Reprise Alternative: Why Teams Are Choosing AI Agents Over Three Demo Products

Executive Summary

- Reprise charges $30K-$100K+/year for three separate products (Reveal, Replay, Replicate). G2 ease-of-use score: 7.5/10.

- Implementation takes 4+ weeks to 3 months. Users report rebuilding demos "from scratch" after product updates.

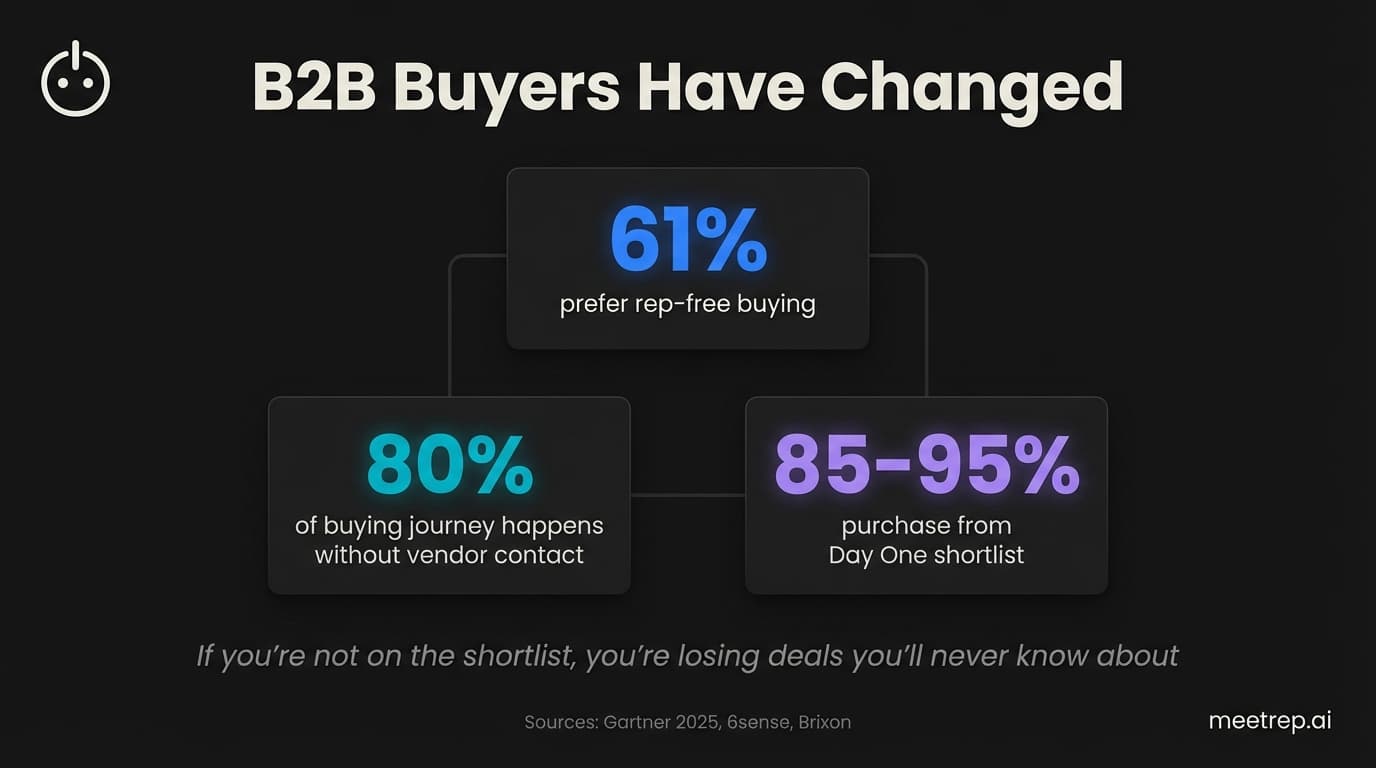

- 61% of B2B buyers now prefer rep-free experiences. Interactive demos deliver 7.9x higher conversion.

- The market is shifting from static demo tools to autonomous AI agents. Gartner predicts 33% of enterprise apps will include agentic AI by 2028.

Reprise built the Cadillac of enterprise demo tools. Three products. Full application cloning. SOC 2 certification. A $30,000 minimum annual commitment. And G2 reviews describing it as "one of the buggiest tools I have ever used."

I've spent years building sales automation products—first GoCustomer.ai, now Rep. Here's what I've learned: the most sophisticated tool isn't always the right tool. Sometimes it's an expensive way to solve yesterday's problem.

If you're searching for a Reprise alternative in 2026, you're asking the right question. But you might be asking it too narrowly. The real question isn't "What's a cheaper Reprise?" It's "Do I even need three demo products when one AI agent could do the job?"

What Reprise Actually Offers (And Who It's Built For)

Reprise is three separate products sold as a platform, each solving a different demo use case with enterprise-grade complexity.

Reveal is a browser extension overlay for live sales calls. Your AE demos the real product while Reveal injects custom data on the fly. Replay captures screenshots or HTML to build interactive product tours for your website. Replicate clones your entire application—front-end AND back-end API calls—for full sandbox POC environments.

| Product | What It Does | Primary User | Best For |

|---|---|---|---|

| Reveal | Live demo overlay via browser extension | AEs on sales calls | Real-time data customization |

| Replay | Screen/HTML capture for interactive tours | Marketing teams | Website embeds, product tours |

| Replicate | Full application clone with API capture | Solutions Engineers | Complex sandbox POCs |

This isn't a criticism. For enterprise SEs building offline-capable sandboxes for complex products, Reprise Replicate is genuinely impressive. Dell, Databricks, Zendesk, and MongoDB use it. The platform is SOC 2 Type II and ISO 27001 certified.

But here's the thing: most teams searching for a Reprise alternative don't need pixel-perfect application clones. They need demos that work, update automatically, and don't require a dedicated admin.

Key Insight: Reprise explicitly targets companies with 300+ employees. If you're smaller than that, you're probably over-buying.

The Hidden Costs Behind Reprise's Complexity

The price tag is just the beginning. Let me walk you through what actual users say about living with Reprise day-to-day.

What G2 Reviews Actually Say

I read through 174+ G2 reviews so you don't have to. The pattern is clear.

On bugs and reliability:

"This is one of the buggiest tools I have ever used. The autosave often doesn't work and I have to redo work 4-5 times to get it to save."

"We were an early customer of Reprise; unfortunately, the platform has only become more unusable quarter by quarter."

On the learning curve:

"If you want to fully leverage Reprise, it's a learning curve. This is not a tool you just jump in and create a demo in an hour."

The G2 ease-of-use score sits at 7.5/10—well below the industry standard of 9+. One competitor analysis put it bluntly: Reprise is "not something you can just hand to a marketer."

The Maintenance Burden Problem

This is the one that kills you slowly.

According to Consensus's 2024 Presales Landscape Report, Solutions Engineers spend 21 days per year just cleaning demo environments. Twenty-one days. That's a full month of senior technical talent doing janitorial work.

And with Reprise, it gets worse. G2 reviewers consistently report that product updates mean starting over:

"Reprise is extremely manual to set up. If you have feature updates that you want to pull into your demo environment, you basically have to build it again from scratch."

When we built Rep, this was the problem I kept coming back to. Static demo tools—no matter how sophisticated—create a maintenance treadmill. Your product ships weekly. Your demos get stale monthly. Your team burns out quarterly.

Common mistake: Evaluating demo tools on Day 1 capabilities without modeling the ongoing maintenance cost. A $50K tool that requires $15K/year in SE time isn't really a $50K tool.

Implementation Reality Check

Reprise implementation typically takes 4+ weeks for basic deployments and up to 3 months for full enterprise rollouts. And there's no free trial to validate fit before signing a $30K+ annual contract.

Compare that to lighter alternatives like Navattic or Storylane that deploy in hours to days.

Why 61% of B2B Buyers Now Demand Self-Service Demos

Here's where the market context matters.

The Gartner Sales Survey from June 2025 dropped a stat that should worry anyone in sales leadership: 61% of B2B buyers prefer a rep-free buying experience. Even more pointed: 73% actively avoid suppliers with irrelevant outreach.

We're not talking about a small shift. 80% of the B2B buying journey now happens without direct vendor contact. Buyers research, evaluate, and shortlist before they ever talk to your team. And 85-95% of buyers purchase from their Day One shortlist.

If you're not on that shortlist—if prospects can't experience your product on their terms—you're losing deals you'll never know about.

The Data: Interactive demos deliver 7.9x higher website conversion (24.35% vs 3.05%) according to Storylane and Factors.ai's October 2024 analysis of 110,257 sessions.

The Speed-to-Lead Imperative

There's another dimension here: response time.

Forbes reports that responding within 5 minutes makes you 21x more likely to qualify a lead versus waiting 30 minutes. Twenty-one times. And yet the average company takes 42-47 hours to respond. Over half never respond within five business days.

This is why 78% of customers buy from the first business that responds.

Static demos don't solve this. They're passive assets. A prospect clicks around at 2am, then waits for your AE's calendar to open up on Tuesday.

The 2025-2026 Market Shift: From Demo Tools to Demo Agents

Here's my take, and it's not a popular one in Reprise Alternative listicles: most of those articles recommend swapping one screenshot tool for another. That's like recommending a better typewriter in 1990.

The category itself is being disrupted.

Gartner's 2025 strategic technology trends report predicts that 33% of enterprise software applications will include agentic AI by 2028—up from less than 1% in 2024. That's not gradual adoption. That's a category shift.

What does "agentic AI" mean? It's AI that acts autonomously with goals, not just AI that responds to prompts. The difference between a chatbot that answers questions and an agent that joins your meeting, shares its screen, and demos your product.

Key Insight: Gartner predicts AI agents will intermediate more than $15 trillion in B2B spending by 2028. Forrester expects generative AI to displace 100,000 frontline agents in 2025 alone.

McKinsey's late-2025 State of AI report found that 62% of organizations are already experimenting with AI agents. Early majority adoption is happening now.

Interactive Demos vs. AI Agents: The Fundamental Difference

Let me be specific about what separates these approaches:

| Dimension | Interactive Demos (Reprise, Navattic, Storylane) | AI Agents (Rep) |

|---|---|---|

| Asset type | Static—captured screenshots, cloned environments | Active—live browser navigation |

| Interaction | Buyer clicks through pre-built paths | Agent responds to questions in real-time |

| Maintenance | Manual rebuild when product updates | Learns from product changes automatically |

| Availability | Always-on content | Always-on live engagement |

| Response time | Passive (buyer-initiated scheduling) | Instant (hits 5-minute window) |

| Objection handling | Cannot respond | Real-time voice/video responses |

| Implementation | Days to months | Hours to days |

Interactive demos convert well. The 7.9x conversion lift is real. But they're still passive. They can't answer the unexpected question. They can't pivot when a prospect says "actually, can you show me the reporting module instead?"

Reprise Alternatives by Use Case and Budget

Alright, practical guidance. Not everyone needs an AI agent. Here's how I'd segment the decision:

For Marketing Teams (Website/SEO Focus)

If your primary use case is embedding product tours on your website, you probably don't need Reprise's complexity.

Navattic does HTML/CSS capture with ABM analytics. $500-$1,000+/month ($6K-$12K/year). Implementation in hours to days. Customers include Mixpanel, Drift, ClickUp. Their State of the Demo 2025 report found that ungated demos show 10% higher engagement than gated.

Storylane offers the easiest setup I've seen. $40-$1,200/month. Screenshot, HTML, and video options with an AI video avatar feature called Lily.

For Sales Teams (Live Demo Focus)

Walnut has gone hard on AI with their "AI Demo Engine." $9K-$20K/year. 2-3 weeks to implement. Cato Networks reported it "improved time to value."

Consensus pioneered the "Choose Your Own Journey" video-based approach. $12K+/year. They're #1 on G2 for 10 consecutive years. Bazaarvoice saw 33% shorter SMB sales cycles and $3.5M pipeline influenced in Q1.

For Enterprise Presales (Sandbox/Clone Focus)

If you genuinely need Reprise-level cloning, your alternatives are limited:

Demostack offers pixel-perfect clones (99% indistinguishable). $32K-$87K/year. Closest to Reprise in fidelity.

TestBox takes a data-first approach with AI-generated synthetic data. $45K-$60K/year.

Saleo injects live data into your real product—no clones at all. $16K-$83K/year. Demos don't break when your product updates.

For SMBs/Startups (Budget <$10K/year)

Supademo at $27-$38/user/month offers AI-powered interactive demos with voiceovers. Implementation in hours.

Arcade is the simplest entry point at $32-$42/user/month. Screenshot and video hybrid.

Why we built Rep differently: When I started Rep, I kept asking: why are we building static assets at all? The whole point of a demo is a conversation. So we built an AI agent that joins video calls, shares its screen, navigates your product live, and talks to prospects in real-time. No screenshots to maintain. No rebuilds when your product updates. Just an AI teammate that handles demos 24/7.

Making the Switch: What to Consider

If you're evaluating a move away from Reprise, here's a practical framework:

Migration Checklist

Before you switch, audit your current state:

- Map your existing demos — How many are Reveal (live overlay), Replay (tours), or Replicate (sandboxes)? Each needs a different replacement strategy.

- Calculate your maintenance burden — Track SE hours spent on demo updates over the last quarter. Multiply by 4. That's your annual hidden cost.

- Assess your mobile traffic — 88% of interactive demos still happen on desktop, but if your buyers are mobile-first, Reprise's "clunky mobile experience" (per HowdyGo) matters.

- Measure your response time — What's your current lead-to-demo time? If it's over 5 minutes, you're losing to competitors who respond faster.

- Document your security requirements — Do you need SOC 2, ISO 27001? Not all alternatives match Reprise here.

ROI Framework

| Cost Category | Reprise (Annual) | Alternative | Net Change |

|---|---|---|---|

| Software license | $30K-$100K | $6K-$60K (varies) | Savings |

| Implementation | 120+ hours × $200/hr | 8-40 hours | Savings |

| SE maintenance (21 days × loaded cost) | ~$12K | Near-zero for AI agents | Savings |

| Opportunity cost (slow response) | Unmeasured but real | Improved capture | Revenue gain |

The demo automation market is at an inflection point. Reprise built powerful technology for a world where enterprises needed complex sandbox environments and had SE teams to maintain them. That world still exists—but it's shrinking.

My prediction: within two years, most "Reprise alternatives" will themselves feel dated. The teams winning will be the ones who stopped asking "which demo tool?" and started asking "which demo agent?"

If you want to see what that looks like in practice—an AI agent that joins calls, shares its screen, and demos your product 24/7—Rep is what we're building. Book a demo. Or rather, let our AI agent demo itself.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- What Reprise Actually Offers (And Who It's Built For)

- The Hidden Costs Behind Reprise's Complexity

- Why 61% of B2B Buyers Now Demand Self-Service Demos

- The 2025-2026 Market Shift: From Demo Tools to Demo Agents

- Reprise Alternatives by Use Case and Budget

- Making the Switch: What to Consider

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.