Sales Software: The Complete Guide to Building a Stack That Actually Works

Executive Summary

- Most sales stacks are bloated. 85% of leaders plan to consolidate over the next two years.

- Architecture matters more than individual tool selection. Think data flows, not features.

- The 2026 stack has five essential layers: CRM, Revenue Intelligence, Data Orchestration, Autonomous Agents, and Sales Engagement.

- Reps using AI frequently generate 77% more revenue than those who don't.

- Before adding any tool, ask: "Does this reduce non-selling time or increase it?"

Your sales stack is probably broken. Not because you chose bad tools—but because you have too many of them, and they don't talk to each other.

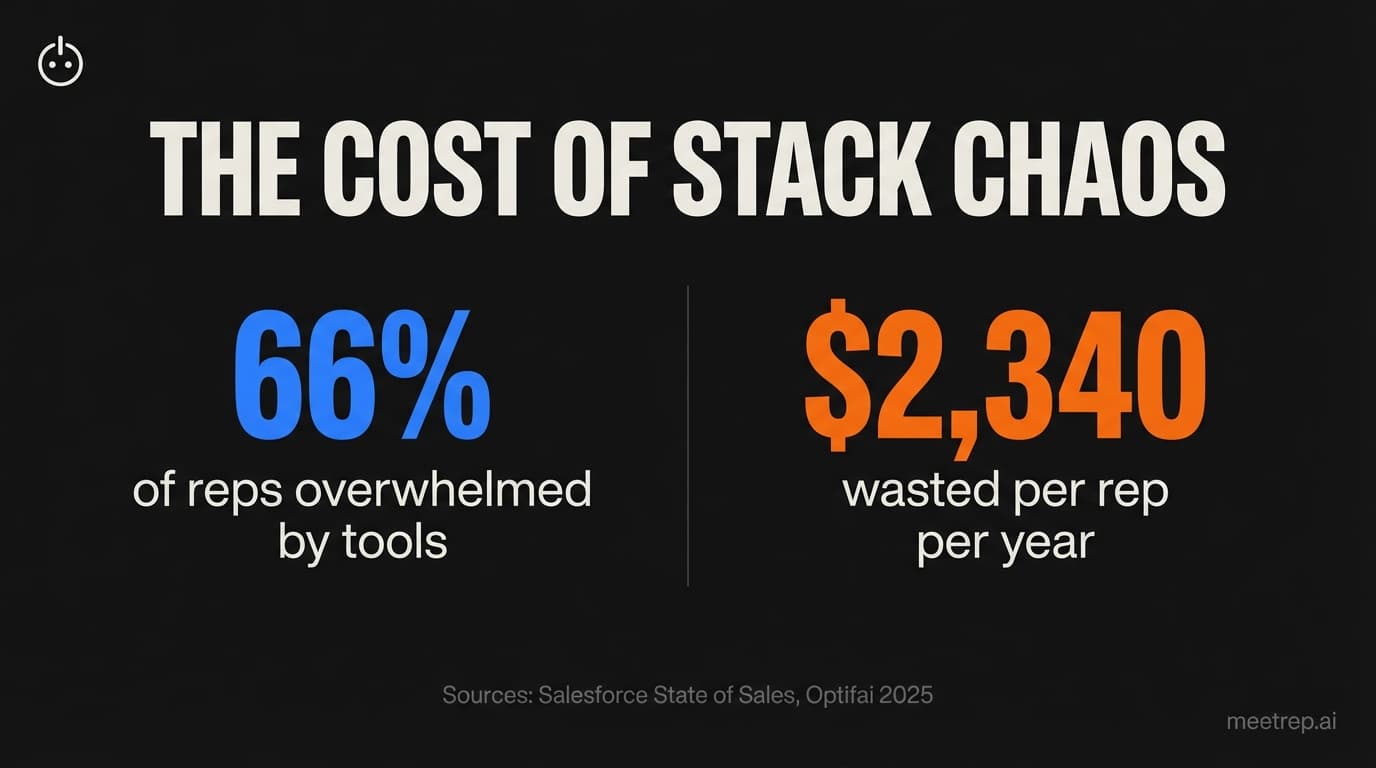

Here's the uncomfortable truth: 66% of sales reps say they're overwhelmed by too many tools, according to Salesforce's State of Sales report. And those tools? They're eating your budget. 73% of teams waste $2,340 per rep per year on overlapping sales software, per Optifai's 2025 benchmark of 938 companies.

I've built sales software. At GoCustomer.ai, we shipped a sales automation platform. Now I'm building Rep, an AI demo agent. So I've seen this problem from the inside—both as someone building tools and someone integrating them into existing stacks. The pattern is always the same: teams buy tools to solve problems, but the tools create new problems.

This guide is different. I'm not going to give you a list of 15 tools and call it a day. Instead, I'll show you how to think about your sales stack architecturally—so you stop buying shelfware and start building something that actually drives revenue.

What Is Sales Software?

Sales software is the collection of digital tools your team uses to find prospects, manage customer relationships, execute outreach, deliver demos, and close deals. It includes everything from your CRM (the system of record) to specialized tools for conversation intelligence, data enrichment, and automated demonstrations. In 2026, this category increasingly includes AI agents that execute tasks autonomously—not just tools that assist humans.

But here's the thing: the definition has shifted dramatically.

In 2020, sales software meant "tools that help salespeople sell." In 2026, it increasingly means "AI agents that sell autonomously." That's not hype—it's a real architectural shift. Gong's State of Revenue AI report found that sellers who frequently use AI generate 77% more revenue than those who don't. The gap is widening.

Key Insight: Sales software is no longer just about assisting reps. It's about autonomous execution—AI that books meetings, runs demos, and qualifies leads without human involvement.

The practical implication? When you're evaluating sales software today, you're not just asking "Does this help my reps?" You're asking "Could this replace tasks my reps shouldn't be doing anyway?"

Why Your Sales Stack Probably Isn't Working

Let me be direct: if your sales team is hitting quota and your stack feels manageable, skip this section. But if only 24% of your sellers are meeting quota (the 2024 industry average, per HubSpot), it's worth examining why.

The numbers tell a brutal story:

| Problem | Impact | Source |

|---|---|---|

| Time spent selling | Only 30% of the week | Salesforce State of Sales |

| CRM implementation failures | 55% don't achieve objectives | Johnny Grow Research 2025 |

| Tool overwhelm | 66% of reps overwhelmed | Salesforce State of Sales |

| Overlapping tool waste | $2,340/rep/year | Optifai 2025 |

Your reps spend 70% of their time on tasks that aren't selling. Think about that. You're paying full salaries for people to do data entry, scheduling, research, and tool maintenance.

What we learned at GoCustomer: Integration is where tools go to die. We built GoCustomer to work with existing CRMs, and the number one implementation blocker was always the same—dirty data and broken integrations from other tools in the stack. It wasn't our product that failed. It was the environment it had to live in.

The root cause isn't bad tools. It's bad architecture. Teams buy tools one at a time, solving isolated problems without considering how data flows between systems. Three years later, you have 10+ tools with conflicting data models, duplicate records, and workflows that require manual bridging.

And the kicker? 85% of sales leaders now plan to consolidate their tech stacks, according to SalesTech Star. The industry knows the current approach is broken. The question is whether you'll consolidate proactively or wait until the pain forces you.

The Five Essential Layers of a Modern Sales Stack

Forget the "37 best sales tools" lists. Your stack needs five layers—not thirty-seven point solutions.

Here's how to think about it:

| Layer | Function | Example Tools | Why It Matters |

|---|---|---|---|

| 1. CRM | System of record | Salesforce, HubSpot | Foundation. Everything flows to/from here. |

| 2. Revenue Intelligence | Deal visibility, forecasting | Gong, Clari | Tells you what's actually happening in your pipeline. |

| 3. Data Orchestration | Enrichment, intent signals | Clay, ZoomInfo | Feeds accurate data to everything else. |

| 4. Autonomous Agents | AI execution (prospecting, demos) | Rep, 11x, Sierra | Scales output without headcount. |

| 5. Sales Engagement | Multi-channel outreach | Outreach, Salesloft | Orchestrates sequences and touchpoints. |

That's it. Five layers.

Now, within each layer, you might have one tool or a few. But the goal is clarity: each layer has a defined job. Data flows cleanly between them. There's no overlap.

Key Insight: Before adding any sales software, ask: "Which layer does this belong to?" If the answer is unclear, or if you already have something in that layer, you're creating future problems.

Let me break down each layer with what actually matters:

Layer 1: CRM (The Foundation) Your CRM is the source of truth. Everything syncs here. The 55% failure rate I mentioned earlier? It usually comes from treating CRM as a data dump instead of an actively maintained foundation. Pick Salesforce for enterprise complexity, HubSpot for mid-market simplicity. Don't overthink it—just commit and maintain it.

Layer 2: Revenue Intelligence This layer answers the question: "What's really happening in my deals?" Tools like Gong analyze calls, surface risks, and improve forecasting. Gong's customers report 75% better forecast accuracy. That matters when your board is asking why you missed the quarter.

Layer 3: Data Orchestration Garbage in, garbage out. This layer ensures your prospect data is accurate and enriched. Tools like Clay run "waterfall enrichment"—hitting multiple data providers until you get valid contact info. If your reps waste 27% of their time on bad CRM data (per Salesso), this layer pays for itself.

Layer 4: Autonomous Agents This is the new layer—and where I'll admit bias since we're building Rep in this space. Autonomous agents execute tasks that used to require humans: AI SDRs that book meetings (11x), AI demo agents that give live product demos (Rep), AI assistants that handle customer inquiries (Sierra). The question isn't whether to use them. It's which tasks you'll hand off first.

Layer 5: Sales EngagementOutreach and Salesloft orchestrate your multi-channel sequences—email, calls, LinkedIn. Salesloft's Forrester study shows 3.3x ROI and 12% higher close rates. But here's my take: this layer only works if your data layer is clean. Sending automated sequences to bad data just scales embarrassment.

How to Choose Sales Software (Without Getting Burned)

I've watched too many teams buy software based on demo day enthusiasm. The demo looked great. The features seemed perfect. Then six months later, nobody uses it. That's shelfware.

Here's a framework that actually works:

Step 1: Define the Problem, Not the Feature

Don't start with "We need a conversation intelligence tool." Start with "Our forecasts are inaccurate because we don't know what's happening in deals."

The problem framing changes everything. Maybe conversation intelligence solves it. Maybe better CRM hygiene solves it. Maybe a weekly deal review process solves it—no new software required.

Step 2: Map the Data Flow

Before buying anything, draw how data will flow:

- Where does this data originate?

- What system is the source of truth?

- How will this tool sync with your CRM?

- Who maintains the integration?

If you can't answer these questions, you're not ready to buy.

Common mistake: Buying tools that create parallel databases instead of extending your CRM. Every parallel database eventually conflicts with your source of truth. Then reps stop trusting any data.

Step 3: Run a Real Pilot

Not a two-week trial where you play with features. A real pilot:

- Specific use case with measurable outcome

- Defined success criteria before you start

- At least one full sales cycle to see results

- Actual adoption metrics (not just "looks good")

Step 4: Calculate True Cost

The license is just the start. Add:

- Implementation time (internal and external)

- Training hours for every user

- Ongoing maintenance and admin

- Opportunity cost of reps learning yet another tool

That $500/month tool actually costs $15K in year one when you count everything.

The Right Stack for Your Stage

Your stack should grow with your company. A 10-person startup doesn't need enterprise tooling. An enterprise doesn't need scrappy workarounds.

| Stage | ARR Range | Stack Approach | Tools to Consider |

|---|---|---|---|

| Early | <$1M | Minimalist. CRM + one engagement tool. | HubSpot Free/Starter, Apollo |

| Growth | $1M-$10M | Add revenue intelligence and data enrichment. | Gong, Clay, Outreach |

| Scale | $10M-$100M | Full five-layer stack. Autonomous agents. | Salesforce, full suite, Rep |

| Enterprise | $100M+ | Custom integrations, governance, security. | Platform consolidation priority |

At the early stage, you don't need a stack—you need focus. HubSpot's free CRM plus basic email sequences can carry you further than you think. I've seen seed-stage founders with elaborate tool stacks and zero revenue. Don't be them.

The Data: Deals closed within 50 days have a 47% win rate versus roughly 20% for deals that drag longer, according to Outreach's 2025 analysis. Your stack should accelerate deals, not create friction that slows them down.

At the growth stage, your problems change. You need visibility into what's working. You need clean data at scale. This is where revenue intelligence and data orchestration earn their ROI.

At scale, you're fighting diminishing returns on headcount. Adding SDR #50 doesn't double output. This is where autonomous agents shine—AI that handles initial demos, books meetings, qualifies leads. You scale output without scaling payroll.

The Rise of Autonomous AI Agents (And Where They Actually Fit)

Let's talk about the hype versus reality.

AI agents are real. They're not vaporware. Gartner predicts that by 2028, 15% of work decisions will be autonomously made by agentic AI, up from essentially zero in 2024. But right now? Most teams are still figuring out where they fit.

Honestly, here's my take from building in this space:

AI agents work best for high-volume, repeatable tasks where the cost of a mistake is low and the learning loop is fast. Examples:

- Initial demo requests (that's what we built Rep for—AI gives a live product demo, qualifies the prospect, and hands off to humans for complex deals)

- Lead enrichment and research

- Meeting scheduling and confirmation

- FAQ handling and initial qualification

AI agents work poorly for high-stakes, relationship-driven tasks where context matters and judgment is required. Enterprise negotiations, strategic account management, complex multi-threaded deals—these still need humans.

Key Insight: The right question isn't "Will AI replace my sales team?" It's "What tasks burn out my team without requiring human judgment?" Those tasks should go to AI first.

The buyer behavior data supports this shift. Forrester's 2025 predictions found that more than half of large B2B purchases (over $1M) are now processed through digital self-serve channels. Buyers want to research and evaluate without a rep. They want to see your product before they talk to anyone.

That's why demo automation is growing. Interactive demos convert 52% better than screen-share demos—38% versus 25% conversion rates, per Optifai. Buyers want to click around, not watch passively.

So where do tools like Rep fit? We built Rep to join video calls, share its screen, and walk prospects through your product live—like your best AE would, but available 24/7. It handles the initial demos that burn out SDR teams. Then humans take over for qualified opportunities. That's the hybrid model that's actually working.

Common Stack Mistakes (And How to Avoid Them)

After building sales software and watching teams use (and abandon) it, I've seen the same patterns repeatedly.

Mistake 1: Buying for features, not workflows

A tool with 50 features loses to a tool that does 3 things perfectly and fits your existing workflow. Reps don't use tools they have to work around.

Mistake 2: Underestimating adoption cost

The tool is easy to use. Great. But will your team use it? 42% of CRM challenges stem from user resistance, per Workbooks research. You're not just buying software—you're changing habits. Budget for change management.

Mistake 3: Integrating before cleaning

Connecting bad data to new tools doesn't fix your data—it spreads the mess. Clean your CRM before adding new integrations. Always.

Mistake 4: Ignoring total cost of ownership

See my earlier point about true cost. That "affordable" tool isn't affordable when you count hours lost to maintenance, training, and troubleshooting.

Mistake 5: Chasing "best of breed" in every category

The industry spent a decade buying the best tool in each category. Now 85% want to consolidate. There's a lesson there. Sometimes "good enough and integrated" beats "best but isolated."

The sales software market is worth over $31 billion and growing at 15% annually, per Mordor Intelligence. Everyone wants to sell you something.

But here's what I believe after building in this space: your stack architecture matters more than which specific tools you pick. Get the five layers right. Maintain clean data flows. Buy less, integrate better.

And when you do evaluate new tools—especially AI agents—start with the tasks that burn out your team without requiring human judgment. That's where you'll find real ROI. That's where we focused when building Rep, and it's where I'd point any team looking to scale without scaling headcount.

Your stack should make selling easier, not harder. If it doesn't, it's time to rebuild.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- What Is Sales Software?

- Why Your Sales Stack Probably Isn't Working

- The Five Essential Layers of a Modern Sales Stack

- How to Choose Sales Software (Without Getting Burned)

- The Right Stack for Your Stage

- The Rise of Autonomous AI Agents (And Where They Actually Fit)

- Common Stack Mistakes (And How to Avoid Them)

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.