week scheduling a call with an unqualified lead, your real prospects are waiting. Or worse—they're demoing with your competitor.

Demo Automation Economics: A Different Kind of Math

Demo automation platforms run anywhere from $10,000 to $150,000 per year depending on your needs. Let me break down the tiers:

| Tier | Annual Cost | % of SE Cost | What You Get |

|---|---|---|---|

| Entry (Navattic, Supademo) | $10K-$25K | 5-10% | Interactive product tours, basic analytics |

| Mid-Market (Walnut, Storylane) | $25K-$75K | 12-30% | Personalization, CRM integration, AI features |

| Enterprise (Consensus, Demostack, Reprise) | $75K-$150K | 35-60% | Full product clones, video demos, advanced analytics |

Even at the enterprise tier, you're paying 35-60% of what one SE costs. At the entry tier, it's 5-10%.

But cost comparison alone misses the point. Here's what actually changes:

| Factor | Human SE | Demo Automation |

|---|---|---|

| Availability | 40 hours/week, one timezone | 24/7/365, all timezones |

| Capacity | 15-20 demos/week max | Unlimited concurrent |

| Ramp Time | 5.7 months | Days |

| Consistency | Varies by person, day, energy | 100% playbook adherence |

| Marginal Cost/Demo | High (fixed capacity) | Near zero |

Why we built Rep this way: When we designed Rep, we focused on the demos that don't need a human—the intro walkthroughs, the "show me how it works" requests that come at 11pm. Rep joins video calls, shares its screen, and navigates your actual product. But for complex enterprise deals with custom architecture requirements? That's still a human conversation.

The economics shift when you think about what you're actually buying: not a replacement for humans, but a way to handle the 35% that shouldn't be going to humans in the first place.

The Buyer Behavior Shift You Can't Ignore

This isn't just about your costs. It's about what buyers want.

The Data:61% of B2B buyers now prefer a rep-free experience according to Gartner's June 2025 survey of 632 buyers.

That's not a slight preference. Nearly two-thirds of your prospects would rather explore your product without talking to a salesperson.

And here's the cost of ignoring that: 40% of buyers abandon when forced to "contact sales" according to TrustRadius research from 2024. You're losing almost half your interested prospects at the form fill.

But wait—maybe you think enterprise deals are different. They're not.

More than 50% of large B2B transactions over $1 million will be processed through digital self-serve channels by 2025 according to Forrester's predictions from October 2024. Self-service isn't just for SMB anymore.

The generational shift is real. 64% of B2B buyers are now Millennials or Gen Z—generations that grew up researching and buying without talking to humans. The expectation of self-service isn't going away. It's accelerating.

What the Performance Data Actually Shows

I was skeptical of demo automation ROI claims until I dug into the numbers from multiple sources. Here's what holds up:

The Data:Interactive demos close at 38% versus 25% for traditional screen-share demos—a 52% lift according to Optifai's analysis of 939 B2B companies.

Why the difference? My theory: interactive demos let prospects explore at their pace. They click on what matters to them, skip what doesn't. Traditional screen shares force everyone through the same linear path regardless of interest.

The data on AI-augmented selling is even more striking. Sellers who effectively partner with AI tools are 3.7x more likely to meet quota according to Gartner's 2024-2025 research. That's not a marginal improvement. It's a completely different performance tier.

And we're still early. By 2028, 60% of brands will use agentic AI for one-to-one interactions according to Gartner's January 2026 predictions. Emily Weiss, Senior Principal Researcher at Gartner, called this "the end of channel-based marketing as we know it."

The companies investing in this now are building capability while competitors are still debating whether to try it.

When to Hire a Human SE vs. When to Automate

So what's the actual answer? Here's the framework I use:

| Factor | Hire Human SE | Use Demo Automation | Hybrid Approach |

|---|---|---|---|

| Deal Complexity | Custom architecture, deep integrations, whiteboarding | Standard configurations, click-through tours | Automation qualifies, human closes |

| ACV | >$100K | <$50K | $50K-$100K |

| Sales Cycle | 6+ months, committee buying | <30 days, self-serve motion | 60-180 days |

| Demo Volume | <50/month | >100/month | 50-100/month |

| Buyer Persona | CTO, Enterprise Architect | End users, department heads | VP/Director level |

| Coverage Needs | Single timezone, business hours | Global 24/7 | Business hours + after-hours automation |

| Company Stage | >$20M ARR with sales team | Seed to $5M ARR | $5M-$20M ARR |

My recommendation: If you're under $5M ARR, demo automation is probably your better "first hire." You get 24/7 coverage, instant availability, and you preserve capital for when you actually need human presales expertise on complex deals. The math rarely makes sense to spend $210K+ on an SE when automation handles 60-70% of the job at 10% of the cost.

Hot take: The hybrid model is criminally underutilized. Most teams think it's either/or. The winners run both.

The Hybrid Model Most Teams Miss

Here's how the best teams I've seen structure this:

Tier 1: Self-Service (Automation)

- Prospects get instant access to interactive demos

- Available 24/7, any timezone

- Captures engagement data, buying signals

- Handles the "just want to see how it works" crowd

Tier 2: Qualification (Automation or Junior SE)

- Validates fit, use case, budget

- Routes based on deal potential

- Filters out the 35% that shouldn't reach senior SEs

Tier 3: Technical Deep-Dive (Senior SE)

- Custom POC work

- Architecture design

- RFP response

- The complex stuff that requires human judgment

The result? Your $167K SE focuses on the deals where their expertise actually moves the needle. The intro demos, the tire-kickers, the 2am requests—automation handles those.

I've seen teams effectively double their SE capacity without new hires using this model. Not because AI replaced the human, but because it handled the work that was never a good use of human time anyway.

How to Calculate Your Own ROI

Here's the framework you can use today:

Step 1: Calculate Your Fully-Loaded SE Cost

- Start with OTE (industry average: $167,283)

- Add benefits (multiply by 1.3 for 30% load): ~$217,000

- Add recruiting (20% of Year 1): ~$33,000

- Add tools ($5K-$10K)

- Year 1 Total: $255,000-$260,000 (with productivity loss during 5.7-month ramp)

Step 2: Calculate Your Waste

- Estimate your unqualified demo rate (industry average: 35%)

- Multiply by total SE cost: $167K × 0.35 = $58,450 wasted annually

Step 3: Calculate Automation Cost

- Entry tier: $10K-$25K

- Mid-market: $25K-$75K

- Enterprise: $75K-$150K

Step 4: Calculate Break-Even

- If automation reclaims 35% of SE time, value = $58K

- If platform costs $30K, break-even = ~6 months

- 3-year savings: ($58K × 3) - ($30K × 3) = $84K net

Step 5: Factor in Opportunity Cost

- What could your SE do with 35% more time on qualified deals?

- What revenue are you losing to demo delays and no-shows?

- What's the cost of losing 40% of prospects at "contact sales"?

Key Insight: The real ROI isn't just cost savings. It's revenue captured that you're currently losing to friction, delays, and misallocated resources.

The question isn't whether AI will handle demos. 60% of brands will use agentic AI for customer interactions by 2028 according to Gartner. The question is whether you'll be ahead of that curve or scrambling to catch up.

My honest take: the companies winning in 2025 aren't choosing between humans and automation. They're building systems where each handles what they do best. Automation absorbs the 35% waste. Humans close the deals that matter.

That $58K you're currently burning on unqualified demos? It could fund your automation layer for years. And your SE would finally have time for the work that actually requires their expertise.

The math is pretty clear. What you do with it is up to you.

If you want to see what AI-powered live demos actually look like, Rep is what we're building to solve exactly this problem.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- How Much Does a Sales Engineer Actually Cost?

- The Hidden Cost Nobody Talks About: SE Replacement Risk

- The 35% Problem: Where Your SE Budget Actually Goes

- Demo Automation Economics: A Different Kind of Math

- The Buyer Behavior Shift You Can't Ignore

- What the Performance Data Actually Shows

- When to Hire a Human SE vs. When to Automate

- The Hybrid Model Most Teams Miss

- How to Calculate Your Own ROI

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.