The 2026 State of Autonomous Sales Report

Executive Summary

- AI adoption in sales nearly doubled: 24% (2023) → 43% (2024), with 81% now experimenting or implementing

- AI-enabled teams see 83% revenue growth vs 66% for non-AI teams—a 17-point gap

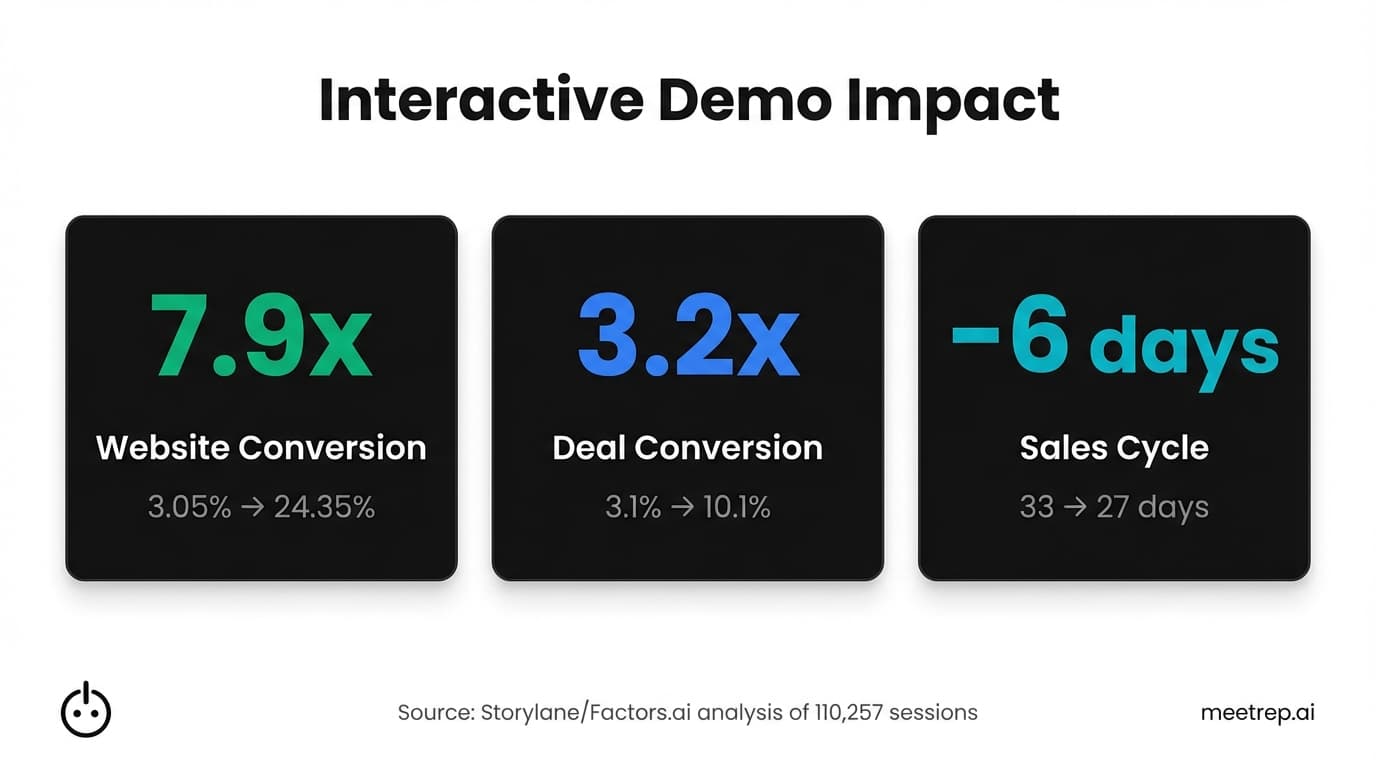

- Interactive demos improve deal conversion by 3.2x and cut sales cycles by 6 days

- Only 6% of organizations qualify as "AI high performers" with 5%+ EBIT impact

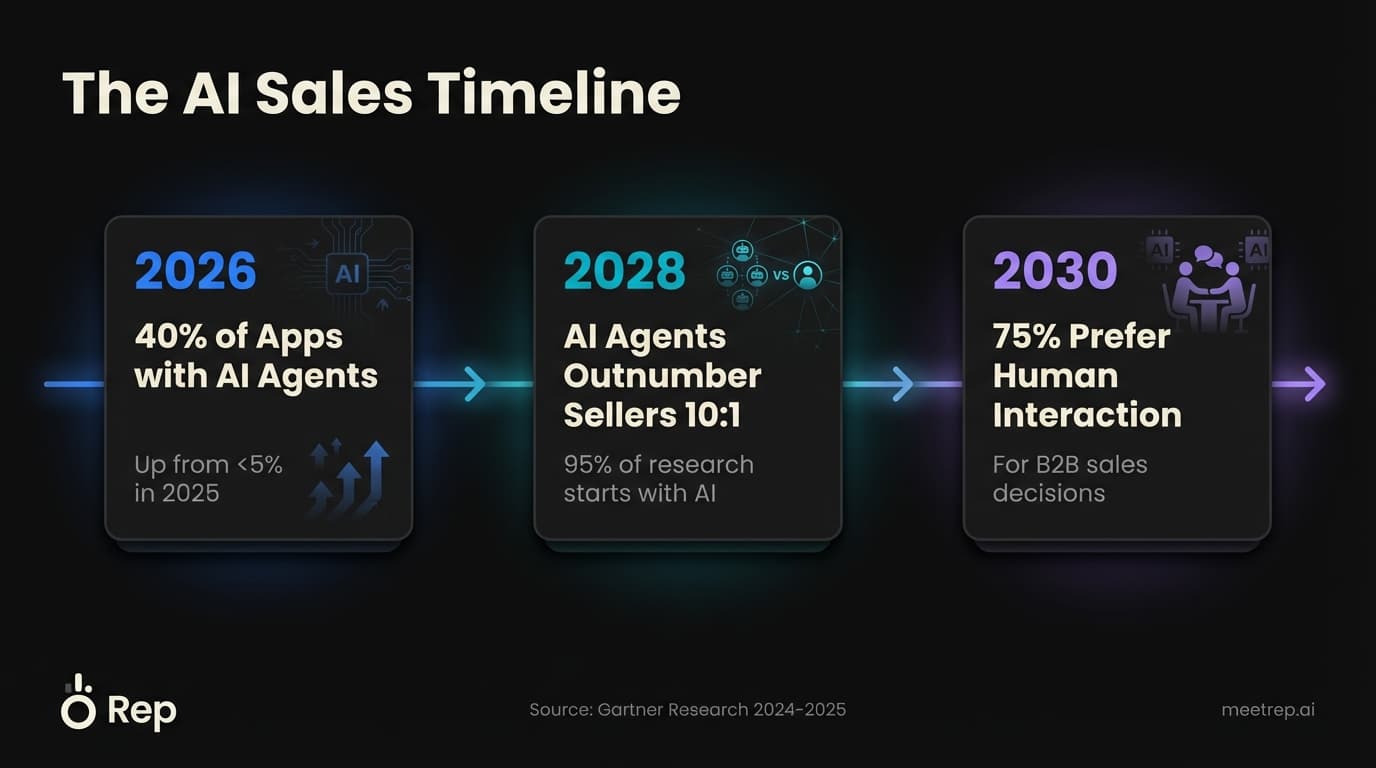

- By 2028, AI agents will outnumber human sellers 10:1—but 75% of buyers will still prefer humans by 2030

Sales has a math problem—and this sales automation report reveals exactly how bad it's gotten.

Your reps spend just 28-30% of their time actually selling, according to Salesforce's 2024 State of Sales report. The rest? CRM updates, email admin, scheduling. Meanwhile, 70% of your buyers prefer to research without talking to a rep at all.

I've spent years building sales automation products—first at GoCustomer.ai, now at Rep. And here's what the data shows: the gap between AI adopters and everyone else is now 17 points in revenue growth. That's not a trend. That's a chasm.

But adoption numbers are misleading. Most companies are "experimenting." Few are winning.

Let's look at what actually separates them.

Where sales AI adoption actually stands

Sales AI adoption is no longer early-adopter territory. It's becoming table stakes. According to McKinsey's November 2025 State of AI report, 78% of organizations now use AI in at least one business function—up from 55% in 2023.

For sales specifically, the acceleration is sharper. HubSpot's 2024 data shows adoption jumped from 24% to 43% in a single year.

And that number keeps climbing.

The Data:Salesforce's State of Sales (6th Edition) found that 81% of sales teams are now experimenting with or have fully implemented AI. The "should we adopt AI?" debate is over.

But here's what those numbers hide. "Experimenting" is doing a lot of work in that sentence. At GoCustomer, we saw the pattern constantly: teams buy tools, run a pilot, and then... nothing. The tool sits there. Reps ignore it. Leadership calls it "implemented."

The real question isn't adoption. It's outcomes.

| Adoption Metric | 2023 | 2024/2025 | Source |

|---|---|---|---|

| AI use in any business function | 55% | 78% | McKinsey State of AI |

| AI adoption in sales | 24% | 43% | HubSpot |

| Sales teams experimenting/implementing AI | — | 81% | Salesforce |

| BDRs using at least one AI tool | 53% | 62% | 6sense |

| Organizations qualifying as "AI high performers" | — | 6% | McKinsey |

That last row matters most. Only 6% of organizations see 5%+ EBIT impact from AI. Everyone else is somewhere between "bought it" and "using it well."

The 17-point revenue growth gap

Here's the number that should worry you if you're still on the fence: AI-enabled sales teams are pulling away.

According to Salesforce's 2024 research, 83% of teams using AI report revenue growth, compared to 66% of non-AI teams. That's a 17-point gap.

Not a slight edge. A chasm.

Key Insight: The competitive gap isn't about having AI—it's about having AI that actually gets used. The 17-point growth difference comes from teams where automation is embedded in daily workflows, not sitting in a dashboard nobody opens.

And the ROI data backs this up. McKinsey's 2024-2025 analysis found that companies investing in sales AI see 10-20% ROI improvement. Bain & Company's 2025 Technology Report went further: AI deployments in sales have boosted win rates by more than 30%.

So why isn't everyone seeing these results?

Because buying a tool isn't the same as changing behavior. And most teams stop at the buying part.

The "30% selling time" crisis

If your reps are spending 70% of their time not selling, you're paying full salary for part-time performance. Harsh? Yes. True? Also yes.

The data from Salesforce is consistent: reps spend 28-30% of their time on revenue-generating activities. The rest goes to CRM updates (19%), admin work (19%), and the endless shuffle of scheduling, researching, and preparing.

This isn't new. But here's what is: the fix now exists.

The Data: Sales professionals using AI/automation save approximately 2 hours and 15 minutes daily, according to HubSpot's 2024 research. That's 11+ hours per week. Multiply that across your team.

When we built GoCustomer, we learned that the tools reps actually adopt are the ones that eliminate tasks they hate. Not the ones with the longest feature lists. Not the "most powerful" platforms. The ones that delete busywork.

Two hours back per day doesn't sound revolutionary. But compound that across a team of 20 reps over a quarter, and you're looking at thousands of hours redirected toward actual selling.

That's not efficiency. That's a different business.

Where demo automation delivers (and the data to prove it)

I'll be honest—I have a bias here. We built Rep specifically for demo automation. But I'm going to share the data anyway, because it's the clearest ROI story in this entire report.

Storylane partnered with Factors.ai to analyze 110,257 web sessions and 150 deals. What they found surprised even me.

| Metric | Without Interactive Demo | With Interactive Demo | Improvement |

|---|---|---|---|

| Website conversion rate | 3.05% | 24.35% | 7.9x |

| Deal conversion rate | 3.1% | 10.1% | 3.2x |

| Average sales cycle | 33 days | 27 days | -6 days |

Read that first row again. 7.9x improvement in website conversion. That's not incrementally better. That's a different category of performance.

And the sales cycle data matters for a reason most people miss: Outreach's 2025 analysis found that opportunities closed within 50 days have a 47% win rate—but after 50 days, that drops below 20%. Speed isn't just nice. It's survival.

Why we built Rep this way: The biggest friction in B2B sales isn't getting meetings. It's the gap between "interested" and "understood your product." A prospect requests a demo, waits three days for scheduling, sits through a generic walkthrough, and loses momentum. We built Rep to collapse that gap—autonomous demos that happen when the prospect is ready, not when a calendar opens up.

Chili Piper's data from 4 million form submissions tells a similar story: form scheduling that enables instant booking doubles inbound conversion from 30% to 66.7%.

The pattern is consistent. Remove friction, capture intent. Wait, and watch it evaporate.

The agentic AI shift: more than a buzzword

Here's where things get interesting—and where most of the hype needs to be separated from reality.

"Agentic AI" has become the term of the moment. What does it actually mean? These are AI systems that can plan, reason, and execute workflows autonomously—not just follow scripts like traditional chatbots.

The market reflects the bet. MarketsandMarkets projects the AI agents market will grow from $5.1 billion in 2024 to $47.1 billion by 2030—a 45.8% CAGR.

That's not gradual adoption. That's a gold rush.

Key Insight: The difference between "AI-powered" and "agentic" is the difference between a tool that helps you work and a tool that works for you. Chatbots follow decision trees. Agents reason through novel situations.

Gartner predicts that 40% of enterprise apps will feature task-specific AI agents by 2026—up from less than 5% in 2025. That's an 8x jump in a single year.

But here's the counterweight, and it's important: Gartner also predicts that by 2030, 75% of B2B buyers will prefer human interaction over AI for sales experiences.

Wait. Both of these can be true?

Yes. And understanding why is the key to the whole strategy.

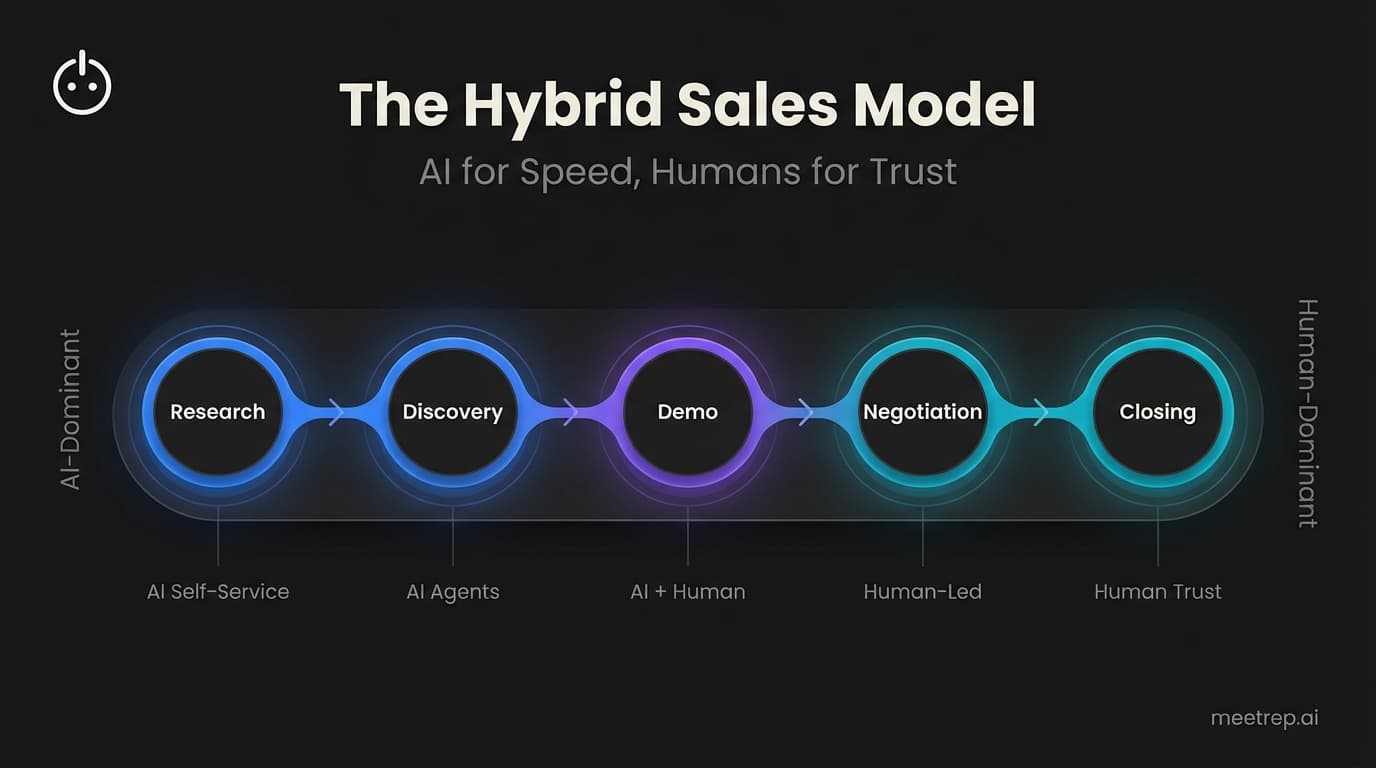

The hybrid model: why "AI vs. humans" is the wrong debate

The data tells a nuanced story that vendor marketing often ignores.

Gartner predicts that by 2028, AI agents will outnumber human sellers by 10:1. But—and this is critical—fewer than 40% of sellers will report that AI agents improved their productivity.

How do you reconcile that with the 17-point growth gap we saw earlier?

Simple. The winners aren't using AI everywhere. They're using AI in the right places.

What we learned at GoCustomer: The teams that got value from our tools weren't the ones trying to automate their entire sales process. They were the ones who mapped where humans add value versus where they don't—and ruthlessly automated the latter. Discovery? Automate it. Demo scheduling? Automate it. Complex negotiation with a VP who has political concerns you can't anticipate? Keep a human in the room.

Here's the framework that matches the data:

| Stage | Best Performer | Why |

|---|---|---|

| Initial research | AI (self-service) | 70% of buyers prefer no rep involvement |

| Discovery & qualification | AI agents | Faster, more consistent, 24/7 availability |

| Product demonstration | AI + human hybrid | Autonomous demos capture intent; humans handle complex questions |

| Negotiation & closing | Humans | 75% of buyers will prefer human interaction by 2030 |

| Post-sale support | AI for routine, human for escalation | Matches complexity to capability |

The companies winning aren't choosing between AI and humans. They're choreographing both.

BDR productivity: what the 2025 benchmarks show

If you manage SDRs or BDRs, 6sense's February 2025 benchmark data offers some grounding reality.

BDRs still achieve 88% of quota on average. That number has held stable since 2023. Despite all the tools, all the AI, all the investment—quota attainment hasn't moved.

Why? Two reasons stand out.

First, the activity required has exploded. BDRs now make 21 attempts per contact (up from 17 in 2024) across roughly 5 social touches, 8 calls, and 8 emails. They engage 9 contacts per opportunity (up from 6.4). That's 189 total attempts per opportunity.

Second, and more concerning: traditional outbound is collapsing. HubSpot's data shows cold calling response rates as low as 2.3%. Meanwhile, social outreach delivers a 42% response rate—compared to 26% for email and 23% for phone.

The Data: Supported BDRs achieve 95% quota attainment vs. 80% for unsupported—a 15-point gap. The "support" isn't just management attention. It's tools that actually reduce busywork. (Source: 6sense 2025 BDR Benchmark)

The takeaway isn't "hire fewer BDRs." It's "stop making them do work that tools should handle." The 95% vs. 80% gap is the clearest evidence that enablement—real enablement, not shelfware—changes outcomes.

What happens next: 2026-2028 predictions

The trend lines point in one direction, but the timeline matters.

Short-term (2026):

- 40% of enterprise apps will feature AI agents (Gartner)

- 75% of B2B organizations will augment traditional playbooks with AI-guided selling (Gartner)

- 80% of B2B sales interactions will occur in digital channels (Gartner)

Medium-term (2027-2028):

- 95% of seller research workflows will begin with AI, up from <20% in 2024 (Gartner via Cirrus Insight)

- AI agents will outnumber human sellers 10:1 (Gartner)

Longer-term (2030):

- 75% of B2B buyers will prefer human interaction over AI (Gartner)

My prediction, based on building in this space: the companies that figure out the handoff—the choreography between AI and human—will own the next five years. Everyone else will either over-automate (and annoy buyers) or under-automate (and get outpaced).

The data in this sales automation report points to one conclusion: the gap is widening, and it's widening fast.

Teams using AI well see 17 points more revenue growth. Interactive demos convert at 3.2x the rate. Supported BDRs outperform unsupported by 15 points on quota.

But only 6% of organizations are "AI high performers."

My take? The winners won't be the companies that buy the most tools. They'll be the ones that figure out the choreography—AI for speed and scale, humans for trust and complexity.

At Rep, we're building for that hybrid future: AI that handles live product demos autonomously so your team can focus on the conversations that actually close deals.

The question isn't whether to adopt. It's whether you'll be in the 6% that gets it right.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- Where sales AI adoption actually stands

- The 17-point revenue growth gap

- The "30% selling time" crisis

- Where demo automation delivers (and the data to prove it)

- The agentic AI shift: more than a buzzword

- The hybrid model: why "AI vs. humans" is the wrong debate

- BDR productivity: what the 2025 benchmarks show

- What happens next: 2026-2028 predictions

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.