Saleo vs Demostack vs Walnut vs Rep: The 2026 Enterprise Demo Showdown

Executive Summary

- Saleo ($16K-$83K/year): Live data overlays for human-led demos. Best AE tool on the market. 4.9/5 G2 rating.

- Demostack (~$55K+/year): High-fidelity sandbox clones. Best for leave-behind demos. 30-90 day implementation.

- Walnut (~$9K-$20K/year): Screenshot-based product tours. Best budget option for marketing.

- Rep ($30K-$130K/year): Autonomous AI agent that gives live demos 24/7. Only option that doesn't require a human.

Your prospects have already decided if you're worth talking to. Before the first call. Before the email reply. Before your SDR even knows they exist.

61% of B2B buyers now prefer a rep-free buying experience, according to Gartner's 2025 sales survey. And 94% of buying groups rank their vendor shortlist before first contact, per 6sense research.

So when you're comparing Saleo vs Demostack vs Walnut vs Rep, you're not just picking a demo tool. You're choosing how to meet buyers where they actually are—which, increasingly, is anywhere but on your SDR's calendar.

I've spent years building in the sales automation space, first at GoCustomer.ai and now at Rep. And here's what I've learned: the demo tool market has split into two distinct categories. Most comparison articles miss this entirely.

Why This Comparison Is Different

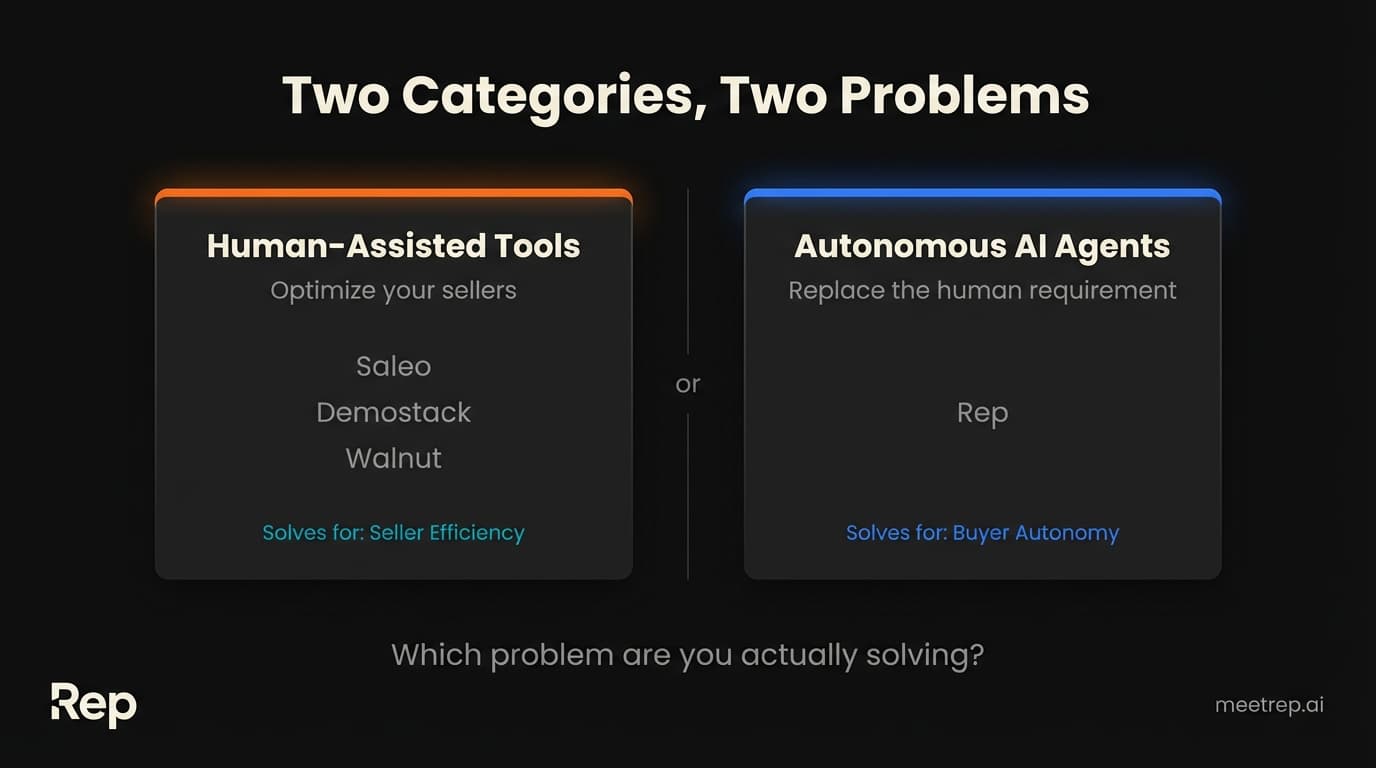

Most "Saleo vs Demostack" articles treat these platforms like direct competitors. They're not. They solve different problems for different buying motions.

Here's the split:

Human-Assisted Demo Tools (Saleo, Demostack, Walnut): These make your existing sales team better at demoing. Your reps still run the show. The tool just makes their demos cleaner, more consistent, or more scalable.

Autonomous AI Agents (Rep): This category doesn't optimize human demos—it handles them without humans entirely. An AI joins the video call, shares its screen, navigates your product, and answers questions in real-time.

Key Insight: The question isn't "which tool is better?" It's "am I solving for seller efficiency or buyer autonomy?" Different problems need different solutions.

That 61% rep-free preference isn't going away. Gartner predicts AI agents will outnumber human sellers by 10x by 2028. But that doesn't mean human-led demos are dead. It means you need to think carefully about which problem you're actually solving.

The Buyer Behavior Shift You Can't Ignore

Before diving into each platform, let's look at what's actually happening with your buyers.

The Data:83% of the buying process now happens without the seller in the room, according to Consensus and Gartner's 2025 Buyer Behavior Report. Your sellers are present for maybe 17% of the journey.

Meanwhile, buyers wait an average of 6-10 days before talking to sales. That's 6-10 days where a competitor with better self-serve options is capturing their attention.

And traditional outbound? Cold call conversion rates dropped to 2.3% in 2025. Your SDRs are hearing "no" 97 times to get 2-3 conversations. This surprised me when I first saw the data—but it tracks with what we're seeing across the industry.

The question isn't whether buyers want self-service. They do. The question is whether you'll give it to them or let a competitor do it first.

Saleo: The Live Overlay Leader

Saleo injects clean, personalized data directly into your live product during demos. It's not a clone or a recording—it's your actual product with fake data overlaid in real-time.

How it works: Saleo uses HTML injection to modify what appears in your browser during a live demo. Your prospect sees your real product interface, but with data that matches their industry, company size, or use case. Your AE controls everything.

Pricing: $16,000-$83,000 annually (custom enterprise pricing)

Implementation: 15-30 days typical—fastest among the major platforms

G2 Rating:4.9/5 on G2—genuinely impressive for sales software

| Strength | Limitation |

|---|---|

| Most authentic demo experience (it's your real product) | Requires a human to run every demo |

| Fastest implementation (15-30 days) | Overlays can break when your UI changes |

| Excellent for personalization at scale | Can't be used for leave-behind demos |

| Strong enterprise validation (Salesforce, Seismic) | Doesn't work offline or without live product access |

Customer results:Saleo customers including Salesforce and Seismic report 60%+ reduction in demo prep time.

My take: Saleo is the best tool for AEs who need perfect data in live demos. If your bottleneck is demo quality (not demo quantity), and you have the humans to run them, Saleo is hard to beat. But it won't help you at 2am when a prospect in Singapore wants to see your product.

Demostack: The Sandbox Builder

Demostack creates high-fidelity clones of your product using patented frontend cloning technology. Not screenshots—actual functional replicas that prospects can explore independently.

How it works: Demostack captures your product's frontend code and creates a sandboxed environment. Prospects interact with what feels like your real product, but it's isolated from production. These clones can be shared as leave-behind demos.

Pricing:Starts around $55,000/year, with enterprise deals exceeding $87,000

Implementation: 30-90+ days—the longest among major platforms

| Strength | Limitation |

|---|---|

| Highest fidelity replicas (true interactive clones) | Most expensive option ($55K+ entry) |

| Works for leave-behind and async demos | Heavy maintenance burden—clones must be recreated after product updates |

| Sandboxed environment protects production data | Longest implementation (30-90+ days) |

| Strong enterprise customer base | Not suitable for products with frequent UI changes |

Customer results:Gainsight saw +25% increase in win rates after adopting Demostack. Synack cut demo prep time from 100+ hours to under 10 hours.

What we've seen building in this space: Cloning approaches work well for stable products with slower release cycles. But if your engineering team ships weekly, you'll spend significant time recreating clones. That 25% win rate lift is real, but so is the maintenance cost.

Walnut: The Budget-Friendly Tour Guide

Walnut captures screenshots and HTML to create guided product tours. It's the most accessible entry point into demo automation, especially for marketing teams.

How it works: Walnut stitches together captured screens to create interactive tours. Users click through a guided experience that looks like your product but isn't actually functional. Think "interactive slideshow" more than "sandbox."

Pricing:Starts around $9,000/year for Lite plans, scaling to $20K+ for enterprise

Implementation: Fastest setup—capture-based approach means you can be live in days

| Strength | Limitation |

|---|---|

| Lowest price point (~$9K entry) | "Static feel"—less authentic than live demos or clones |

| Fastest time-to-value | Declining G2 rankings despite strong customer base |

| Great for marketing website embeds | Not suitable for complex products requiring interactivity |

| Works well for SDR outbound sequences | Screenshot-based approach shows "seams" |

Customer base: Adobe, Dell, Darwinbox, FarEye—strong enterprise names, though detailed results are less publicly documented than competitors.

Honest assessment: Walnut is the right choice if you need marketing assets fast and your product is relatively simple. But if prospects are comparing your Walnut tour against a competitor's live demo or Demostack sandbox, you might look less polished. You get what you pay for.

Rep: The Autonomous AI Agent

Rep is a different category entirely from the other three. It's not a tool that helps humans demo better—it's an AI that handles demos without humans present.

How it works: Rep joins video calls as an AI participant. It shares its screen, navigates your actual product using stored demo credentials, and converses with prospects in real-time. It answers questions by pulling from your knowledge base, captures detailed conversation data including transcripts and sentiment, and works 24/7.

Pricing: $30,000-$130,000/year (custom/usage-based)

Implementation: Medium effort—requires training the AI through live demos, recordings, or documentation uploads

| Strength | Limitation |

|---|---|

| Only autonomous option—no human required | Newer category with limited public case studies |

| 24/7 availability captures global demand | Requires organizational trust in AI voice/video |

| Addresses the 61% who prefer rep-free experience | Best for TOFU/MOFU, not final deal closure |

| Captures more data than humans (transcripts, sentiment) | Higher price tier than Walnut |

Validation: Rep has raised $7.5M Series B to build digital twin sales reps. Enterprise customers using the Reprise cloning platform (Rep's parent technology) include Databricks, Dell, and Microsoft. Hireology reported 50% sales cycle reduction.

Why we built Rep this way: At Rep, we looked at the 61% rep-free stat and asked: what if prospects could get a live demo—not a recording, not a tour, an actual demo—without waiting for a human's calendar to open up? That's the problem we're solving. It's not about replacing your AEs for complex deals. It's about capturing demand that currently bounces because nobody's available.

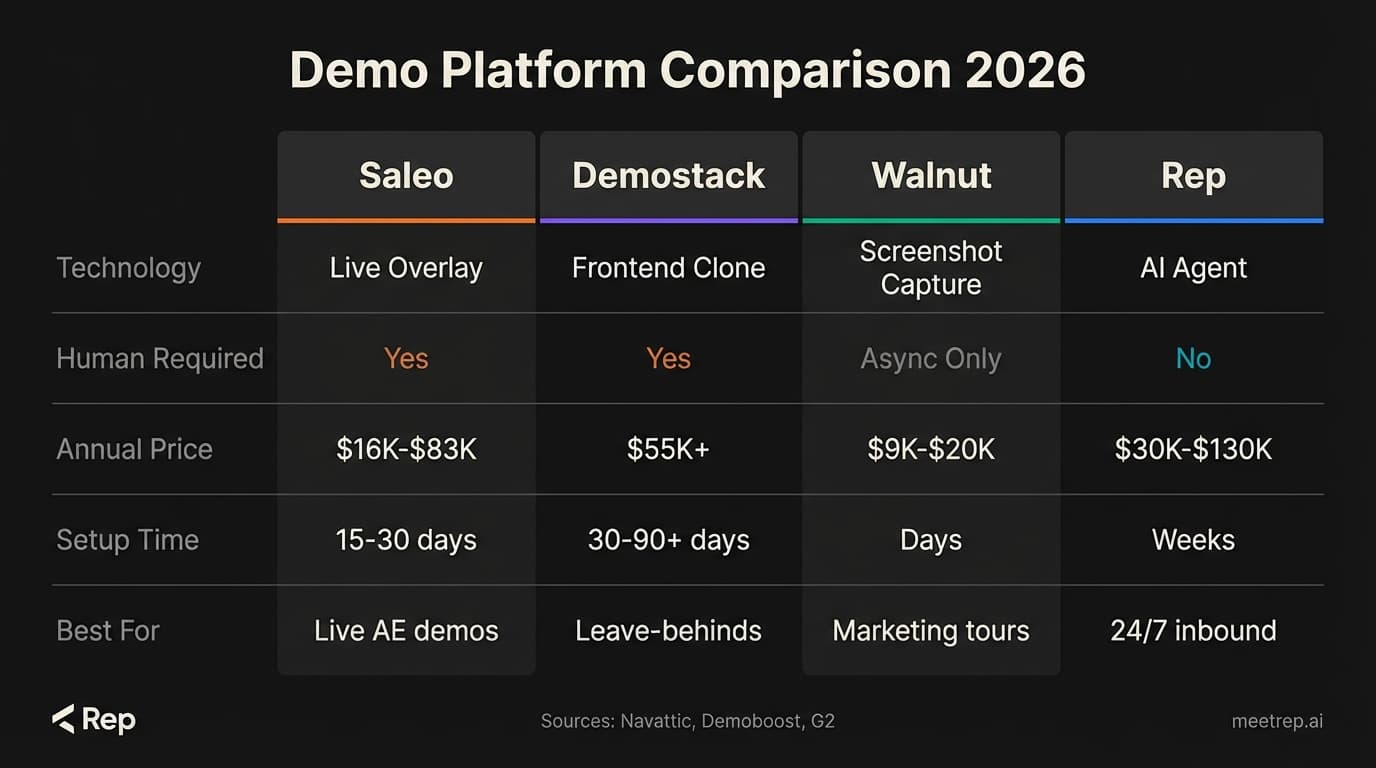

Feature & Pricing Comparison

| Feature | Saleo | Demostack | Walnut | Rep |

|---|---|---|---|---|

| Core Technology | Live overlay (HTML injection) | Frontend cloning (patented) | Screenshot/HTML capture | AI voice agent + browser automation |

| Human Required? | Yes | Yes | No (async) | No (autonomous) |

| Best Use Case | Live AE demos | Sandboxes & leave-behinds | Marketing tours | 24/7 inbound demos |

| Setup Time | 15-30 days | 30-90+ days | Days | Weeks (AI training) |

| Est. Annual Price | $16K-$83K | $55K+ | $9K-$20K | $30K-$130K |

| Live Conversation | Human-led | Human-led | None | AI-led |

| Leave-Behind Capability | No | Yes | Yes | Yes (recordings) |

Which Demo Platform Should You Choose?

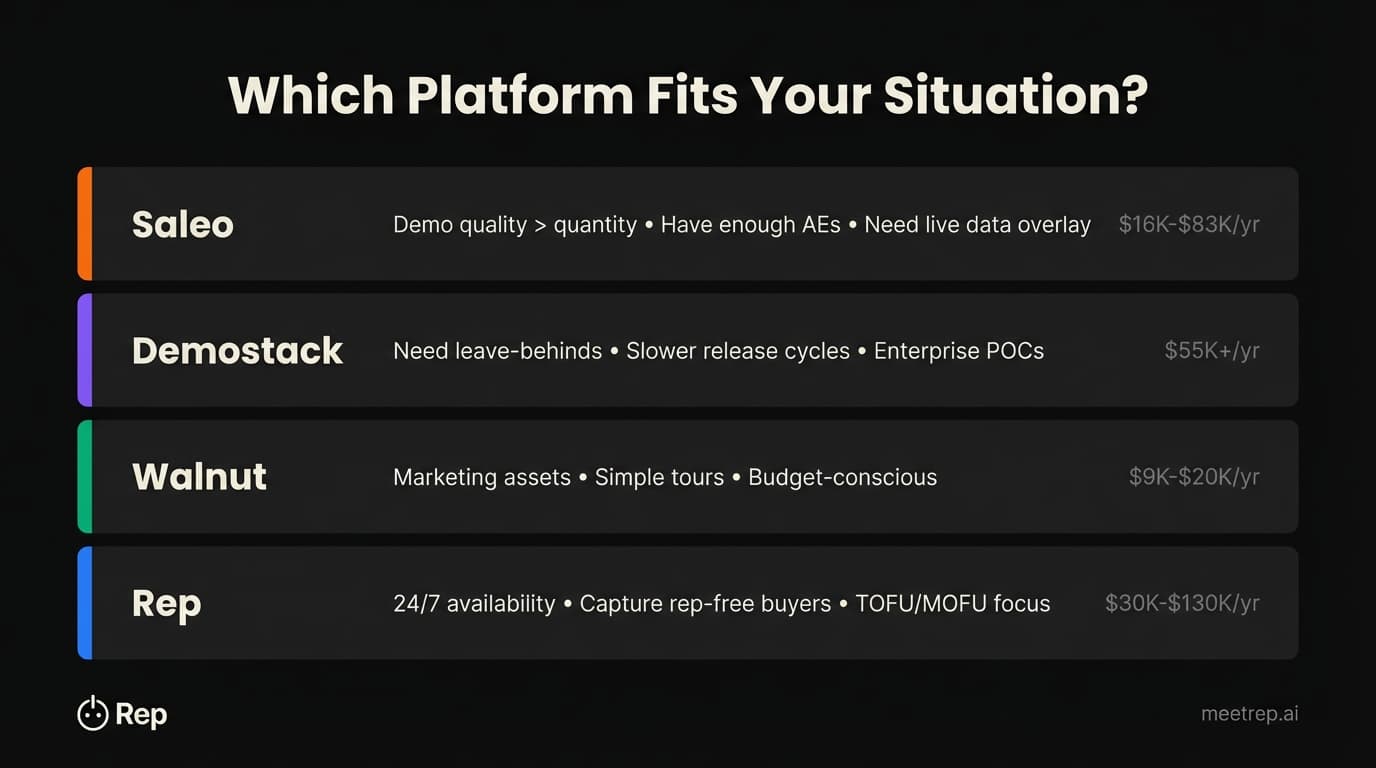

The right choice depends on your specific situation. Here's how I'd think about it:

Choose Saleo if your bottleneck is demo quality, not quantity. You have enough AEs to handle demand, but your demos are inconsistent or require too much prep time. You want your live product with clean data—no clones, no simulations. Budget: $16K-$83K/year. Timeline: live in 15-30 days.

Choose Demostack if you need stable sandbox environments for enterprise POCs and leave-behind demos. Your product release cycle is slower (monthly, not weekly), so clone maintenance won't kill you. You have budget—$55K+ annually—and can wait 30-90 days for implementation. Leave-behinds are a critical part of your sales motion.

Choose Walnut if you need marketing assets for your website and outbound sequences. Simple product tours are sufficient for your use case. You're optimizing for speed and budget over fidelity. Entry at ~$9K/year makes this the lowest-risk option to test demo automation.

My recommendation: If you're reading this and thinking "but what about prospects who want a demo right now, at 11pm, without scheduling anything?"—that's the Rep use case. 80% of buyers contact their top-ranked vendor first. If you're not available when they're ready, you might not get the call at all.

Choose Rep if you want to capture the 61% of buyers avoiding human contact. 24/7 demo availability is non-negotiable for your business. You're willing to pioneer the agentic AI category. Your focus is TOFU/MOFU pipeline generation, with human AEs closing deals. Budget: $30K-$130K/year.

The Bigger Picture: Tools vs. Agents

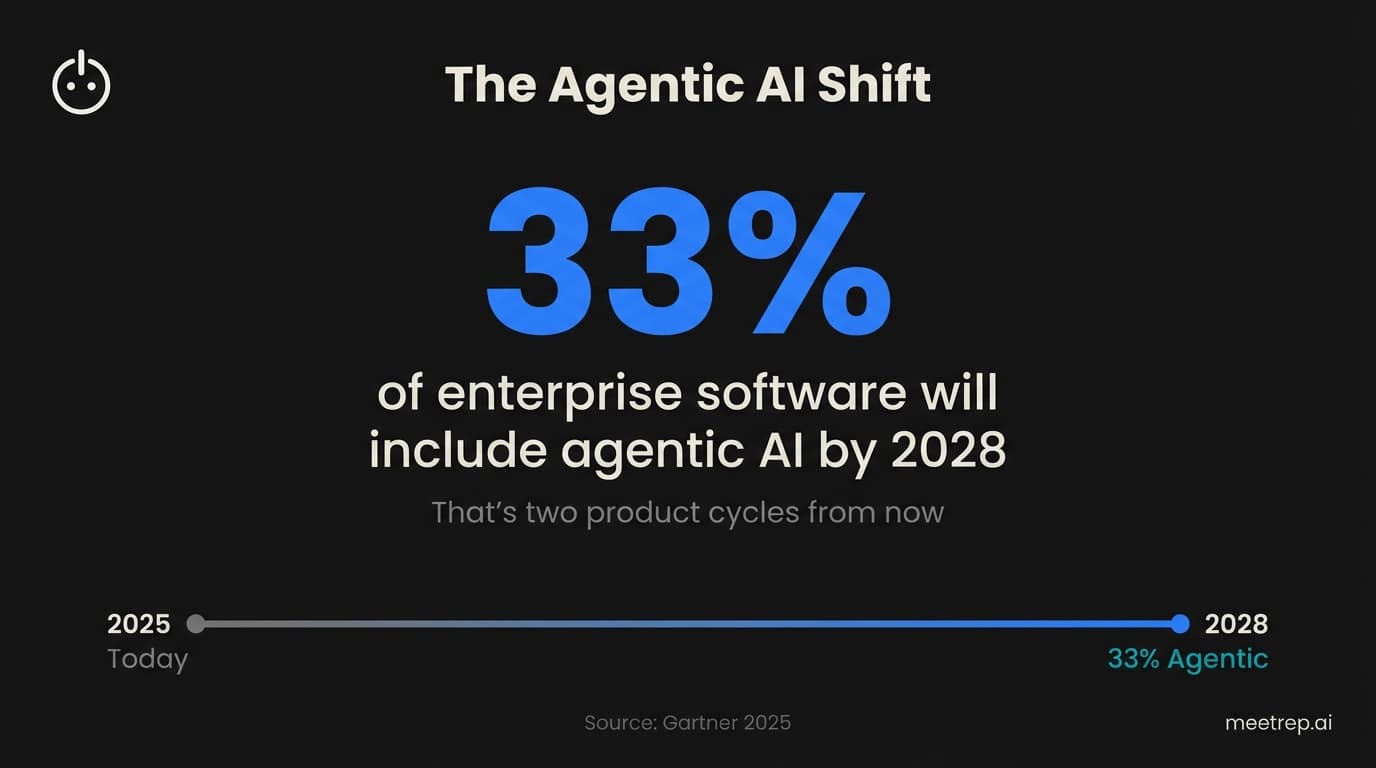

Here's what most comparison articles miss: Gartner predicts 33% of enterprise software will include agentic AI by 2028. That's not a distant future. That's two product cycles from now.

Saleo, Demostack, and Walnut optimize what humans do. They're excellent at it. But they don't solve the fundamental problem: your best AE can only be in one place at a time.

The question isn't whether AI agents will handle initial demos. They will. The question is whether you'll be ahead of that curve or chasing it.

The demo automation market isn't about finding the "best" tool. It's about matching the right solution to your actual problem.

If your AEs need better tools, Saleo and Demostack are excellent. If marketing needs assets, Walnut works. But if you're losing deals because prospects can't get a demo when they want one—and increasingly, they want one without waiting for a human—that's a different problem entirely.

At Rep, we're betting that autonomous AI demos become table stakes within a few years. But even if I'm wrong about the timeline, I'm confident about the direction. Buyers are voting with their behavior. 94% rank vendors before first contact. 61% prefer no human involvement.

The only question is whether your demo strategy meets them there.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- Why This Comparison Is Different

- The Buyer Behavior Shift You Can't Ignore

- Saleo: The Live Overlay Leader

- Demostack: The Sandbox Builder

- Walnut: The Budget-Friendly Tour Guide

- Rep: The Autonomous AI Agent

- Feature & Pricing Comparison

- Which Demo Platform Should You Choose?

- The Bigger Picture: Tools vs. Agents

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.