The Missing Dataset: What Sales Data Analytics Gets Wrong About Demo Intelligence

Executive Summary

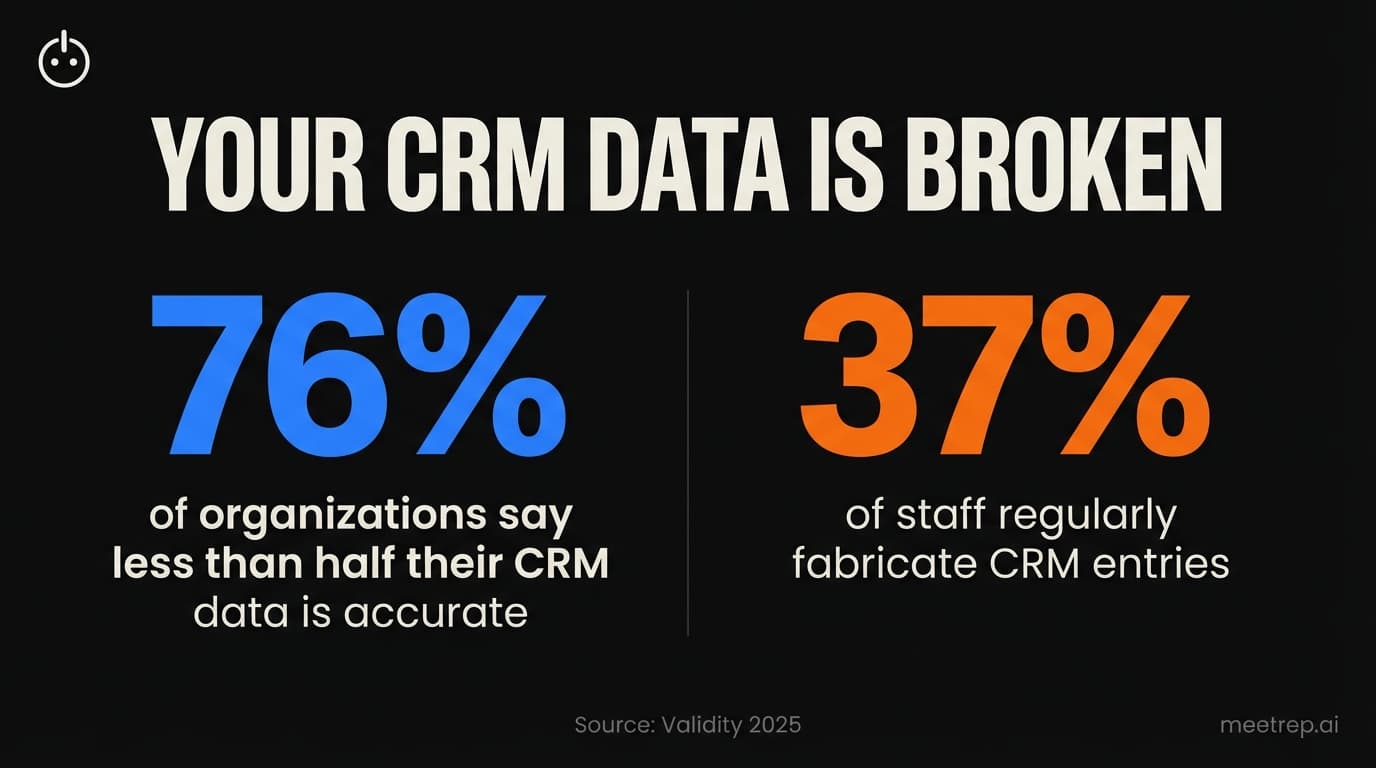

- 76% of organizations say less than half their CRM data is accurate—and 37% of staff fabricate entries

- 80-90% of sales data is unstructured "dark data" from voice, video, and demos that never gets analyzed

- Traditional conversation intelligence captures calls but misses product demos—the highest-intent moments

- AI demo agents can capture structured behavioral data (feature interest, objections, pain points) automatically

- Organizations lose 26% of revenue annually to "Revenue Leak" caused by these blind spots

Your CRM is lying to you.

Not because the data is wrong. Because it's empty. Or worse—fabricated. Validity's 2025 State of CRM Data Management report found that 37% of staff regularly make up CRM data to tell leaders what they want to hear. And even when reps try to log accurately, they're working from memory hours after a call ended.

I've watched this problem from both sides. At GoCustomer.ai, we built sales automation infrastructure. At Rep, we're building something different: AI that captures demo interactions in real-time. The gap between what happens in a sales conversation and what ends up in your CRM? It's massive. Most sales data analytics strategies completely miss it.

Here's what actually matters—and what RevOps teams need to capture. My bet is that most of you reading this have felt this pain but couldn't name it.

What Is Sales Data Analytics (And Why Most of It Fails)?

Sales data analytics is the systematic process of collecting, processing, analyzing, and acting on sales-related data to improve forecasting accuracy, identify pipeline risks, understand buyer behavior patterns, and ultimately drive revenue growth. It spans everything from deal stage tracking to conversation analysis to activity metrics.

But here's the problem: the analytics are only as good as the data feeding them.

And that data is mostly garbage.

According to Validity's 2025 report, 76% of organizations said less than half of their CRM data is accurate and complete. Think about that. Three-quarters of companies are building their entire sales strategy on a foundation where most of the data is wrong or missing.

The Data:Corefactors' 2024 Revenue Leak Report found that 71% of revenue leaders say their pipeline details and forecasts are hidden or inaccurate due to poor data quality. You're forecasting blind.

The root cause? Manual entry. Salesroom's 2024 research shows that 43% of sales professionals spend 10-20 hours weekly on note-taking and CRM data entry. That's half their week. And they're still not capturing most of what matters.

So what falls through the cracks?

The "Dark Data" Problem in Sales

Here's a stat that should scare every RevOps leader: Edge Delta reports that 80-90% of total data volume generated by businesses is unstructured—voice recordings, video, text, demo interactions—and it remains largely unanalyzed.

That's not a typo. Eighty to ninety percent.

This is what analysts call "dark data." Information you're technically collecting but never actually use for decision-making. In sales, dark data includes:

- Demo black holes: Which features did the prospect actually see? Which did they skip? Where did they hesitate? Nobody knows.

- Unlogged objections: The concern they raised at minute 23 of the call that the rep forgot to note

- Sentiment gaps: Was the buyer excited or skeptical? Did their tone shift when you mentioned pricing?

- Champion questions: What did your internal champion ask that indicated how they'd sell this internally?

Sound familiar? My experience building sales tools taught me this gap exists in every organization I've worked with.

Key Insight: The richest buyer signals—the moments that actually predict deal outcomes—happen during live product interactions. But most sales data analytics tools were built to measure what reps log, not what prospects do.

When we built GoCustomer.ai, I saw this constantly. The data that mattered most was trapped in formats nobody could use. Call recordings that sat unlistened. Demo sessions with zero tracking. Email threads where buying signals got buried.

The conversation intelligence market (Gong, Chorus, and others) solved part of this. They started capturing calls. But calls are only one piece. What about the product demo itself?

Why Conversation Intelligence Isn't Enough

Let me be direct: conversation intelligence tools are useful. They capture calls. They transcribe. They flag keywords.

But they miss the demo.

Think about a typical enterprise sales process. There's discovery calls, yes. But the highest-stakes interaction—the moment the prospect actually sees your product—often happens with screen sharing, live navigation, and real-time Q&A. That's where they reveal what features matter to them. That's where objections surface. That's where you see hesitation or enthusiasm.

What do most CI tools capture from that demo? A transcript. Maybe some speaker time ratios.

They don't capture which features the prospect spent time on. They don't know what was on screen when they asked a question about pricing. They can't tell you that the prospect skipped the integrations section entirely—which might be a dealbreaker signal.

| What Gets Captured | Traditional CI (Gong/Chorus) | AI Demo Intelligence |

|---|---|---|

| Voice transcript | ✓ | ✓ |

| Talk-listen ratio | ✓ | ✓ |

| Feature viewed | ✗ | ✓ |

| Time per feature | ✗ | ✓ |

| Navigation path | ✗ | ✓ |

| On-screen context for questions | ✗ | ✓ |

| Structured pain point extraction | Partial | ✓ |

| Real-time objection logging | ✗ | ✓ |

This isn't a knock on conversation intelligence. It's a recognition that the category solved one problem and left another completely dark.

What we learned at GoCustomer: We spent months trying to stitch together call data with product analytics. The gap was always the demo itself. What happened during those 30-45 minutes of screen sharing was invisible. That's why we built Rep differently. My frustration with this exact problem is what drove the product direction.

What AI Demo Intelligence Actually Captures

Here's where sales data analytics is heading—and where most RevOps teams haven't caught up yet.

AI demo agents don't just record. They participate. They navigate your product live, share their screen, and have voice conversations with prospects. And because they're controlling the browser and responding in real-time, they capture structured data that human-led demos never could.

Navigation behavioral data:

- Which features were shown (and which were skipped)

- Time spent per feature or page

- Scroll depth and click patterns

- "Back button" moments that signal confusion

Voice and conversation data:

- Pain points explicitly stated

- Questions asked (categorized: technical, pricing, implementation)

- Objections raised with sentiment scoring

- Buying signals ("When could we start?" vs. "We'll think about it")

Visual context data:

- What was on screen when a question was asked

- Error messages encountered (friction points)

- "Aha moment" timestamps

Structured extraction: Instead of a transcript you have to read, you get fields: Pain Point = "Integration complexity." Priority Feature = "Reporting dashboard." Objection = "Concerned about implementation timeline."

That's the difference. Not more data. Structured data that actually flows into your CRM and pipeline analytics.

Rep's Intelligent Extraction Engine does this automatically. During every demo, it identifies action items, pain points, decisions, and follow-ups—with confidence scores and speaker attribution. No rep logging required.

The Revenue Cost of Missing Demo Data

Let's put a number on this.

Clari's 2024 Revenue Leak Report found that organizations lose 26% of global revenue to "Revenue Leak"—process breakdowns, data silos, and disjointed handoffs.

Twenty-six percent. A quarter of your revenue, gone to blind spots.

Where does that leak happen? The handoff between demo and follow-up. The objection that never got logged. The champion who needed a leave-behind demo to share internally but didn't get one. The high-intent signal that stayed dark.

The Data:Salesforce's State of Sales 2024 found that sales teams using AI saw 83% revenue growth compared to 66% for teams without—a 17-point gap. But only if they're capturing the right data to feed those AI systems.

And here's what kills me: Consensus's 2025 research shows that deals with 9+ demo views have 8-10× higher close rates than low-engagement deals. But if you're not tracking demo engagement, you can't prioritize those high-intent prospects.

You're leaving money on the table. Specifically, you're leaving about a quarter of it.

What RevOps Teams Actually Need

Okay, enough about problems. What should you actually do?

Based on building in this space and talking to RevOps leaders, here's the framework that works:

1. Audit your "dark data" gaps.

Map where leads go dark without explanation. Deals that stalled in "Demo Completed" with no notes. Win/loss analyses that cite "unknown reasons." If you don't know which features prospects viewed during demos, you have a dark data problem.

2. Separate structured from unstructured capture.

Transcripts are nice. Structured fields that auto-populate your CRM are better. When you evaluate any demo or conversation tool, ask: does this give me searchable, filterable, CRM-compatible data? Or just more recordings to not listen to?

3. Prioritize real-time over retrospective.

The best time to capture buyer intent is while it's happening. AI that participates in demos captures signals a recording can only guess at. The prospect's tone when they see pricing. The question they ask while looking at the integrations page.

4. Connect demo data to deal outcomes.

This is where it gets powerful. If you know that prospects who spend 3+ minutes on the reporting feature close at 2× the rate, you can train reps to emphasize reporting. If you know that skipping the API section correlates with churn, you can flag those deals for technical follow-up.

5. Measure the right things.

Not just "demos completed." Track demo engagement scores. Demo-to-opportunity conversion by engagement level. Time from demo to follow-up. Feature interest correlation with win rate.

One caveat: this approach works best for teams with 10+ demos per week. If you're running fewer, the manual logging might still be manageable. My recommendation is to start with the audit before buying any tools.

Rep does all of this automatically—captures the demo, extracts structured insights, syncs to your CRM, and gives you a dashboard showing which behavioral signals predict closed deals. But even if you're not using Rep, the framework applies.

Here's the reality: Gartner predicts that by 2026, 75% of the highest-growth companies will deploy a RevOps model. The teams that win will be the ones capturing complete data—including the demo interactions everyone else ignores.

Sales data analytics isn't about more dashboards. It's about capturing the signals that actually predict what happens next.

At Rep, we built our entire architecture around this idea. An AI agent that joins demos, navigates your product live, extracts structured insights, and syncs to your CRM without a rep touching the keyboard. No more demo black holes. No more manual logging. No more dark data.

Your CRM has been lying to you. Maybe it's time to give it better information.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- What Is Sales Data Analytics (And Why Most of It Fails)?

- The "Dark Data" Problem in Sales

- Why Conversation Intelligence Isn't Enough

- What AI Demo Intelligence Actually Captures

- The Revenue Cost of Missing Demo Data

- What RevOps Teams Actually Need

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.