SDR Productivity Metrics: What Good Looks Like in 2026

Executive Summary

- Only 41.2% of software SDRs hit quota; 83.4% fail to hit quota monthly

- Quality conversations dropped 55% since 2014 (from 8 to 3.6 per day)

- Top-quartile SDRs book 12-15 meetings/month; bottom quartile books 4-6 (a 3x gap)

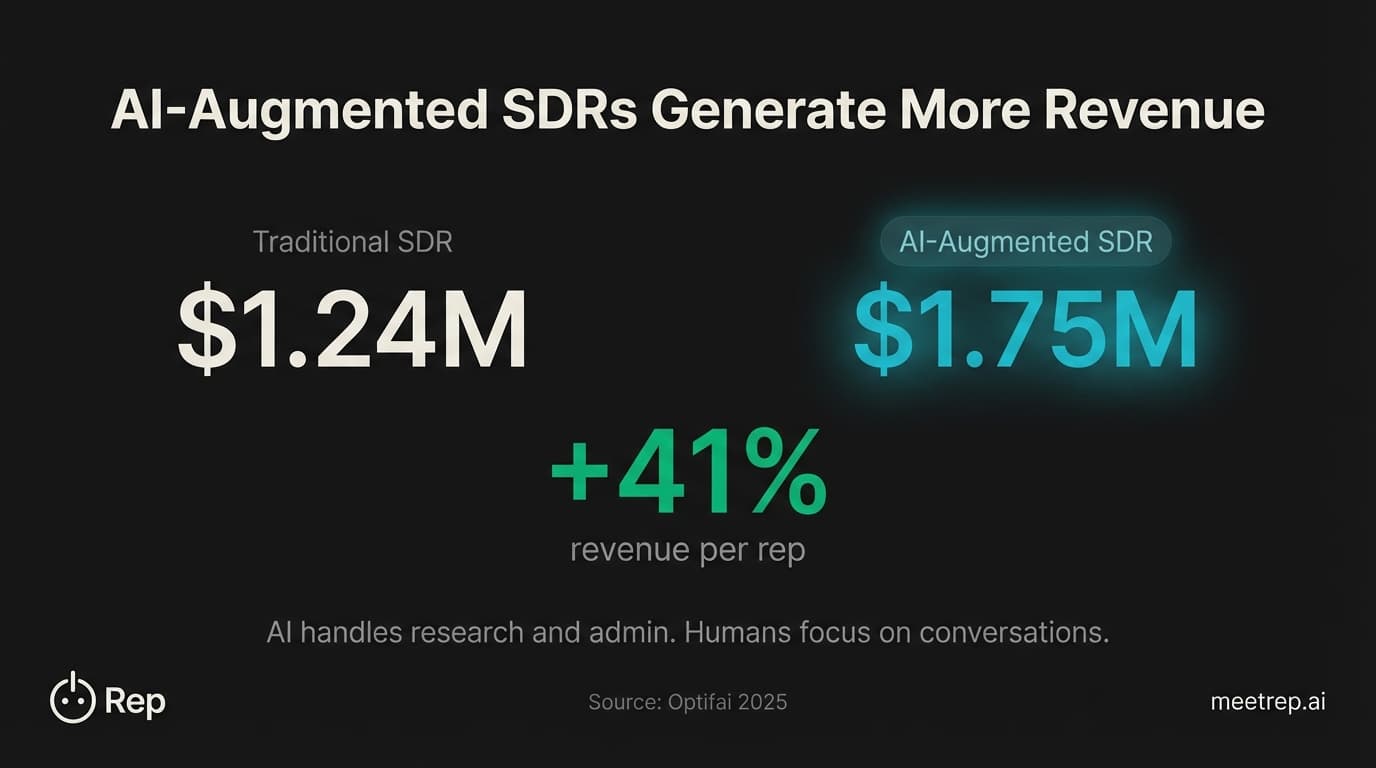

- AI-augmented reps generate 41% more revenue ($1.75M vs $1.24M)

- Activity metrics still matter—but only when paired with quality indicators

Only 41.2% of software reps hit quota in Q1 2025. Let that sink in.

The majority of SDRs are missing their numbers. Not by a little. By a lot. And here's what bothers me: most sales leaders respond by demanding more activity. More dials. More emails. More touches. But when I look at the data—and I've spent years building sales automation tools at GoCustomer and now at Rep—that response is exactly backwards.

The problem isn't effort. It's measurement. Teams track the wrong SDR metrics and wonder why performance keeps declining.

This guide gives you the actual 2026 benchmarks for SDR performance. Not recycled 2019 advice. Real numbers from Bridge Group, 6sense, Optifai, and RepVue—broken down by company size, with the context to actually use them.

What Are SDR Metrics and Why Have They Changed?

SDR metrics are the performance indicators that measure how effectively Sales Development Representatives prospect, qualify, and generate pipeline. These metrics fall into three categories: activity metrics (calls, emails, touches), outcome metrics (meetings booked, pipeline generated), and efficiency metrics (conversion rates, ramp time, cost per meeting).

But here's what's changed in 2026: the old playbook is dead.

I mean this literally. According to Salesso.com's 2025 research, call-back rates for generic cold outreach have dropped below 1%. One percent. That means if your SDRs make 100 cold calls with a generic pitch, they're getting maybe one callback. Maybe.

The "spray and pray" approach that worked in 2015 now actively damages your pipeline.

Key Insight: The shift isn't from "activity metrics don't matter" to "only outcomes matter." It's from "activity alone" to "activity paired with quality indicators." Track dials AND meaningful conversation rate. Track emails sent AND reply rate trends. The teams winning in 2026 measure both volume and quality at every step.

What triggered this shift? Three things converging at once:

Buyer behavior changed. According to Forrester's 2025 predictions, over 50% of large B2B purchases now happen through digital channels. Buyers research before they ever talk to your SDRs. They're more informed and less patient.

Channel saturation hit critical mass.Belkins analyzed 16.5 million cold emails and found reply rates dropped from 6.8% in 2023 to 5.8% in 2024. Every channel is noisier than it was two years ago.

AI changed what's possible.6sense's 2025 BDR Benchmark found that 60% of BDRs now use AI tools. The productivity gap between AI-augmented and traditional reps is widening fast.

The Quota Crisis: Why 83.4% of SDRs Are Missing Their Numbers

Let me show you something that should terrify every sales leader.

According to Salesso.com's 2025 analysis, 83.4% of sales reps fail to consistently hit quota on a monthly basis. Not annually. Monthly. And this isn't a blip—it's a multi-year trend.

The RepVue Cloud Sales Index pegged software rep quota attainment at 41.2% in Q1 2025. It recovered slightly to 43.2% in Q3 2025, but that's still less than half of reps hitting their number.

Why? The data points to three root causes:

1. Quality conversations collapsed.

Bridge Group's research found that quality conversations per SDR dropped 55% since 2014—from 8 per day to 3.6. Your SDRs aren't having fewer interactions. They're having fewer real conversations.

2. It takes forever to reach anyone.

Salesso.com reports it now takes 18 or more dials to connect with a prospect by phone. That's not 18 total touches across channels. That's 18 phone calls to get one live conversation.

3. SDRs spend most of their time NOT selling.

Here's the stat that kills me: SDRs spend only 18-30% of their time on actual selling activities, according to Salesso.com. The rest? Admin. Research. Data entry. Scheduling. Tasks that add zero pipeline.

The Data: The gap between top performers (88% quota attainment per 6sense) and average performers (roughly 41-57%) keeps widening. According to Salesso.com, this represents a systematic performance crisis—not individual underperformance.

So what separates the 41% who hit quota from the 59% who don't? It's not that they work harder. It's that they measure differently.

Activity Metrics: What the Numbers Actually Look Like

Activity metrics still matter. But context matters more.

Here's what I mean: if you benchmark your SDRs against generic "50-80 calls per day" targets without accounting for your market segment, you're setting them up to fail. Honestly, an enterprise SDR targeting Fortune 500 accounts operates completely differently from an SMB SDR working high-volume inbound leads.

Based on Optifai's 2025 benchmark study of 847 SDRs across 156 companies, here's what activity looks like by segment:

| Metric | SMB | Mid-Market | Enterprise |

|---|---|---|---|

| Calls per day | 60-80 | 50-60 | 40-60 |

| Emails per day | 40-50 | 30-40 | 25-35 |

| LinkedIn touches per day | 20-30 | 15-25 | 15-20 |

| Total touches (top performers) | 150-170 | 140-150 | 120-140 |

Notice something? Enterprise SDRs make fewer calls. That's intentional. Their accounts require deeper research and more strategic outreach.

But here's where most teams go wrong: they track activities without tracking quality indicators.

What we learned at GoCustomer: When we built GoCustomer.ai, we saw this pattern repeatedly. Teams that obsessed over activity counts consistently underperformed teams that paired activity with quality metrics. The high-activity teams hit their dial quotas but generated less pipeline. Why? Because SDRs optimized for the metric, not the outcome. They dialed fast, left voicemails, marked it done. The quality-focused teams dialed less but converted better.

The quality indicator that matters most? Meaningful conversation rate.

Leads at Scale reports that elite teams achieve a 14.5% meaningful conversation rate—meaning 14.5% of their outreach attempts result in actual two-way dialogue. Average teams? They're at 3.6 quality conversations per day according to Bridge Group, regardless of how many dials they make.

Track both. Dials AND conversation rate. The activity metric alone tells you nothing about effectiveness.

Outcome Metrics: Meetings, Pipeline, and What "Good" Actually Means

Here's where the rubber meets the road. Outcome metrics tell you whether all that activity is actually producing results.

Meetings booked per month is the headline metric, but context matters here:

| Segment | Outbound SDR | Inbound SDR |

|---|---|---|

| Top performers | 12-15 qualified | 20-25 |

| Average performers | 8-10 | 15-18 |

| Bottom quartile | 4-6 | 8-10 |

Source: Optifai November 2025 and Salesso.com 2025

That 3x gap between top and bottom quartile (12-15 vs 4-6 meetings) represents millions in unrealized pipeline annually. And it's not about effort—bottom quartile SDRs often work just as hard. They're measuring the wrong things.

Show rate is the metric most teams forget. Booking a meeting means nothing if the prospect doesn't show up. Operatix's 2024-2025 research found that top teams maintain 85%+ show rates while average teams hover around 80%.

Pipeline generated varies dramatically by segment:

| Segment | Monthly Pipeline | Annual Pipeline |

|---|---|---|

| SMB | $100-200K | $1.2-2.4M |

| Mid-Market | $250-400K | $3-4.8M |

| Enterprise | $500K-1M | $6-12M |

Source: Optifai November 2025

Quota attainment is the ultimate outcome metric—and it's in crisis. School of SDR research found that only 15.52% of SDRs achieve 90%+ quota attainment. Fifteen percent. The targets might simply be unrealistic.

Efficiency Metrics: Conversion Rates, Speed, and Cost

Efficiency metrics reveal how well your team converts activity into outcomes.

Channel conversion rates vary widely:

| Channel | Conversion to Meeting |

|---|---|

| Cold call | 2.0-3.5% |

| Cold email | 0.8-2.0% |

| LinkedIn DM | 2.0-4.5% |

| Multi-touch sequence | 4.0-7.0% |

Source: Optifai November 2025

The multi-touch number is the one to focus on. Teams running coordinated sequences across calls, emails, and social convert at 4-7%—nearly double single-channel approaches.

Speed to lead might be the most underrated metric.

Martal Canada's research found that responding to inbound leads within 5 minutes makes them 9x more likely to convert. Nine times. That's not a marginal improvement. That's a different business.

And yet, according to Gradient Works, average lead response time is 42 hours. Not 42 minutes. Hours.

This gap—5 minutes vs 42 hours—represents massive opportunity for any team willing to prioritize speed. At Rep, this is exactly why we built demo automation that operates 24/7. Prospects don't wait 42 hours. They move on.

Ramp time affects efficiency calculations more than most leaders realize. Bridge Group's research found that average ramp to productivity is 3.1-3.2 months. Combined with SaaStr's finding that average SDR tenure is 14-16 months, you get roughly 11 months of full productivity per hire.

Cost per meeting reveals the true economics. Gradient Works references Outbound Sales Pro data showing in-house cost per held meeting at $821-$1,150.

How AI Is Rewriting SDR Metrics in 2026

Look, I need to be direct about something: AI isn't coming for SDR jobs. It's already here.

Emergence Capital's April 2025 survey via SaaStr found that 36% of companies decreased SDR headcount in 2025—the highest reduction among all sales roles. According to Outreach's 2025 Prospecting Report, 22% of companies have fully replaced SDRs with AI, while 45% use a hybrid AI-human model.

But here's what the hype cycle misses: most AI SDR implementations fail.

Tomasz Tunguz, founder of Theory Ventures, shared at SaaStr that a CRO from a publicly traded company disclosed that while an AI SDR generated substantial lead volume over nine months, it resulted in zero actual sales. Zero.

The teams seeing results with AI are measuring new metrics:

| Metric | Human SDR Average | AI-Augmented SDR |

|---|---|---|

| Revenue per rep | $1.24M | $1.75M (+41%) |

| Qualified leads generated | Baseline | 2.3x increase |

| Time spent on admin | 70-82% | Reduced by 12 hours/week |

| Response time | 42 hours | Under 5 minutes |

Sources: Optifai 2025, MarketsandMarkets 2025, Salesso.com 2025

The 41% revenue boost for AI-augmented reps comes from AI handling the low-value tasks—research, data entry, initial qualification—while humans focus on actual conversations.

There's an important distinction here. Outbound AI SDRs (like 11x and Artisan) focus on cold email and calling automation. Inbound AI, like what we built at Rep, handles a different problem: delivering live product demos 24/7 so prospects don't wait 42 hours for a response.

My recommendation: Don't ask "should we replace SDRs with AI?" Ask "which SDR tasks should humans do, and which should AI handle?" The answer isn't either/or. It's which parts of the workflow benefit from human judgment (complex qualification, relationship building) versus which benefit from AI consistency (instant response, 24/7 availability).

SDR Benchmarks by Company Size: The Complete Picture

Every metric needs segment context. Here's the full view based on Optifai's November 2025 research:

| Metric | SMB | Mid-Market | Enterprise |

|---|---|---|---|

| Activity | |||

| Calls/day | 60-80 | 50-60 | 40-60 |

| Emails/day | 40-50 | 30-40 | 25-35 |

| LinkedIn touches/day | 20-30 | 15-25 | 15-20 |

| Outcomes | |||

| Meetings booked/month | 18-22 | 12-15 | 8-12 |

| Monthly pipeline | $100-200K | $250-400K | $500K-1M |

| Efficiency | |||

| Connect rate | 12-15% | 8-12% | 5-7% |

| Ramp time | 1-2 months | 2-3 months | 3-4 months |

| SDR:AE ratio | 1:1 to 1:2 | 1:2 to 1:3 | 1:3 to 1:4 |

Use these as calibration, not gospel. Your specific market, product complexity, and average deal size should influence targets.

Common SDR Metrics Mistakes (And What to Do Instead)

After building sales automation tools for years, I've seen the same measurement mistakes kill pipeline over and over. My experience shows that fixing these unlocks significant performance gains.

Mistake 1: Tracking activity without quality indicators.

When SDRs are measured only on dials, they optimize for dials. Activity numbers look great. Pipeline suffers.

Fix: Pair every activity metric with a quality metric. Dials + meaningful conversation rate.

Mistake 2: Using "meetings booked" instead of "meetings held."

A 20% no-show rate is common. If your SDRs book 15 meetings but only 12 happen, you have 12 meetings worth of pipeline.

Fix: Track meetings held as the primary metric.

Mistake 3: One-size-fits-all targets.

I've watched enterprise SDR teams get demoralized by SMB-level activity targets they could never hit.

Fix: Segment your benchmarks. Use the table above as a starting point.

Mistake 4: Ignoring ramp time in quota design.

Setting full quota for SDRs in their first month is setting them up to fail.

Fix: Implement ramp quotas. Month 1: 20-30%. Month 2: 50-60%. Month 3: 80-90%. Full quota in month 4.

Mistake 5: Measuring response time in hours, not minutes.

That 42-hour average response time? Unacceptable.

Fix: Set a target under 5 minutes during business hours. Use automation to hit that target 24/7.

The data tells a clear story. The quota crisis is real—41.2% attainment isn't a measurement error. It's the predictable result of optimizing for the wrong metrics across an entire industry.

But I've also seen what happens when teams get measurement right. Quality conversations instead of dial counts. Speed to response instead of response volume. The 3x gap between top and bottom quartile SDRs isn't talent—it's measurement discipline.

At Rep, we built demo automation specifically to address part of this problem: the 42-hour response time gap and the 70% of SDR time spent on non-selling activities. An AI that can deliver live product demos 24/7 means your human SDRs focus on what actually requires human judgment.

The teams that win in 2026 aren't asking whether to use AI or humans. They're asking which tasks benefit from each. And they're measuring what matters: outcomes, not just activity.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- What Are SDR Metrics and Why Have They Changed?

- The Quota Crisis: Why 83.4% of SDRs Are Missing Their Numbers

- Activity Metrics: What the Numbers Actually Look Like

- Outcome Metrics: Meetings, Pipeline, and What "Good" Actually Means

- Efficiency Metrics: Conversion Rates, Speed, and Cost

- How AI Is Rewriting SDR Metrics in 2026

- SDR Benchmarks by Company Size: The Complete Picture

- Common SDR Metrics Mistakes (And What to Do Instead)

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.