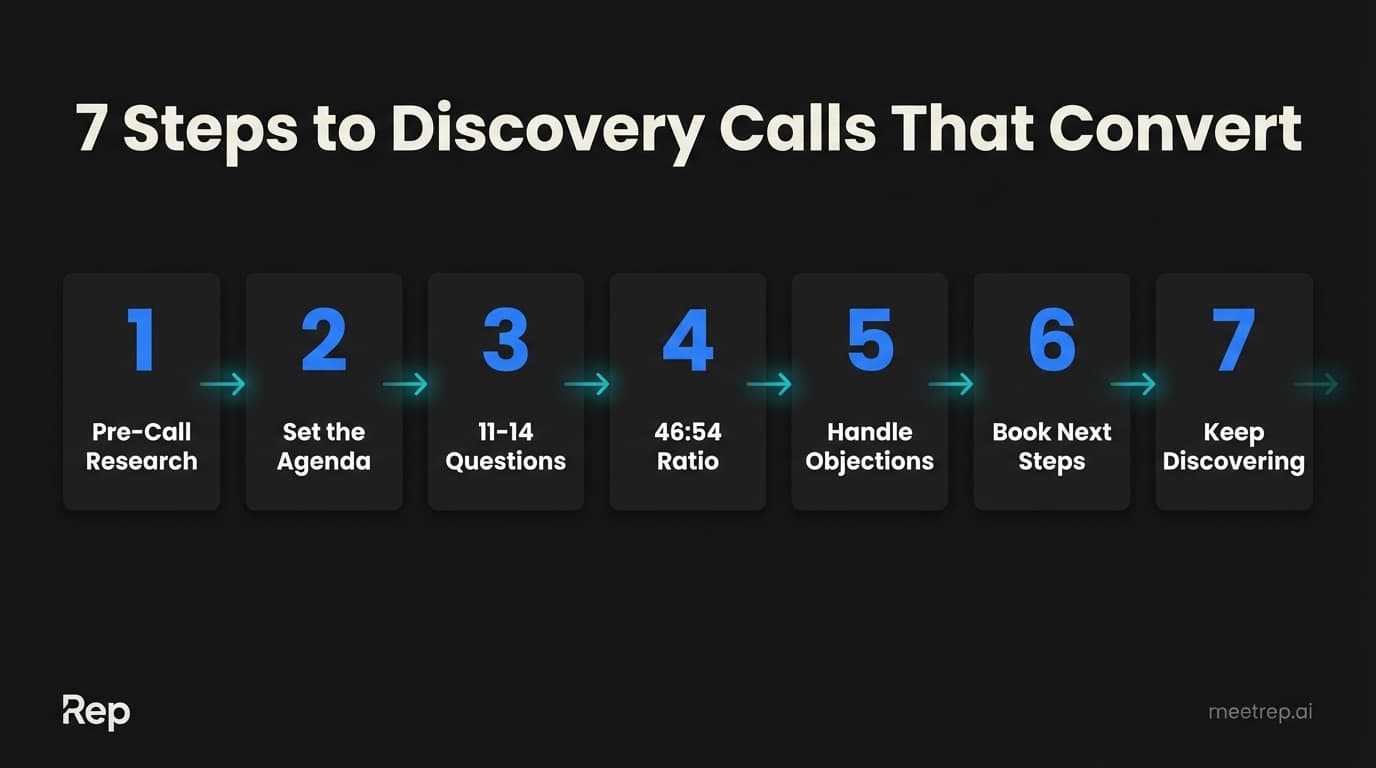

How to Run a Discovery Call That Actually Converts (7-Step Framework)

Executive Summary

- Ask 11-14 questions per call—this correlates with 74% success rates vs. 46% for fewer than 7

- Keep your talk time to 46% or less—let prospects talk 54%+ of the time

- Aim for 38 minutes average duration—shorter means shallow discovery

- Multi-thread or die—single-threaded deals lose 2.3x more often

- Always book the next meeting while on the call—86% of deals stall without clear next steps

It takes roughly 40 dials to book one discovery call in 2025. With a 2.3% cold call success rate, every disco call you land is precious. And yet most reps wing it.

Here's the problem: 67% of lost sales trace back to poor qualification. That's not a skills gap. That's a process failure. I've watched thousands of sales conversations flow through automation platforms—first at GoCustomer.ai, now while building Rep—and the pattern is always the same. Reps talk too much, ask too little, and end calls with vague "I'll follow up next week" promises that go nowhere.

This guide is different. It's built on analysis of over 519,000 recorded sales calls, updated for how buyers actually behave in 2025. You'll learn the exact question count (11-14), optimal call duration (38 minutes), and talk-to-listen ratio (46:54) that separate top performers from everyone else.

What Is a Discovery Call? (And Why the Old Definition Is Wrong)

A discovery call is the first real conversation between a sales rep and a prospect where you determine mutual fit. You're not pitching. You're diagnosing—uncovering their challenges, goals, timeline, and decision process to see if there's a reason to keep talking.

But here's where most definitions get it wrong.

Discovery isn't a "stage" you complete and move past. It's an ongoing process that continues through demo, negotiation, and close. The best reps I've worked with keep discovering new information all the way to signature. They're still asking "who else needs to weigh in?" during contract review.

Key Insight: According to G2's 2024-2025 Buyer Behavior Report, 69% of B2B buyers don't engage salespeople until after they've already made their decision. If they're talking to you, they either have a specific problem they can't solve alone—or they're already comparing you to competitors. Either way, generic questions won't cut it.

Discovery Call vs. Demo Call

| Factor | Discovery Call | Demo Call |

|---|---|---|

| Primary Goal | Qualify prospect, uncover pain points | Demonstrate solution fit |

| Talk Ratio | Rep: 46% / Prospect: 54% | Rep: 65-70% / Prospect: 30-35% |

| Ideal Duration | 38 minutes | 30-45 minutes |

| Key Questions | Pain, impact, decision process, timeline | "How would you use this?" |

| Position in Funnel | Early (qualification) | Mid-to-late (evaluation) |

| Your Focus | Listening | Presenting |

The difference matters. When you treat a discovery call like a demo, you pitch before you understand. When you treat a demo like discovery, you waste everyone's time with questions you should've asked already.

Step 1: Pre-Call Research (The 82% Opportunity)

Only 18% of buyers believe salespeople show up prepared. That means 82% of your competitors are walking into calls cold. This is your easiest win.

I'm not talking about spending 30 minutes on every prospect. You need a focused 5-10 minute ritual that gives you ammunition no one else has.

The 3x3 Research Method: Find 3 relevant facts in 3 focused minutes across these areas:

LinkedIn (60 seconds):

- Recent posts or activity (last 30 days)

- Career trajectory—did they just start this role?

- Shared connections you could reference

Company Signals (90 seconds):

- Recent funding or acquisitions (Crunchbase)

- Job postings—hiring means growth means budget

- Tech stack hints from job descriptions

CRM & Past Interactions (60 seconds):

- SDR notes from initial outreach

- Content they downloaded

- Previous conversations with anyone at your company

Common Mistake: Never ask questions you could've Googled. "What does your company do?" signals you don't care enough to prepare. In a world where 73% of buyers avoid suppliers who send irrelevant outreach, lazy prep kills trust instantly.

What You're Really Looking For: Critical Events

The best discovery questions reference specific triggers. Look for:

- New leadership (new VP = new priorities)

- Expansion or new offices (scaling challenges)

- Product launches (infrastructure strain)

- Regulatory changes (compliance requirements)

- Competitor mentions in their content (pain with alternatives)

When you find one, open with it: "I noticed you brought on a new VP of Sales last month. What's shifted in terms of priorities since then?"

That's a different conversation than "Tell me about your challenges."

Step 2: Set the Agenda (The Upfront Contract)

The first two minutes determine whether the prospect stays engaged or mentally checks out. You need to lower their guard while establishing control.

The Upfront Contract Script:

"Thanks for taking the time, [Name]. I know you're busy, so here's what I'm thinking for our 30 minutes together.

I've done some research on [Company]—saw that [specific fact from your research]—so I have some context. My goal is to understand [pain area they likely have] and see if we might be able to help.

If it looks like a fit, we'll figure out next steps together. If not, I'll tell you honestly and point you somewhere better. Fair?

Before we get into it, I'm curious—what made you take this call?"

That last question matters. It's your first real discovery question, and it tells you everything about their intent.

Why This Works:

- Shows you did homework (instant differentiation)

- Sets expectations (reduces anxiety)

- Promises honesty (builds trust)

- Hands control back to them (removes pressure)

- Immediately starts discovery (no wasted small talk)

For Group Calls (6-10 Stakeholders):

Buying committees keep growing. Philomath Research reports that the average B2B deal now involves 6-10 decision-makers. When you're on a call with multiple people, modify your opening:

"I see we have [names] joining from [teams]. Before we dive in, it would help to understand what each of you is hoping to get from this conversation. Can we do a quick round—30 seconds each—on what's your stake in solving [problem area]?"

Now you know who cares about what. Your discovery just became surgical instead of scattered.

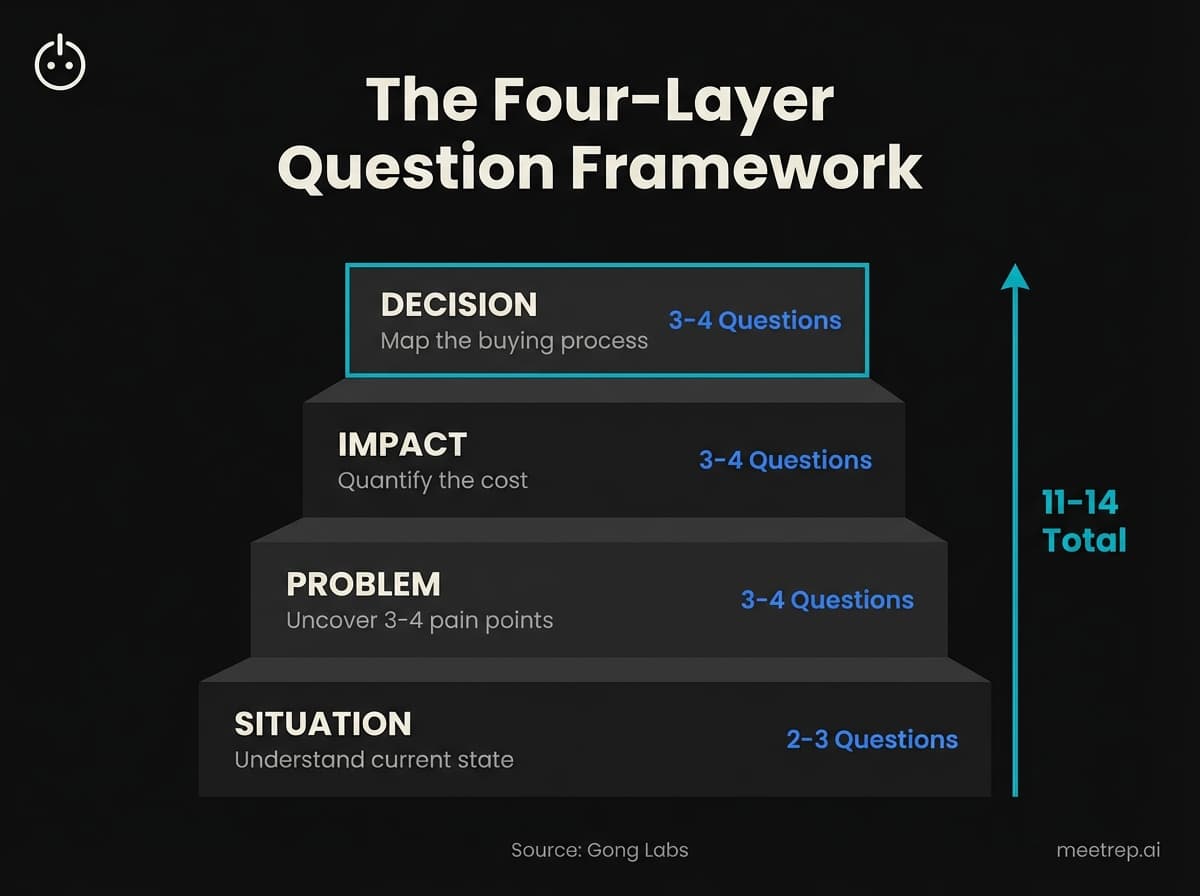

Step 3: The 11-14 Question Framework (The Sweet Spot)

Here's the data that changed how I think about discovery.

Gong's analysis of 519,000+ B2B sales calls found that asking 11-14 questions correlates with a 74% success rate. Ask fewer than 7 questions, and success drops to 46%. Ask more than 14, and it feels like an interrogation—success rates fall back to average.

The Data: 11-14 targeted questions = 74% success rate. Under 7 questions = 46% success rate. Over 14 questions = diminishing returns. Source: Gong Labs 2024-2025

The key word is targeted. Not a checklist. Not rapid-fire. Layered questions that build on each answer.

The Four-Layer Framework:

| Layer | Purpose | Questions | Time |

|---|---|---|---|

| Situation | Understand current state | 2-3 | 5 min |

| Problem | Uncover 3-4 pain points | 3-4 | 10 min |

| Impact | Quantify the cost | 3-4 | 8 min |

| Decision | Map the buying process | 3-4 | 8 min |

Layer 1: Situation Questions (2-3 questions)

You're building context without asking anything obvious.

- "Walk me through your current process for [relevant workflow]."

- "What tools are you using today to handle [function]?"

- "How is your team structured around [area]?"

After each answer, probe deeper: "Tell me more about that" or "How does that affect [related area]?"

Layer 2: Problem Questions (3-4 questions)

This is where deals are won or lost. Gong's research shows that uncovering 3-4 distinct business problems correlates with the highest deal advancement rates. One problem isn't enough. You need to understand the full picture.

- "What triggered you to look for a solution now?" (This reveals the critical event driving urgency)

- "What happens if you don't solve this in the next [timeline]?" (Loss aversion—powerful)

- "Who else on your team is affected by this challenge?" (Starts multi-threading)

- "Have you tried solving this before? What happened?" (Reveals past failures, vendor history)

Layer 3: Impact Questions (3-4 questions)

This is where 78% of reps struggle, according to Cuvama's research. They uncover problems but never connect them to business outcomes.

- "How is this affecting [revenue/efficiency/team morale]?"

- "Can you put a number on what this is costing you?"

- "What does success look like in 6 months if this is solved?"

- "If you fix [pain 1], what else does that enable for you?"

The goal: leave with a quantified business case you can reference in every future conversation.

Layer 4: Decision Questions (3-4 questions)

Here's a stat that should scare you: 130% higher win rates for multi-threaded deals over $50K. Single-threaded deals—where you're only talking to one contact—lose 2.3x more often.

- "Who else needs to be involved in this decision?"

- "What's your typical process for evaluating new solutions?"

- "What's driving the timeline? Is there a critical event?"

- "Are you looking at other vendors? How are you thinking about the comparison?"

What we learned at GoCustomer: When we analyzed successful deals vs. stalled ones, the difference wasn't product fit. It was multi-threading. Deals with 3+ contacts at the prospect company closed at nearly double the rate. One champion isn't enough. Your champion can leave, get promoted, or lose political capital. Then you're dead.

Step 4: The 46:54 Talk Ratio (Shut Up and Listen)

Most reps talk too much. The data is clear.

Top performers maintain a 46:54 talk-to-listen ratio—they speak 46% of the time and listen 54%. Mindtickle's research shows reps who talk more than 57% of the time need immediate coaching intervention. Lower performers often hit 70%+.

That's not discovery. That's a pitch with occasional pauses.

Practical Techniques:

The 3-Second Rule: After they finish answering, wait 3 seconds before responding. Silence feels awkward. Lean into it. 80% of the time, they'll add more detail without you asking.

Mirroring: Repeat the last 3 words they said as a question.

- Prospect: "We're struggling to forecast accurately."

- You: "Forecast accurately?"

- Prospect: "Yeah, we have no visibility into what's actually closing this month..."

You just got deeper without saying anything substantive.

Labeling: Name the emotion or situation you're sensing.

- "It sounds like this has been frustrating for a while."

- "It seems like the team is skeptical about changing systems."

This validates what they're feeling and invites them to expand.

Verbatim Notes: Write down their exact phrases, not your interpretation. When someone says they're "drowning in manual work," don't write "inefficient processes." Write "drowning in manual work." Those exact words go in your follow-up email and proposal.

Key Insight: If you're using conversation intelligence tools like Gong or Chorus, check your talk-time reports after every call. Seeing "62%" staring back at you is a wake-up call. Iron Mountain saw a 148% improvement in new rep performance after implementing this kind of coaching. The data doesn't lie—you're probably talking more than you think.

Step 5: Handle the "Just Show Me the Demo" Objection

Every rep has heard it. Five minutes into discovery, the prospect cuts you off: "Can we just see the product?"

I get it. They're busy. They've done their research. They want to evaluate, not be evaluated.

But here's my take: giving a demo without discovery is like prescribing medication without diagnosis. You'll show features they don't care about. You'll miss the problems they actually need solved. And then you'll wonder why they went dark.

The Pivot Script:

"Absolutely—I want to show you exactly what matters for your situation. Here's the thing: I could walk through the whole platform in 30 minutes, and you'd tell me 'that's nice' and we'd both wonder if it's relevant.

Or I could spend 10 minutes understanding [pain area], then show you the 3 features that'll actually solve your problem. Which sounds more useful?"

This reframes the demo as more valuable after discovery, not a barrier you're putting up.

Alternative: The AI Demo Handoff

This is where I'll mention Rep, because it genuinely solves this problem.

We built Rep to handle this exact tension. When a prospect wants to see the product before they're ready for a strategic conversation, you can send them a demo link. Rep—our AI voice agent—joins the call, shares its screen, navigates your actual product, and answers questions in real-time using your knowledge base.

It's not a recorded video. It's a live, interactive conversation. The prospect explores at their own pace, 24/7. And when they're done, you get a transcript of their questions and the features they explored.

Then your human discovery call focuses on strategy, not screen-sharing.

The Data: In an era where 61% of buyers prefer rep-free experiences, giving prospects a way to self-educate on their terms isn't just nice—it's necessary. The human call becomes more valuable when it's not spent on basics.

Step 6: Close for Next Steps (Or Qualify Out)

Here's a number that should keep you up at night: 86% of B2B purchases stall during the buying process. Not lost to competitors. Stalled. Stuck in limbo. Death by indecision.

The difference between deals that move and deals that stall? Clear next steps, booked while on the call.

"I'll follow up next week" is not a next step. It's a death sentence.

The Booking Script:

"Based on what you shared, it sounds like we can help with [pain 1], [pain 2], and [pain 3]. For our next conversation, I'd want to include [stakeholder type] so we can address [their concern] directly.

I have Tuesday at 2pm or Thursday at 10am. Which works for you and [stakeholder]?"

Notice what's happening:

- You summarized what you heard (proves you listened)

- You identified who else should be there (multi-threading)

- You gave specific times (assumes the yes)

- You made it about their needs (not your pipeline)

When They Push Back on Including Others:

"I appreciate you wanting to champion this internally. What I've found is that when we can address [CFO's] ROI questions or [IT's] integration concerns directly, deals move faster—and you look better for bringing in a solution that's already been vetted. Would it make sense to loop them in early?"

When They Won't Commit:

Sometimes the answer is no. And that's actually valuable information.

"I'm sensing some hesitation—totally fine. Is this not the right priority right now, or is there something we haven't addressed?"

If they confirm it's not a priority, qualify them out gracefully. Your time is better spent on prospects who are ready to move. Not every call should advance. Some should end.

The 24-Hour Follow-Up:

Within 24 hours, send a recap email with:

- Their pain points (in their exact words)

- The outcomes they want

- Next meeting details with all stakeholders

- Any resources you promised

This creates accountability. It proves you listened. And it gives your champion ammunition to sell internally.

Step 7: Keep Discovering (It Never Really Ends)

I mentioned this earlier, but it's worth repeating because it's the mindset shift that separates good reps from great ones.

Discovery isn't a stage. It's a process.

The best salespeople keep asking questions through demo, trial, negotiation, and contract review. Because buying committees of 6-10 people mean new stakeholders with new requirements can surface at any point.

"Who else needs to weigh in on this?" is a question you ask on call one and call seven.

The Mindset Change:

Old thinking: "We do discovery on Call 1, demo on Call 2, close on Call 3."

New reality: You're discovering new information through demo, trial, and negotiation. Buying committees of 6-10 people mean each stakeholder introduces new requirements.

What This Means Practically:

- During demos, ask "How would you use this?" after each feature

- During trials, ask "What's working? What's confusing?"

- During pricing, ask "What would make this a no-brainer?"

- During negotiation, ask "What concerns does [new stakeholder] have?"

Discovery creates trust. Pitching creates resistance. Never stop doing the thing that builds trust.

The Discovery Mistakes That Kill Deals

Let me be direct about what doesn't work. These are patterns I've seen repeatedly—in data at GoCustomer, in conversations with sales leaders, in my own early failures.

Mistake 1: Talking more than 57% of the time. You're pitching, not discovering. The prospect feels interrogated or lectured, neither of which builds trust.

Mistake 2: Asking Googleable questions. "What does your company do?" signals you don't care. 82% of your competitors make this mistake. Don't join them.

Mistake 3: Single-threading. Your one champion leaves the company. Now what? Multi-thread from day one. Every call should identify at least one new stakeholder.

Mistake 4: Using only BANT. Budget, Authority, Need, Timeline works for transactional sales. For complex B2B, you need MEDDIC or SPICED. They surface decision criteria, competition, and champions that BANT misses entirely.

Mistake 5: Ending without clear next steps. "I'll send some info" doesn't count. Book the meeting on the call, with specific stakeholders, at specific times.

Mistake 6: Not recording or documenting. If you're not using conversation intelligence tools in 2025, you're flying blind. You don't know your real talk time. You forget details. Your follow-ups are generic. Fix this.

Discovery is the highest-leverage activity in your sales day. With only 2 hours daily spent on actual selling, you can't afford to wing it. The reps who master this—who ask the right number of questions, listen more than they talk, and always book next steps—close more deals with less effort.

The framework is simple. Simple doesn't mean easy. But it does mean repeatable.

Start with your next call. Count your questions. Check your talk time. Book the next meeting before you hang up. Do it consistently, and you'll separate yourself from the 67% who lose deals to poor qualification.

And when your prospects want to explore your product on their own terms, Rep can handle that 24/7—so your human conversations focus on the strategic questions only you can ask.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- What Is a Discovery Call? (And Why the Old Definition Is Wrong)

- Step 1: Pre-Call Research (The 82% Opportunity)

- Step 2: Set the Agenda (The Upfront Contract)

- Step 3: The 11-14 Question Framework (The Sweet Spot)

- Step 4: The 46:54 Talk Ratio (Shut Up and Listen)

- Step 5: Handle the "Just Show Me the Demo" Objection

- Step 6: Close for Next Steps (Or Qualify Out)

- Step 7: Keep Discovering (It Never Really Ends)

- The Discovery Mistakes That Kill Deals

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.