The Business Case for Autonomous Demo Agents: An Executive's Guide to AI Demo ROI

Executive Summary

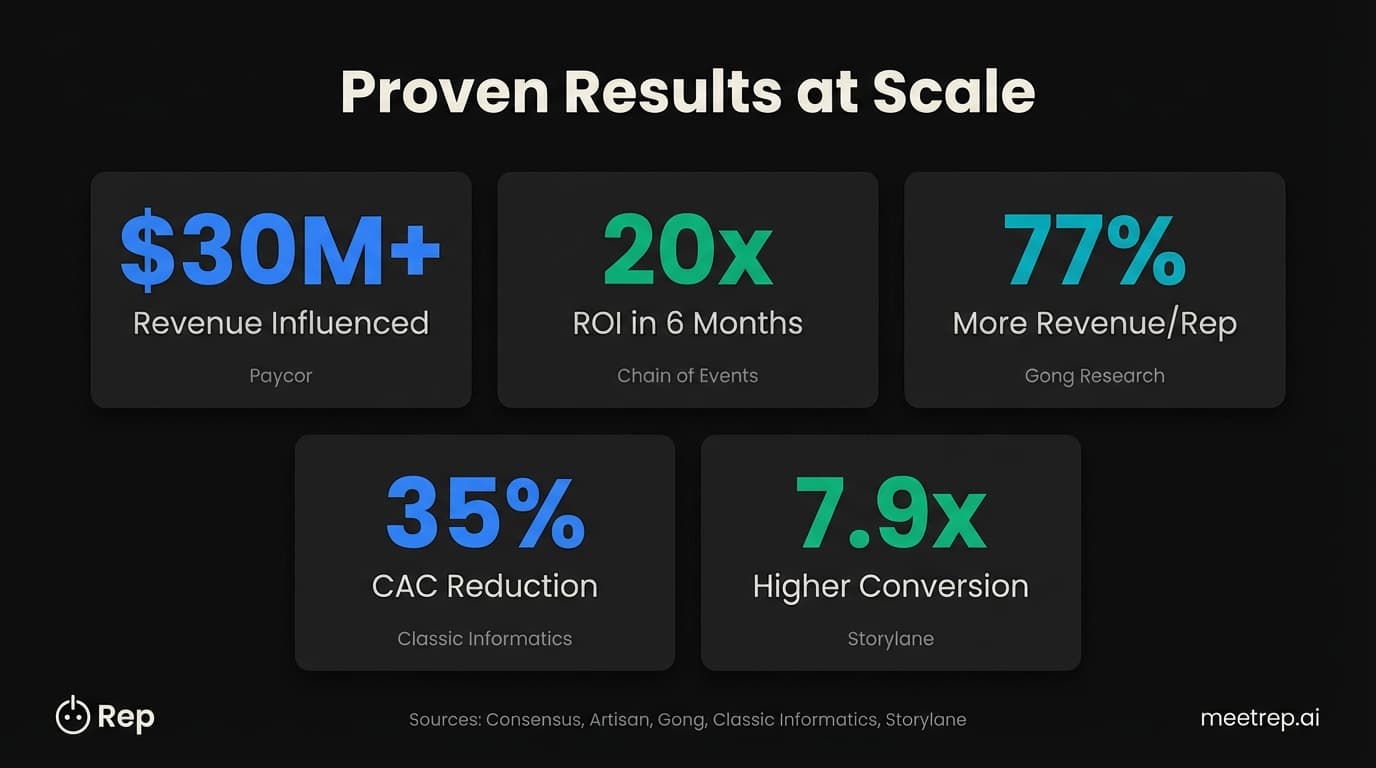

- Demo automation drives measurable outcomes: 7.9x higher conversion, 35% lower CAC, and $30M+ revenue influence documented at enterprise scale

- 87% of sales leaders face CEO/board pressure to deploy AI—this isn't optional anymore

- Buyers prefer AI for early-stage discovery (60%), but prefer humans for high-stakes decisions (75% by 2030)—the winning model is hybrid

- ROI timeline: 7 months median, with outliers hitting 20x returns in 6 months

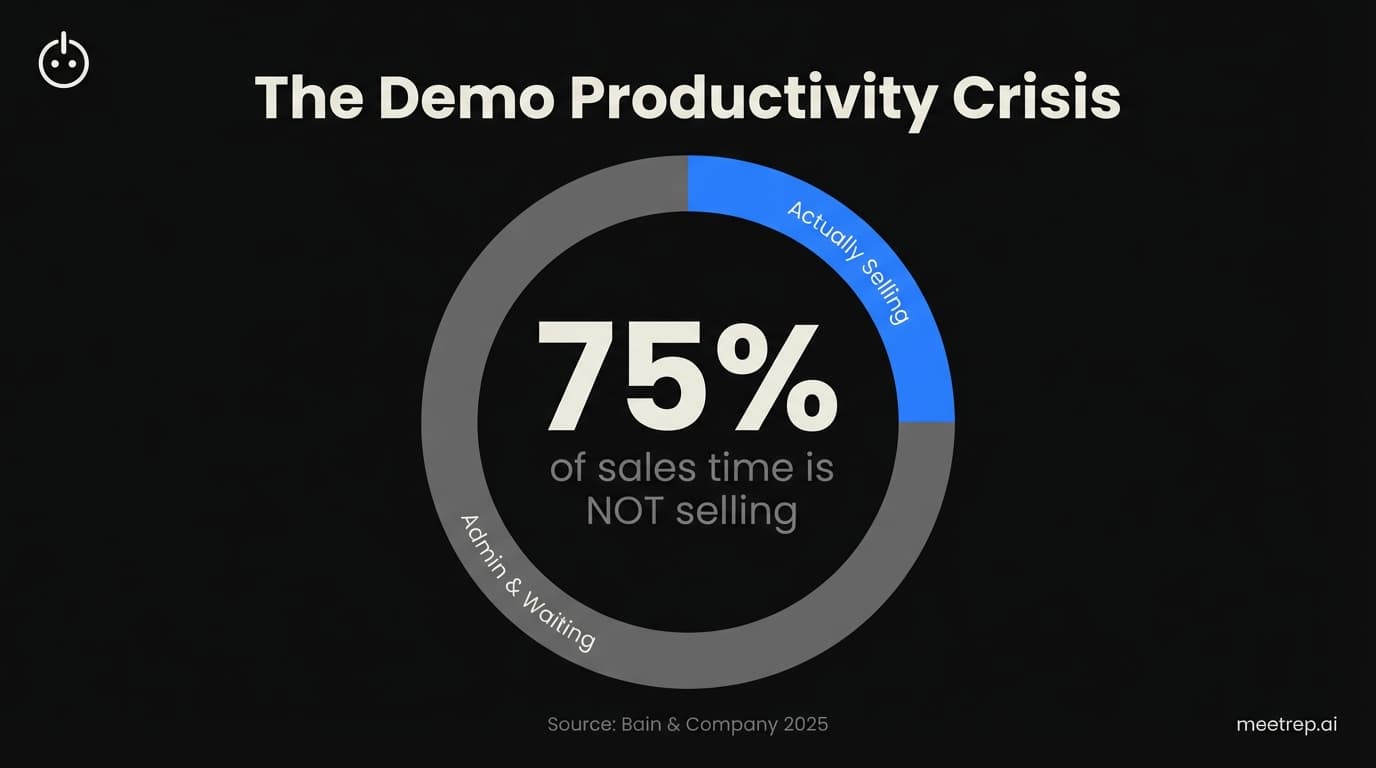

Your sales team spends 75% of their time not selling.

That's not a typo. According to Bain & Company's 2025 research, sellers spend only about 25% of their time actually selling to customers. The rest? Admin. Scheduling. Waiting. And delivering repetitive demos to prospects who may never buy.

I've spent years building sales automation tools—first at GoCustomer.ai, now at Rep. And here's what I've learned: the demo layer is where deals go to die. Not from lack of interest. From friction. Understanding AI demo ROI isn't about chasing shiny technology. It's about fixing the most expensive bottleneck in your pipeline.

This guide gives you the hard numbers and frameworks you need to build a business case that actually gets approved.

Why Your Demo Process Is Bleeding Revenue

Demo scheduling friction kills more deals than bad product-market fit. And the numbers prove it.

Consensus's 2025 SE Workload Report found that 67% of sales engineers take 5+ business days to deliver a demo. Five days. In a world where your competitor's website loads in 2 seconds. That's not a gap—it's a canyon.

But speed isn't even the biggest problem. It's waste. The same research shows that 30-50% of demos delivered are unqualified—prospects who were never going to buy, eating hours of your most expensive technical resources.

The Data: Demo no-show rates hit 20-40% industry-wide, reaching 75% at some companies before intervention. Every missed demo costs you SE time, pipeline momentum, and often the deal itself. (Reply.io 2024, 11x.ai case studies)

Sound familiar? Most sales leaders I talk to know this pain intimately. They feel the SE bottleneck. They see the no-shows pile up. They watch qualified prospects go dark after waiting a week for a demo.

The math is brutal. If your SE costs $150K fully loaded and wastes 40% of their demo time on unqualified prospects, you're burning $60K per SE per year on nothing. Scale that across a team. It adds up fast.

And here's what really frustrates me: we've known this for years, but most "solutions" just move the bottleneck around. Self-serve click-through demos? Great for marketing. But they don't have conversations. They don't answer questions. They don't close deals.

What Buyers Actually Want (It's Not What You Think)

Here's where the conventional wisdom gets it wrong. The pitch for demo automation usually sounds like this: "Buyers want self-service! They don't want to talk to salespeople!"

Partially true. Mostly misleading.

Conversica's 2025 research found that 60% of buyers prefer AI agents during the exploratory and education phases. But why? Not because they hate people. Because they want information without the sales pressure. They want to learn at their own pace, ask "dumb" questions without judgment, and explore before committing to a conversation with an AE who has quota to hit.

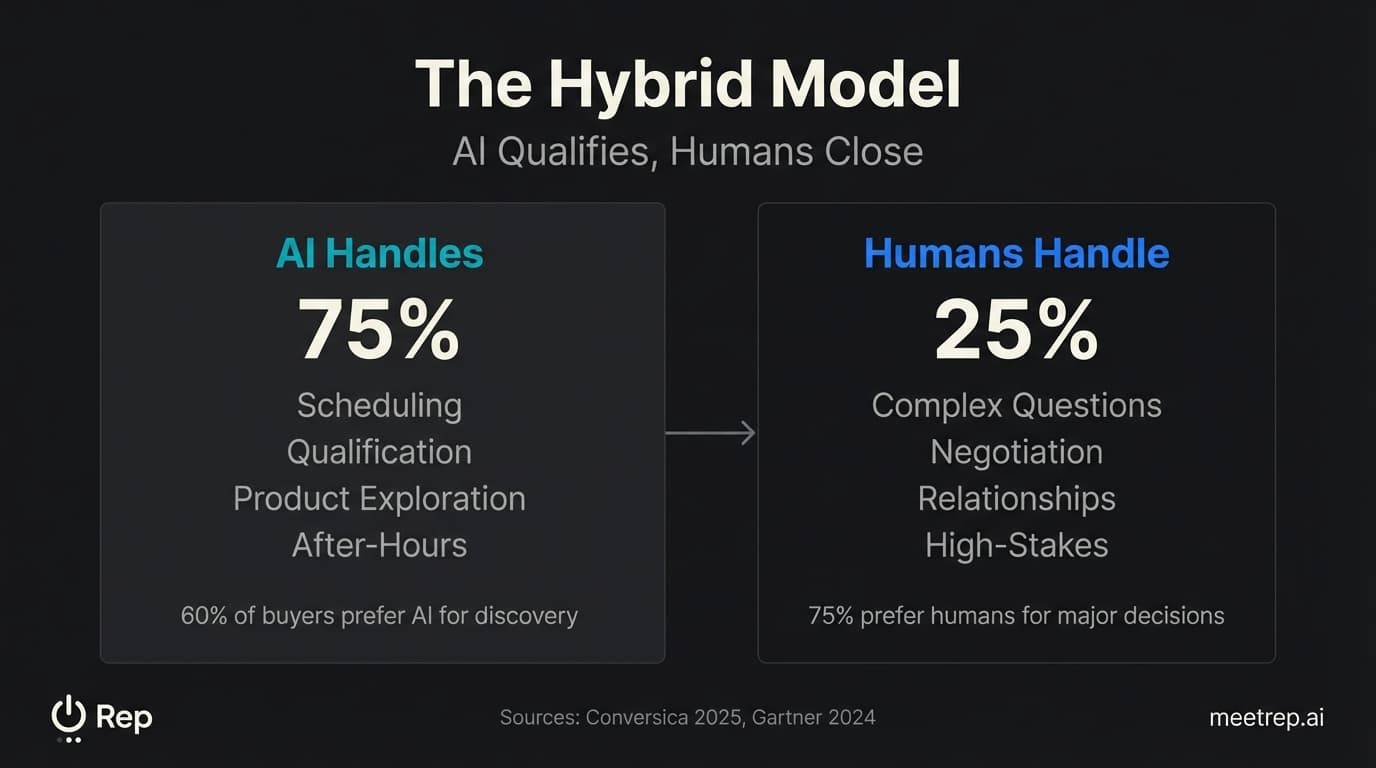

Key Insight: Buyers prefer AI for speed in discovery. They prefer humans for trust in closing. The winning model isn't "replace humans with AI"—it's "AI qualifies, humans close."

Gartner's 2024 prediction confirms this distinction: by 2030, 75% of B2B buyers will prefer human interaction for high-stakes decisions. Enterprise deals, complex implementations, strategic partnerships—these still need humans.

So what does this mean for your demo strategy?

The answer is hybrid. AI handles the 75% of non-selling time: scheduling, initial qualification, repetitive product walkthroughs, after-hours requests. Humans handle the 25% that actually requires expertise: complex technical questions, negotiation, relationship building.

This isn't a compromise. It's an optimization. Your best SEs stop wasting time on tire-kickers. They focus on the deals that need their expertise.

The Real ROI: What Case Studies Actually Show

Let's talk numbers. Not projections. Not vendor claims. Documented results from named companies.

Revenue Impact

Paycor's implementation with Consensus influenced over $30M in revenue. They also saw a 30% increase in presales capacity—equivalent to 9 additional FTEs—without adding headcount. Their sales cycle shortened by 18%.

Chain of Events deployed Artisan's AI BDR and generated $700K ARR in 6 months on a $28K investment. That's 20x ROI. Not over three years. Six months.

VentureBeat reported that teams using AI tools generate 77% more revenue per rep—a six-figure difference per salesperson annually.

Efficiency Gains

Classic Informatics' 2025 analysis documented 35% CAC reduction for companies embedding agentic AI across their sales stack. That's not from working harder. It's from automating prospecting and qualification.

Gainsight's results with Demostack showed demo response times dropping from 48 hours to 1 hour—a 97.9% improvement. Their win rates increased 25%.

What we learned building Rep: When we architected Rep's system, we focused on one metric above all others: time-to-demo. Every day a prospect waits, your competitor gets closer. The goal isn't just automation—it's instant access to your product story.

Conversion Improvements

Storylane's analysis of 110,257 web sessions showed 7.9x higher website conversion when prospects engaged with interactive demos—from 3.05% to 24.35%.

Chili Piper's data from 4 million form submissions found that immediate booking doubles inbound conversion: from 30% to 66.7%.

The pattern is clear: speed and interactivity drive conversion. The question is how you deliver both at scale.

Beyond Click-Throughs: Why Architecture Matters

Not all demo automation is created equal. And this is where I'll get opinionated.

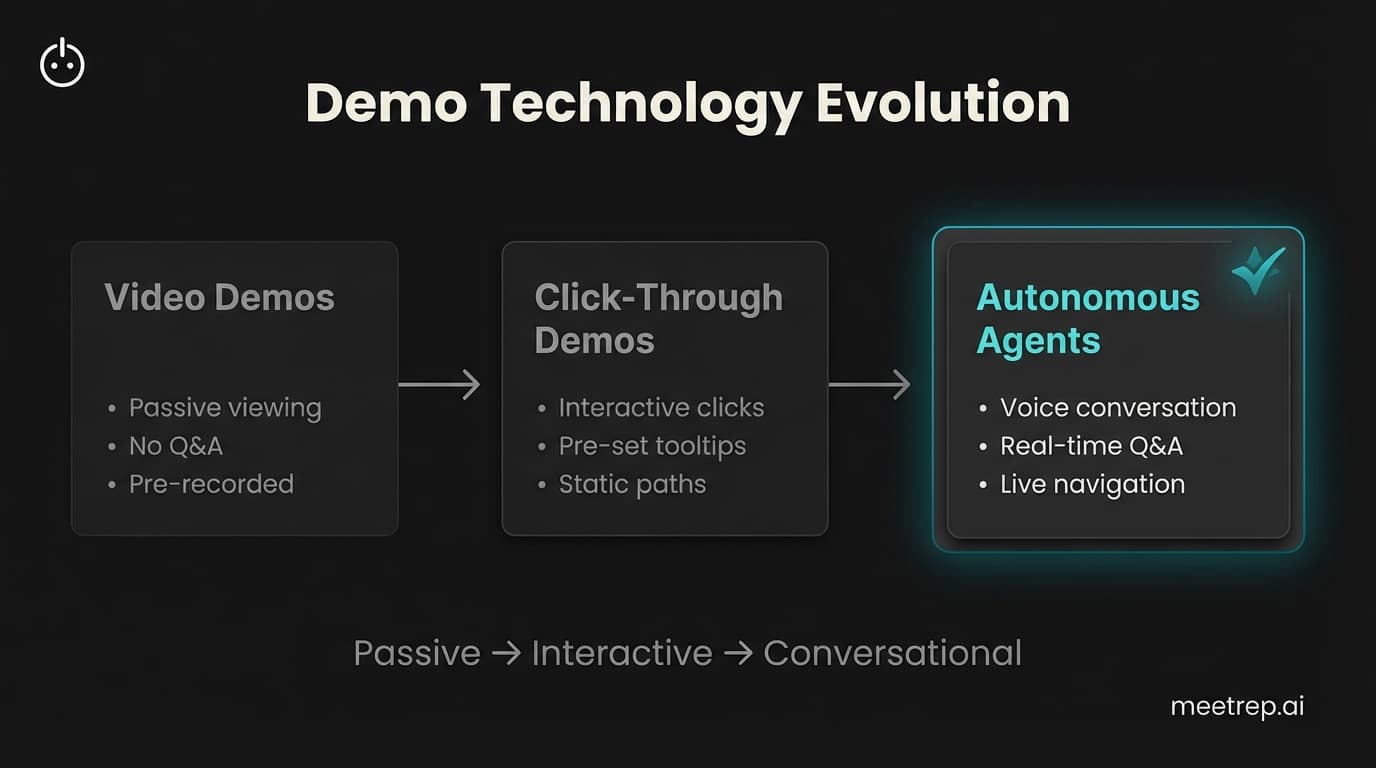

The market has three generations of solutions:

| Capability | Video-Based (Consensus) | Click-Through (Navattic, Walnut) | Autonomous Agents (Rep) |

|---|---|---|---|

| Interaction mode | Passive viewing | Mouse clicks on screenshots | Voice conversation + live navigation |

| Q&A capability | None | Pre-set tooltips | Real-time, context-aware |

| Environment | Pre-recorded video | Cached HTML/screenshots | Live browser |

| After-hours availability | Yes (passive) | Yes (passive) | Yes (active conversation) |

| Best for | Stakeholder enablement | Website marketing | Live demo replacement |

Video demos (Consensus) work well for multi-threading—sharing product info with buying committees. But they can't answer questions. When a CFO asks "How does pricing work for our use case?" the video just keeps playing.

Click-through demos (Navattic, Walnut, Storylane) are great for website embeds. That 7.9x conversion stat? Real. Valuable. But click-throughs are static. They show a pre-defined path. They don't adapt to what the prospect actually cares about. And they definitely don't have conversations.

Autonomous demo agents represent something different: AI that can talk AND show simultaneously. That joins video meetings as a participant. That navigates your actual product live while answering questions in natural conversation.

This isn't incremental improvement. It's architectural.

At Rep, we built this capability because we kept hitting the same wall with earlier approaches. Click-throughs couldn't handle the "wait, can you show me that again?" moments. Videos couldn't pivot when a prospect said "I don't care about that feature—show me integrations." Live navigation plus voice conversation solves both.

Key Insight: The reliability question matters. Salesforce's internal AI agents handled 1 million requests with 93% accuracy (Alpha Corp 2024). That's the benchmark. Hallucination risk is real but manageable with proper knowledge bases and guardrails.

How to Calculate AI Demo ROI for Your Business

AI demo ROI measures the financial return from replacing manual, scheduled product demonstrations with automated, on-demand alternatives. It quantifies revenue acceleration, costs avoided, and efficiency gains—not just time saved. Here's the framework:

Step 1: Quantify current demo costs

SE fully-loaded salary ÷ demos per month = cost per demo. Typical range: $200-500 per demo. Don't forget the 30-50% unqualified rate—those demos cost the same but return nothing.

Step 2: Measure time recaptured

Hours saved per SE × hourly rate × number of SEs. Baseline: if 67% of your SEs take 5+ days to deliver demos, you have massive room for improvement.

Step 3: Calculate conversion uplift

Current demo-to-close rate × documented improvement rate. Conservative: 15-25% improvement. Aggressive (with strong implementation): 25-50%.

Step 4: Factor sales cycle reduction

Average deal value × cycle reduction percentage. Documented ranges: 18% (Paycor) to 50% (Hireology with Reprise).

Step 5: Compute total ROI

(Annual benefits - platform cost) ÷ platform cost × 100.

| ROI Component | Conservative Estimate | Aggressive Estimate | Source/Benchmark |

|---|---|---|---|

| SE time saved | 30% capacity gain | 50% capacity gain | Paycor: 30% (9 FTE equivalent) |

| CAC reduction | 20% | 35% | Classic Informatics: 35% |

| Revenue per rep | +40% | +77% | VentureBeat/Gong: 77% |

| Sales cycle | 15% faster | 30% faster | Paycor: 18%, Hireology: 50% |

| Payback period | 12 months | 6 months | Chain of Events: 6 months |

Target: 300%+ ROI within Year 1 based on Forrester TEI methodology benchmarks.

My recommendation: Start your calculation with the 30-50% unqualified demo rate. That's where the waste is hiding. If you can reclaim even half of that SE time, you've already justified the investment.

Addressing the Three Objections You'll Hear

Your executive team will push back. Here's how to respond.

"AI demos will hallucinate and embarrass us"

Valid concern. Bad implementation. The solution isn't avoiding AI—it's implementing it with guardrails. Salesforce's internal agents hit 93% accuracy handling a million requests. That's achievable.

At Rep, we built "Playbook" and "Guardrails" features specifically for this. The AI doesn't improvise answers about pricing or capabilities—it pulls from a verified knowledge base. When it doesn't know something, it says so and escalates to human.

"Buyers hate talking to bots"

The data says otherwise. 60% prefer AI for exploration (Conversica 2025). They prefer it specifically to avoid aggressive human sales tactics.

But—and this matters—they prefer humans for closing. Position AI demos as qualification and education, not replacement. "Talk to Rep to explore the product, then book time with an AE when you're ready to discuss implementation."

"Implementation will take forever and become shelfware"

Time-to-value is shorter than most enterprise software. Paycor implemented Consensus in one week. Arcade's data shows median demo publish time of 6 minutes.

The shelfware risk is real for any software. Mitigate it with clear success metrics, phased rollout, and executive sponsorship. Start with one use case (inbound demo requests), prove ROI, then expand.

Building Your Business Case: The CFO Template

Your CFO thinks in three buckets: costs, risks, and returns. Structure your business case accordingly.

Current State Costs (What You're Paying Now)

- SE salary × % time on unqualified demos (30-50%)

- Opportunity cost: prospects who ghosted while waiting 5+ days

- No-show waste: 20-40% of scheduled demo time

Projected Benefits (What You'll Gain)

- Revenue impact: Apply 77% revenue-per-rep benchmark to your AE count

- CAC improvement: Apply 35% reduction to current CAC

- Capacity gain: Apply 30% presales capacity increase

Risk Mitigation (Why This Won't Fail)

- Start with pilot: one product line, 90-day measurement

- Hybrid model: AI qualifies, humans close

- Phased rollout: website demos → meeting assistance → full autonomy

Timeline to Value

- Implementation: 1-4 weeks

- First metrics: 30-60 days

- Full ROI: 6-12 months

- Benchmark: 20x ROI at 6 months (Chain of Events)

The Data: 87% of sales leaders report direct pressure from CEOs and boards to deploy generative AI (Gartner 2024, Cirrus Insight 2025). If you're not presenting this business case, someone else on your leadership team probably is.

The window for "we're evaluating AI" is closing.

81% of sales teams are already experimenting with or deploying AI tools. 87% of leaders face board-level pressure to act. And the gap between AI-enabled teams and laggards is growing—29% higher sales growth for adopters, according to Gong's 2024 research.

My take: autonomous demo agents aren't about replacing your team. They're about fixing a broken process that's been bleeding revenue for years. The question isn't whether to deploy AI for demos. It's whether to lead the shift or follow it.

Ready to see what autonomous demos look like in practice? Watch Rep deliver a live demo—no humans required, no scheduling needed.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- Why Your Demo Process Is Bleeding Revenue

- What Buyers Actually Want (It's Not What You Think)

- The Real ROI: What Case Studies Actually Show

- Beyond Click-Throughs: Why Architecture Matters

- How to Calculate AI Demo ROI for Your Business

- Addressing the Three Objections You'll Hear

- Building Your Business Case: The CFO Template

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.