Presales Tools: A Practical Guide for SE Leaders Who Are Done With Demo Overload

Executive Summary

- 35% of presales demos are wasted on unqualified prospects (Consensus 2025)

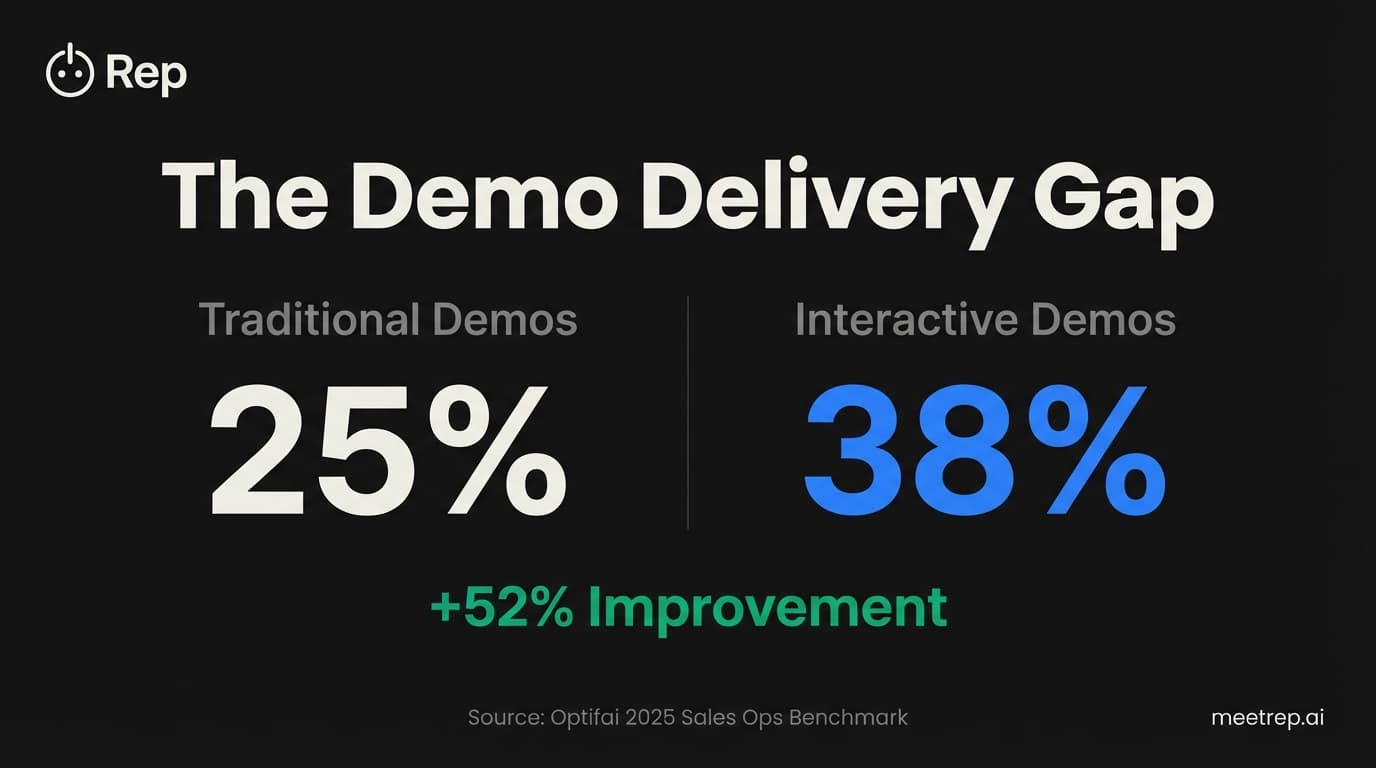

- Interactive demos convert at 38% vs. 25% for traditional screen shares (Optifai 2025)

- 57% of orgs already automate some demo processes—you're probably behind

- Seven tool categories exist, but most teams only need 2-3 to start

- Fix qualification before you buy automation (seriously)

Your SEs are drowning. Not in work—in the wrong work.

According to the 2025 Consensus SE Report, 35% of demos go to prospects who were never qualified to begin with. That's a third of your team's time. Gone. And it's getting worse: the same report found that 70% of B2B deals now require presales support to close.

I've spent years building sales automation products—first at GoCustomer.ai, now at Rep. The presales tool market is a mess. Vendors want you to believe you need twelve different platforms. You don't. This guide breaks down what actually matters, backed by data I can point to.

What Are Presales Tools, and Why Do They Matter Now?

Presales tools are software platforms that help sales engineering teams deliver demos, qualify prospects, and enable buyers to evaluate products without constant SE involvement. They span categories from demo automation to conversation intelligence to presales management—and choosing the right ones can determine whether your team scales efficiently or burns out trying.

Here's why this matters more in 2025 than ever before.

The Optifai Sales Ops Benchmark, analyzing 939 B2B companies, found the average demo-to-close rate is just 25%. Three out of four demos don't result in a closed deal. And that's the average—plenty of teams are doing worse.

Meanwhile, deal complexity keeps climbing. Consensus reports a 19% increase in stakeholders per deal. More people involved means more demos requested. Your SE headcount isn't growing 19% per year. Mine wasn't either.

The Data: The demo automation market is projected to grow from $2.1B in 2023 to $7.8B by 2033—a 14.2% CAGR. (DataHorizon Research)

That's not hype. That's demand signal. SE leaders are buying because they have to.

The Seven Categories of Presales Tools (And When You Actually Need Each)

The presales software presale pitch usually lumps everything together. But these tools solve different problems. Here's what each category does:

1. Demo Automation Platforms

What they do: Create self-serve or asynchronous demos that prospects can experience without a live SE.

When you need them: When unqualified demo volume is crushing your team. When you're losing deals to competitors who let prospects explore on their own schedule.

Examples:Consensus, Storylane, Navattic

2. Interactive Demo Software

What they do: Let prospects click through a guided version of your product—either cloned environments or HTML captures.

When you need them: When website conversion is the bottleneck. When prospects want to "try before they talk."

Examples:Walnut, Demostack, Reprise

3. Presales Management Platforms

What they do: Track SE activities, manage POCs, measure presales contribution to pipeline.

When you need them: When you have 10+ SEs and no visibility into what's working. When leadership asks "what's the ROI of presales?" and you can't answer.

Examples:Vivun, PreSkale, Homerun

4. RFP Automation

What they do: Speed up response time on RFPs and security questionnaires.

When you need them: When RFPs are eating weeks of SE time. When you're losing deals because you couldn't respond fast enough.

Examples:Responsive (formerly RFPIO), Loopio

5. Digital Sales Rooms

What they do: Create shared spaces for multi-stakeholder deals with content, timelines, and collaboration.

When you need them: When deals involve 5+ stakeholders. When content gets lost in email threads.

Examples:Dock, Aligned

6. Conversation Intelligence

What they do: Record, transcribe, and analyze sales calls to extract insights.

When you need them: When you want to understand why demos win or lose. When you're coaching SEs and need data.

Examples:Gong, Chorus

7. POC/Sandbox Environments

What they do: Spin up isolated product environments for technical evaluations.

When you need them: When POCs require real product access. When you need data isolation between prospects.

Examples:TestBox, CloudShare

The Real Cost of Not Having the Right Presales Tool Stack

I could tell you what you'd gain with better tools. But let's talk about what you're losing without them.

The Optifai 2025 benchmark found that 32% of demos fail due to poor qualification. Not bad demos—demos that never should have happened.

Here's what that actually means. If your team runs 100 demos a month, 32 are wasted. At an average of 90 minutes per demo (including prep and follow-up), that's 48 hours of SE time. Per month. Burned.

Key Insight: 10% increase in unqualified demos creates burnout equivalent to 2 additional crunch weeks per quarter. (Consensus 2024)

And burnout isn't just a morale problem. It's a retention problem. Replacing an SE costs 6-9 months of salary. You do the math.

The right presales tools don't just add efficiency. They stop the bleeding.

Why Interactive Demos Are Changing Conversion Math

This is the part where the data gets interesting.

Traditional demos—live screen shares where an SE walks through the product—convert at about 25% on average. But interactive demos, where the prospect controls the experience? They convert at 38%.

That's a 52% improvement. Same prospects. Different delivery method.

| Demo Type | Conversion Rate | Source |

|---|---|---|

| Traditional (live screen share) | 25% | Optifai 2025 |

| Interactive (prospect-controlled) | 38% | Optifai 2025 |

| SaaS companies (all types) | 30% | Optifai 2025 |

Why the gap? My theory: interactive demos let prospects focus on what matters to them, not what your demo script covers. They skip the irrelevant parts. They spend more time on the features that actually solve their problem.

Navattic's 2025 research, analyzing 28,000+ demos, found that top-performing interactive demos hit 61.6% completion rates with 54% click-through rates. The same study showed ungated demos have 10% higher engagement than gated ones.

So: let people in, let them explore, and get out of the way.

What we learned at GoCustomer: We built automation tools for two years before I fully understood this. More control for the prospect means less friction in the deal. We kept trying to optimize the demo delivery. We should have been optimizing the prospect experience.

How Leading Teams Actually Use Demo Automation

Here's the good news: you're not the first team to figure this out.

Consensus 2024 reports that 57% of organizations now automate at least some demo processes. And the ones that do it well see results.

According to Consensus, teams using demo automation see a 15% reduction in unqualified demos. That's not magic—that's qualification happening before the SE gets involved. Prospects watch the automated demo, self-select whether it's a fit, and only the interested ones book time.

But does this mean replacing SEs? No. And anyone telling you that is selling something.

The best implementations I've seen use automation for early-stage discovery—intro demos, feature overviews, initial qualification. SEs then focus on complex technical discussions, custom POCs, and deals that actually need human expertise.

Sovos, a tax compliance company, reported that SMB deals now close with just 35 minutes of internal SE resources. Previously, those deals took weeks of SE involvement. That's not replacing SEs—that's freeing them for higher-value work.

My recommendation: Don't start with automation if your qualification process is broken. Automating a bad process just creates automated bad outcomes faster. Fix qualification first. Then automate.

Building Your Presales Tool Stack by Team Size

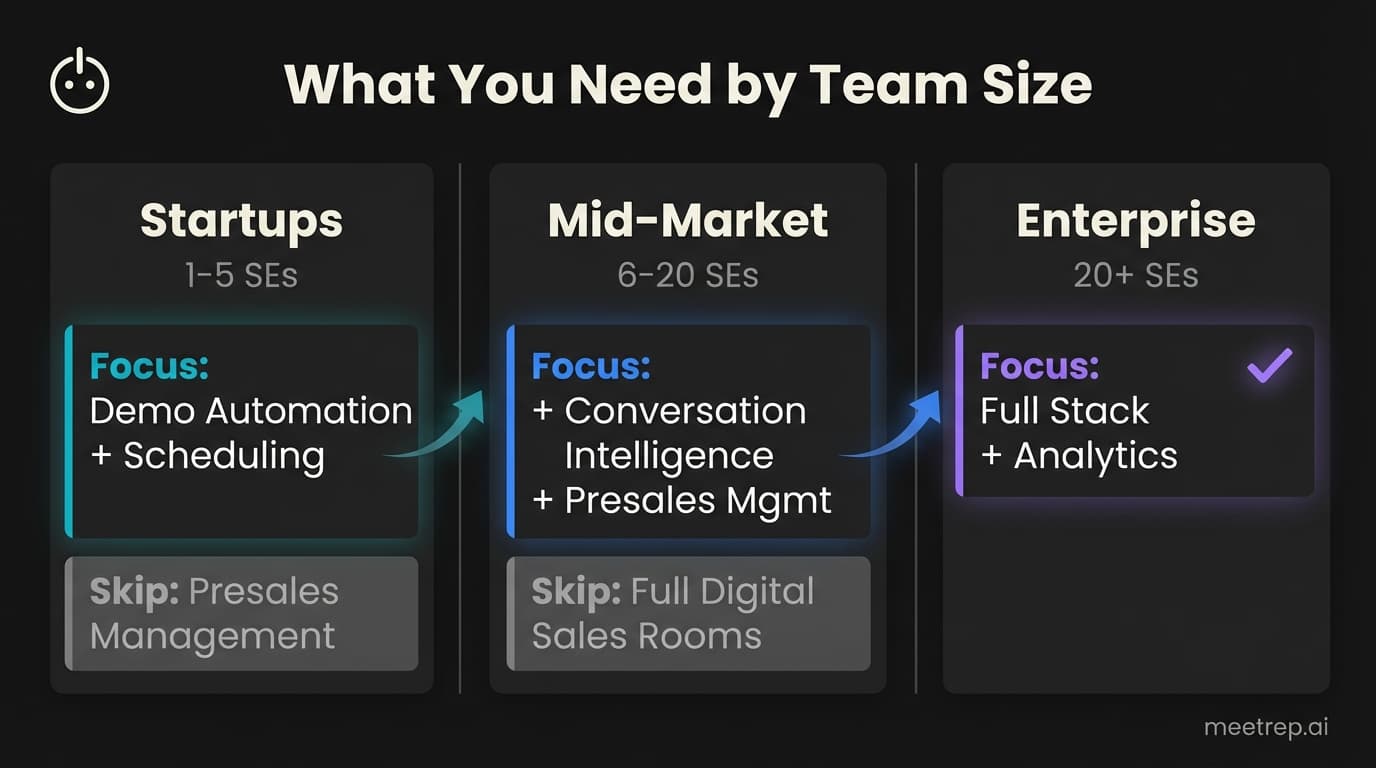

Not every team needs every category. Here's what I'd prioritize based on team size:

Startups (1-5 SEs)

Focus on: Demo automation + instant scheduling

At this size, every SE hour matters. You can't afford to waste time on unqualified demos. Start with one interactive demo tool (Storylane and Navattic both have startup-friendly pricing) and connect it to scheduling automation.

Skip for now: Presales management platforms. You don't have enough data to justify the overhead.

Mid-Market (6-20 SEs)

Focus on: Demo automation + conversation intelligence + presales management

Now you need visibility. Who's doing what? Which demo approaches win? Gong or a similar tool becomes worth it when you have enough call volume to see patterns. And you need some system—even if it's just structured Salesforce fields—to track presales contribution to pipeline.

Skip for now: Full digital sales rooms (unless your deals routinely involve 7+ stakeholders).

Enterprise (20+ SEs)

Focus on: Full stack with analytics

At this scale, the 15% reduction in unqualified demos from automation represents hundreds of recovered hours per quarter. You need presales management for capacity planning, conversation intelligence for coaching, and likely digital sales rooms for your biggest deals.

The Metrics That Actually Matter for Presales Tools

Your VP of Sales is going to ask about ROI. Here's what to track:

| Metric | Benchmark | Source |

|---|---|---|

| Demo-to-close rate | 25% B2B average, 30% SaaS | Optifai 2025 |

| Unqualified demo percentage | Under 15% is good | Consensus 2024 |

| Lead qualification rate | 60-70% healthy, 70-80% great | RevenueHero 2025 |

The companies getting real value from presales tools track these before and after implementation. Not just "we have demo automation now" but "demo-to-close improved from 22% to 31%."

Case study numbers I can actually point to:

- Coupa + Navattic: $10M+ ARR influenced by interactive demos

- Upland Software + Storylane: 300+ leads in 90 days, 75% engagement, deals closing in weeks instead of months

- meez + Navattic: Self-serve revenue grew from 10% to 50% of monthly new revenue

These aren't theoretical. They're published case studies with named companies and specific numbers.

What's Next: AI Agents and Autonomous Demos

This is the part where I have to mention what we're building at Rep. I'll keep it brief.

The current demo automation tools are mostly asynchronous—recorded videos, interactive click-throughs, self-guided tours. They work. But they don't answer questions in real-time. They can't pivot based on what a prospect asks.

We're building something different: AI agents that join video calls, share their screen, navigate your actual product live, and have real conversations with prospects. Not a recording. Not a chatbot. An AI that demos like your best SE would.

It's early. I'm not going to claim it solves everything. But if the trend line holds—57% of orgs automating some demos now, projected to grow significantly—autonomous demos feel like the obvious next step.

Gartner's Melissa Hilbert noted recently: "AI agents are everywhere, but there's a value ceiling. Beyond a certain point, more AI does not mean more productivity."

I think she's right. My take: the winning approach won't be "AI everywhere." It'll be AI in the places where it actually makes your team's life better.

The presales tool market will keep growing. Vendors will keep claiming their platform solves everything. They don't.

Start with your biggest problem. If it's unqualified demo volume, look at demo automation. If it's no visibility into what's working, start with conversation intelligence and basic tracking. Don't buy seven tools because someone told you it's the "complete stack."

Your SEs are smart. Give them the right tools and get out of their way.

If you're curious about what autonomous demos look like in practice—AI that joins calls, shares screen, and actually demos your product—see how Rep works.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- What Are Presales Tools, and Why Do They Matter Now?

- The Seven Categories of Presales Tools (And When You Actually Need Each)

- The Real Cost of Not Having the Right Presales Tool Stack

- Why Interactive Demos Are Changing Conversion Math

- How Leading Teams Actually Use Demo Automation

- Building Your Presales Tool Stack by Team Size

- The Metrics That Actually Matter for Presales Tools

- What's Next: AI Agents and Autonomous Demos

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.