Sales Discovery: Master the Art of Understanding Your Prospect

Executive Summary

- 80% of reps fail at discovery, and win rates have dropped to 21-25% in 2025

- Top performers ask 11-14 questions (not more)—going beyond that kills deals

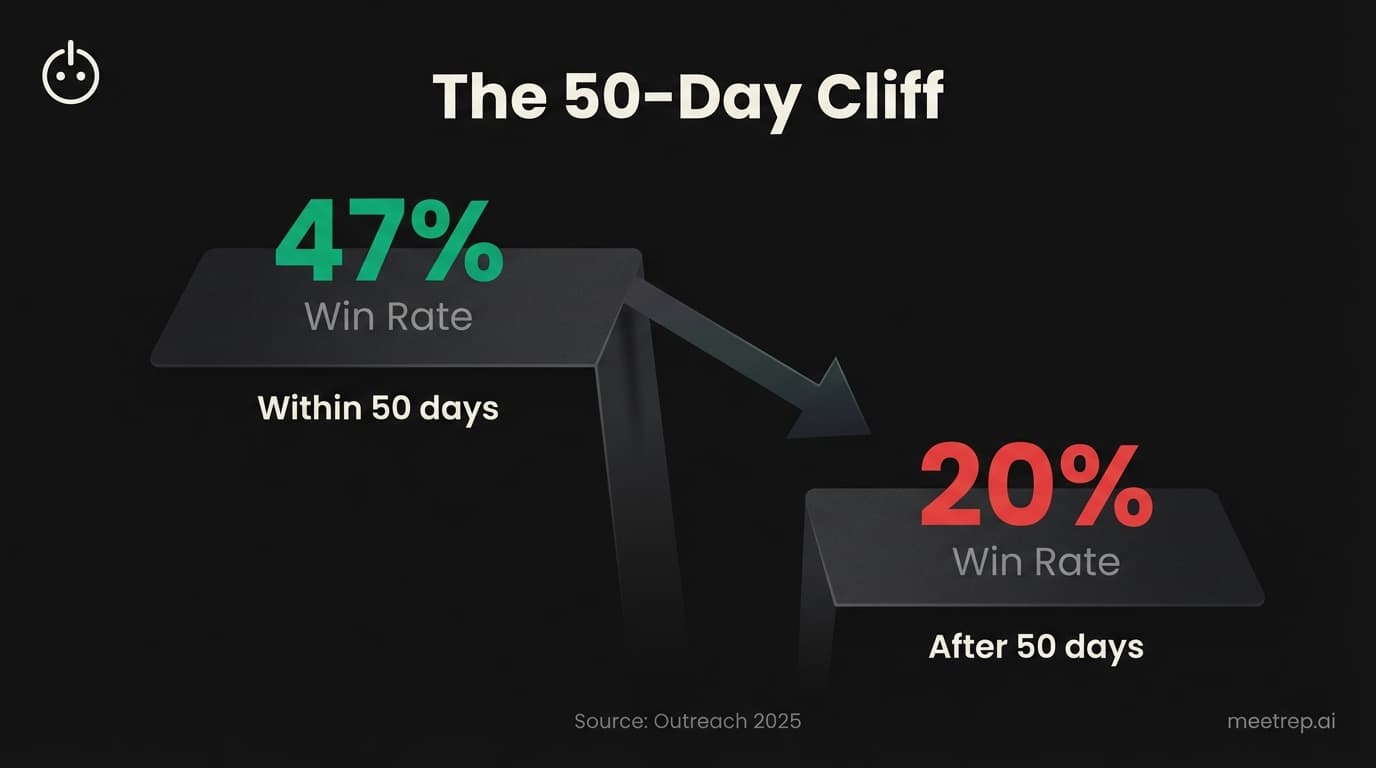

- The "50-day cliff": opportunities closed within 50 days have 47% win rates; after that, you're looking at 20%

- Multi-threading to 6.7+ stakeholders boosts enterprise win rates by 130%

- 69% of buyers decide before talking to sales—your discovery window is smaller than you think

Here's an uncomfortable truth about sales discovery: 80% of reps fail at it.

Not "could improve." Fail. According to Cuvama's 2024 research across 35+ B2B SaaS companies, four out of five deals are compromised before they even get started. And it shows—87% of enterprises missed their 2025 revenue targets according to Clari Labs.

I've watched this pattern play out repeatedly. At GoCustomer.ai, we saw reps with identical training produce wildly different results. Same scripts. Same products. Different outcomes. The gap wasn't knowledge—it was execution in those first conversations.

Why 80% of Sales Discovery Calls Fail

Sales discovery is the diagnostic phase of B2B selling where reps use strategic questioning to understand a prospect's situation, challenges, decision process, and desired outcomes. It determines whether mutual fit exists before anyone presents solutions. The goal isn't to pitch—it's to listen, understand, and qualify.

Cuvama's research found that 85% of B2B sales reps struggle to get prospects to engage and open up during discovery. The vast majority of discovery calls fail at the most basic level—getting the other person to talk.

The Data: 78% of sales reps struggle to connect prospect pain to business impact and metrics. Without quantified business impact, deals stall or die. (Cuvama 2024)

Why does this happen?

Reps treat discovery like interrogation. They front-load 15-20 questions in the first five minutes. The prospect feels grilled, not heard. Trust evaporates.

They pitch too early. What practitioners call "premature pitchulation"—jumping to slides and features before understanding the problem.

They accept surface-level answers. "We need to improve efficiency" is not a pain point. It's a cliché. Top performers go three layers deep. Most reps nod and move on.

They rely on gut feeling. According to Salesloft's 2025 survey, 43% of sellers prioritize buyer engagement based on personal judgment. Only 20% use actual buyer signals to guide decisions.

The 50-Day Cliff: Why Speed Matters

Here's the stat that should keep you up at night.

Outreach's 2025 analysis found that opportunities closed within 50 days achieve a 47% win rate. That's roughly double the market average. After 50 days? Win rates collapse to around 20%.

| Days to Close | Win Rate | Implication |

|---|---|---|

| Under 50 days | 47% | 2x market average |

| Over 50 days | ~20% | Below market average |

| Market average 2025 | 21-25% | Down from 31-40% in 2024 |

Every day of poor discovery pushes deals past this cliff.

Key Insight: Speed isn't about rushing. It's about removing friction. Good discovery identifies the real problem faster, surfaces the right stakeholders sooner, and eliminates wasted cycles on deals that were never going to close.

And here's the kicker: 69% of software buyers now only engage a salesperson after they've already made their purchasing decision, according to G2's 2024 research. Your discovery window isn't just shorter—it might not exist at all if you're not meeting buyers where they are.

This is why we built Rep. When most buyers research and decide before talking to a human, you need a way to engage them during those hours. An AI that can demo your product at 2am, answer questions, and capture intent data isn't a nice-to-have anymore.

What Separates Top Performers From Everyone Else

The performance gap in sales is staggering. Clari Labs reports that the top 10% of reps drive 65% of all revenue. The bottom 50%? Less than 8%.

So what do top performers do differently?

They Ask 11-14 Questions (Not More)

Gong's analysis of 519,000+ discovery calls found an optimal range: 11-14 targeted questions. Fewer than that misses critical insights. More than that creates an interrogation.

But here's what matters more than count: distribution. Top performers spread questions throughout the call. They don't rapid-fire them in the first five minutes.

They Multi-Thread Like Their Deals Depend On It

Because they do. Gong's deal orchestration research (analyzing 1.8M deals) found that multi-threading boosts win rates by 130% in deals over $50K. Closed-won deals include an average of 6.7 sales team members by discovery completion.

They Connect Pain to Business Impact

"We're losing deals" isn't actionable. "We're losing 30% of qualified opportunities to scheduling friction, which cost us $2.4M last quarter" is a business case.

The Data: Top performers uncover 3-4 distinct business problems during effective discovery—not just one surface issue. (Gong Labs)

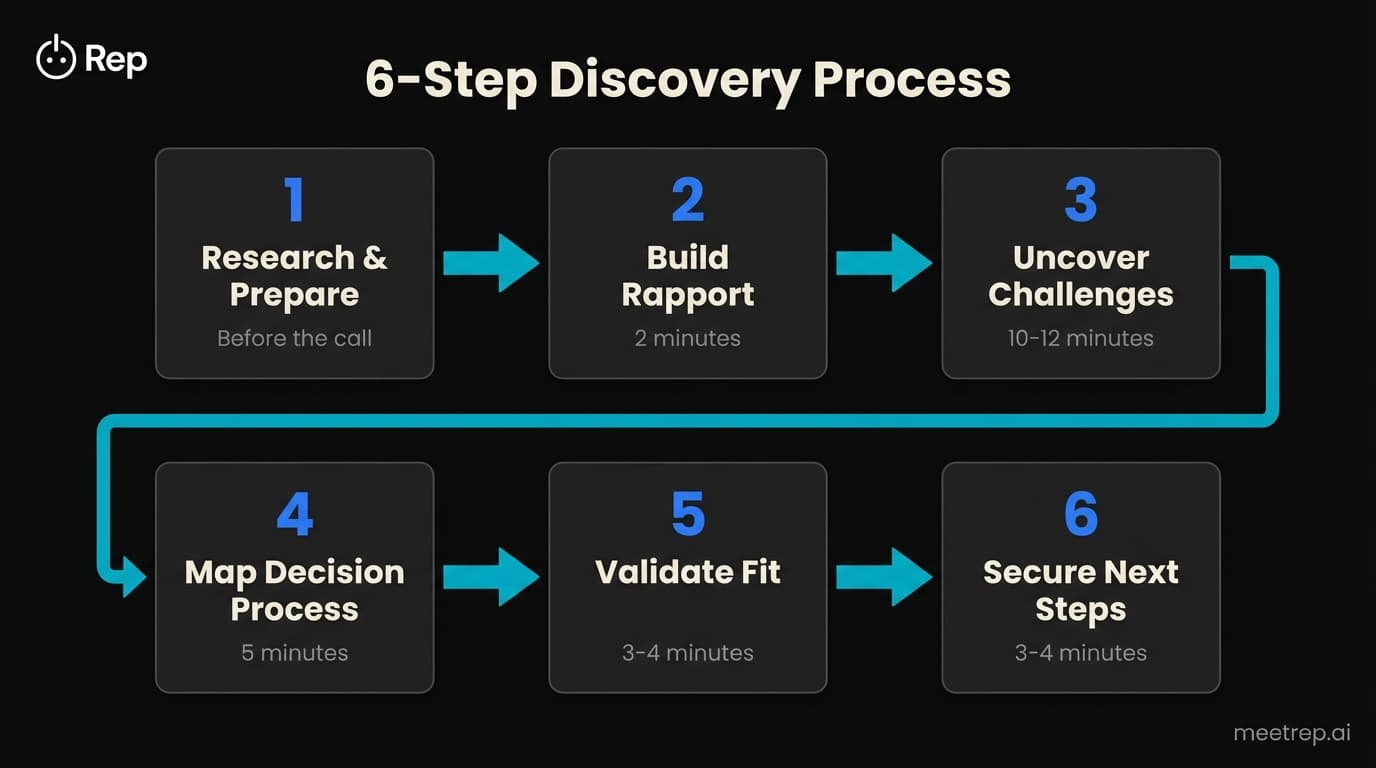

The 6-Step Discovery Process That Works

Here's a framework that works across deal sizes and industries. It's not a checklist—it's a structure that adapts to the conversation.

Step 1: Research and Prepare (Before the Call) Review the prospect's company, industry, competitors, and LinkedIn profiles. Develop hypotheses about their challenges.

Step 2: Build Rapport and Set Agenda (2 Minutes) Establish trust. Confirm the time commitment. Agree on objectives.

Step 3: Uncover Situation and Challenges (10-12 Minutes) Ask 11-14 strategic questions about their current state, pain points, and business impact. Buyer should talk 60-70% of the time.

Go three layers deep:

- Surface: "What's your biggest challenge with X?"

- Context: "How long has that been an issue?"

- Impact: "What does that cost you in time/money/opportunity?"

Step 4: Identify Decision Criteria and Process (5 Minutes) Who else is involved? What's the timeline? What are they evaluating against?

Step 5: Validate Fit and Quantify Impact (3-4 Minutes) Connect their challenges to measurable outcomes. If you can't solve the core problem, say so.

Step 6: Secure Concrete Next Steps (3-4 Minutes) This is where 48% of reps fail. "I'll send over some information" is a death sentence. "Let's schedule 30 minutes next Tuesday with your IT lead—does 2pm work?" is a next step.

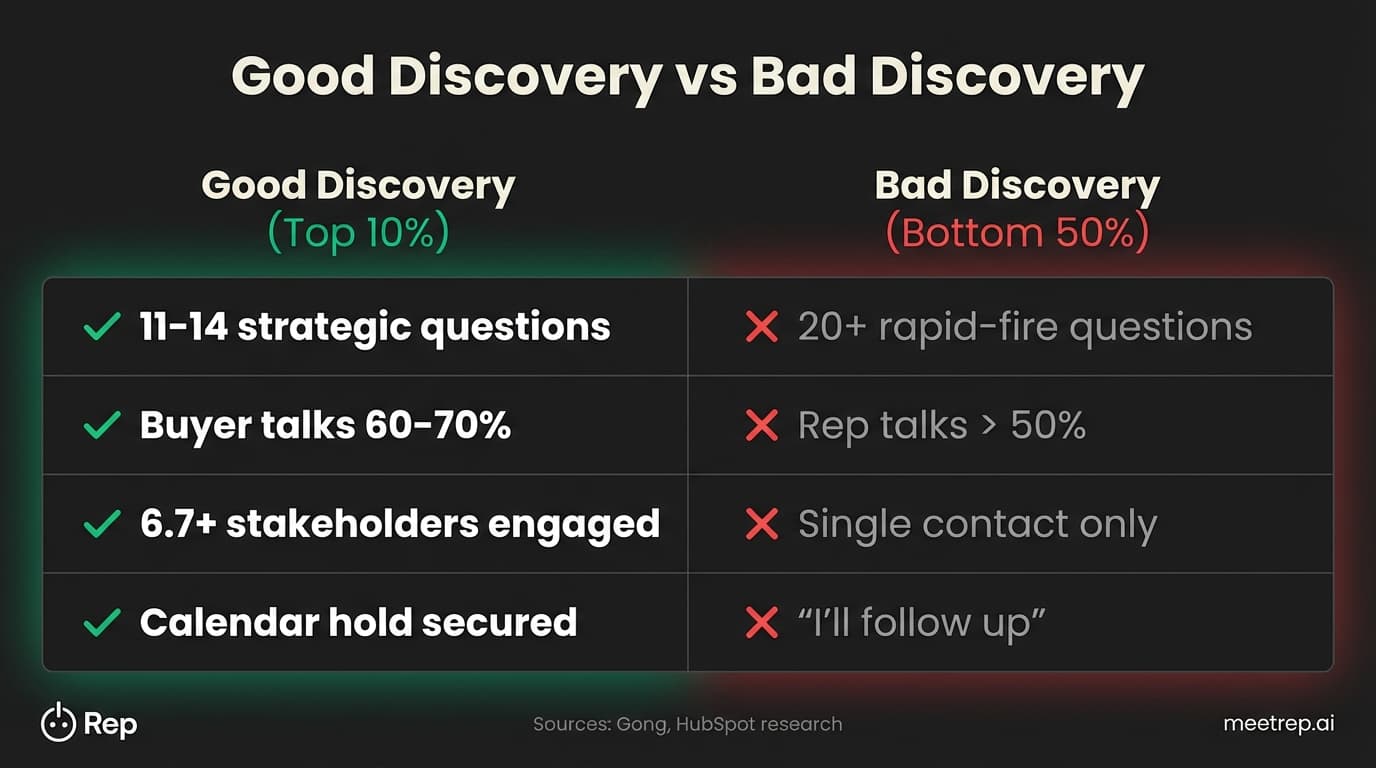

Good Discovery vs. Bad Discovery

| Good Discovery (Top 10%) | Bad Discovery (Bottom 50%) |

|---|---|

| Asks 11-14 strategic questions distributed throughout | Front-loads 20+ rapid-fire questions in first 5 minutes |

| Buyer talks 60-70% of the time | Rep talks more than 50% |

| Goes three layers deep on answers | Accepts surface-level responses |

| Multi-threads to 6.7+ stakeholders | Single-threads to one contact |

| Secures specific next step with calendar hold | Ends with "I'll follow up" |

| Closes within 50 days | Drags past 50-day threshold |

Choosing Your Framework: MEDDIC vs. SPIN vs. BANT

| Framework | Best For | Core Focus |

|---|---|---|

| MEDDIC/MEDDPICC | Enterprise deals ($100K+) | Metrics, Economic Buyer, Decision Criteria, Champion |

| SPIN | Consultative/complex sales | Situation, Problem, Implication, Need-Payoff questions |

| BANT | Transactional/SMB | Budget, Authority, Need, Timeline |

| Gap Selling | Value-based selling | Business Problems, Root Causes, Financial Impact |

My take? BANT alone is outdated for complex B2B. It's a good baseline, but supplement it with MEDDIC for enterprise deals.

What we learned at GoCustomer: The framework matters less than consistent execution. Pick one, customize it to your sales motion, and make sure every rep actually uses it. That last part is where most teams fail.

How AI Is Changing Discovery

The data here is clear. Gong's 2026 research analyzing 7.1M opportunities found that teams using AI in discovery generate 77% more revenue per representative.

But here's the catch: 87% of enterprises missed 2025 targets despite record AI investment. Buying AI tools isn't enough. The gap is in execution.

| Feature | Human-Led Discovery | AI Agent Discovery |

|---|---|---|

| Availability | Business hours only | 24/7 global coverage |

| Consistency | Varies by rep | 100% playbook adherence |

| Capacity | ~4-5 calls/day | Unlimited concurrent sessions |

| Speed to Engage | Requires scheduling | Immediate |

The hybrid approach is the answer. AI handles the 69% of buyers who won't talk to you yet. Humans handle the high-stakes conversations that close deals.

Questions That Uncover Deals

Impact Questions (Use These)

- "What happens if you don't solve this problem in the next 6 months?"

- "How does this challenge impact your personal metrics or KPIs?"

- "What is this costing you right now—in time, money, or missed opportunity?"

Decision Questions (Essential for Multi-Threading)

- "Who else needs to be involved in evaluating this?"

- "What criteria will you use to compare options?"

- "Have you tried to solve this before? What happened?"

Questions That Kill Deals (Avoid These)

- "Tell me about your company" (You should already know this)

- "What's your budget?" (Too early—build value first)

- "What keeps you up at night?" (Cliché, gets cliché answers)

The data is clear. 80% of reps fail at discovery, and win rates have dropped 10 points since 2024. But the top 10% are driving 65% of revenue, proving that execution—not just knowledge—determines outcomes.

My prediction: within 18 months, every serious sales team will combine human discovery expertise with AI agents for initial engagement. The 69% of buyers who decide before talking to humans aren't going away.

The question isn't whether to improve your discovery process. It's whether you'll do it before your pipeline slides past the 50-day cliff.

If you want to see how Rep handles the discovery-to-demo handoff for buyers who want to engage on their schedule, book a demo. Or better yet—experience it yourself and let Rep show you how it works.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- Why 80% of Sales Discovery Calls Fail

- The 50-Day Cliff: Why Speed Matters

- What Separates Top Performers From Everyone Else

- The 6-Step Discovery Process That Works

- Good Discovery vs. Bad Discovery

- Choosing Your Framework: MEDDIC vs. SPIN vs. BANT

- How AI Is Changing Discovery

- Questions That Uncover Deals

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.