How to Reduce CAC by 40%: The Demo Automation Playbook for Sales Leaders

Executive Summary

- CAC rose 14% YoY to $2.00 spent per $1 of new ARR (Benchmarkit 2025)

- 92% of buyers select a vendor before ever contacting sales (Forrester)

- Interactive demos convert at 38% vs. 25% for screen share—a 52% lift (Optifai)

- Companies using AI-driven demos report 30-60% CAC reduction (Martal Group, Leadfeeder)

- The fix: Deploy autonomous demos to capture buyers 24/7, before they choose your competitor

Your CAC is climbing. Fast. Benchmarkit's 2025 SaaS Performance Metrics shows the median CAC ratio hit $2.00 in 2024—meaning companies now spend $2 to acquire every $1 of new ARR. That's a 14% jump in a single year.

And if you're in the bottom quartile? You're burning $2.82 for every dollar of new revenue.

I've spent years building sales automation tools—first at GoCustomer.ai, now at Rep. The pattern I keep seeing is this: most CAC reduction strategies focus on marketing efficiency. Better ads. Cheaper clicks. More content. But the biggest leak isn't at the top of the funnel. It's in the demo-to-close motion, where deals die waiting for a rep to show up.

This guide breaks down exactly how autonomous demos reduce CAC by 30-60%, with verified data from companies actually doing it.

Why Traditional CAC Reduction Strategies Miss the Point

Most advice on reducing CAC focuses on marketing spend: optimize your ad targeting, double down on organic, cut underperforming channels. That's table stakes. And it's not wrong.

But here's what nobody talks about: your sales team is the most expensive part of your acquisition cost, and they're spending 70% of their time on activities that don't close deals.

HubSpot's State of Sales 2025 found that sales reps spend only 30% of their time actively selling. That's roughly 2 hours a day. The rest? Admin, research, CRM updates, waiting for prospects to show up to calls.

The Data: According to Salesforce's State of Sales 6th Edition, 67% of sales reps don't expect to meet quota this year. And 84% missed last year.

So we've got rising acquisition costs, reps drowning in non-selling work, and quotas being missed across the board.

The question isn't "How do I spend less on marketing?" It's "How do I make my sales motion more efficient?"

That's where demos come in.

The Demo Bottleneck Nobody's Measuring

Here's a number that should terrify you: the average B2B lead response time is 42-47 hours.

Two days. Your prospect fills out a "Book a Demo" form, and they wait two days for someone to reach out.

Meanwhile, 78% of B2B customers buy from the first responder. And qualification odds drop 80% after just 5 minutes.

Let that sink in. Five minutes. Not five hours. Five minutes.

What we learned at GoCustomer: When we analyzed our own demo pipeline, we found that deals that got a same-day demo closed at nearly 3x the rate of deals that waited 48+ hours. The product didn't change. The pitch didn't change. Speed was the variable.

And it gets worse. Sales cycles have lengthened 22% since 2022, with the average B2B SaaS deal now taking 84 days to close. Every day in that cycle is compounding cost—rep time, follow-up emails, additional stakeholder meetings.

On average, it takes 3 demos to close a deal. Sometimes 15.

Each demo requires scheduling, prep, execution, and follow-up. Multiply that across your pipeline, and you're looking at a massive time sink that directly inflates CAC.

The "Silent Selection" Problem: Why Your "Book a Demo" Button Is Failing

This is the stat that changed how I think about demos entirely.

Key Insight: According to Forrester Research, 92% of B2B buyers start their journey with at least one vendor already in mind. And 41% have already selected their preferred vendor before formal evaluation even begins.

Read that again. By the time someone clicks "Book a Demo" on your website, there's a 41% chance they've already picked your competitor.

The buying journey isn't linear anymore. Buyers research in private—at 11pm, on weekends, during their commute. They compare features on G2. They read your documentation. They watch your YouTube videos. They form opinions.

And then, when they finally reach out, they're not exploring. They're confirming.

Gartner predicts that 80% of B2B sales interactions will occur in digital channels by 2025. This isn't a future prediction anymore. It's happening now.

If you're only engaging buyers when they schedule a call, you're showing up to a race that's already been run.

How Autonomous Demos Actually Reduce CAC

Demo automation isn't a new category. Tools like Consensus, Demostack, and Navattic have been around for years, offering interactive click-through demos that prospects can explore on their own.

And they work. Optifai's 2025 Sales Ops Benchmark (N=939 companies) found that interactive demos convert at 38%, compared to 25% for traditional screen share demos. That's a 52% improvement in conversion rate.

But there's a newer approach gaining traction: autonomous demos powered by agentic AI.

Here's the difference.

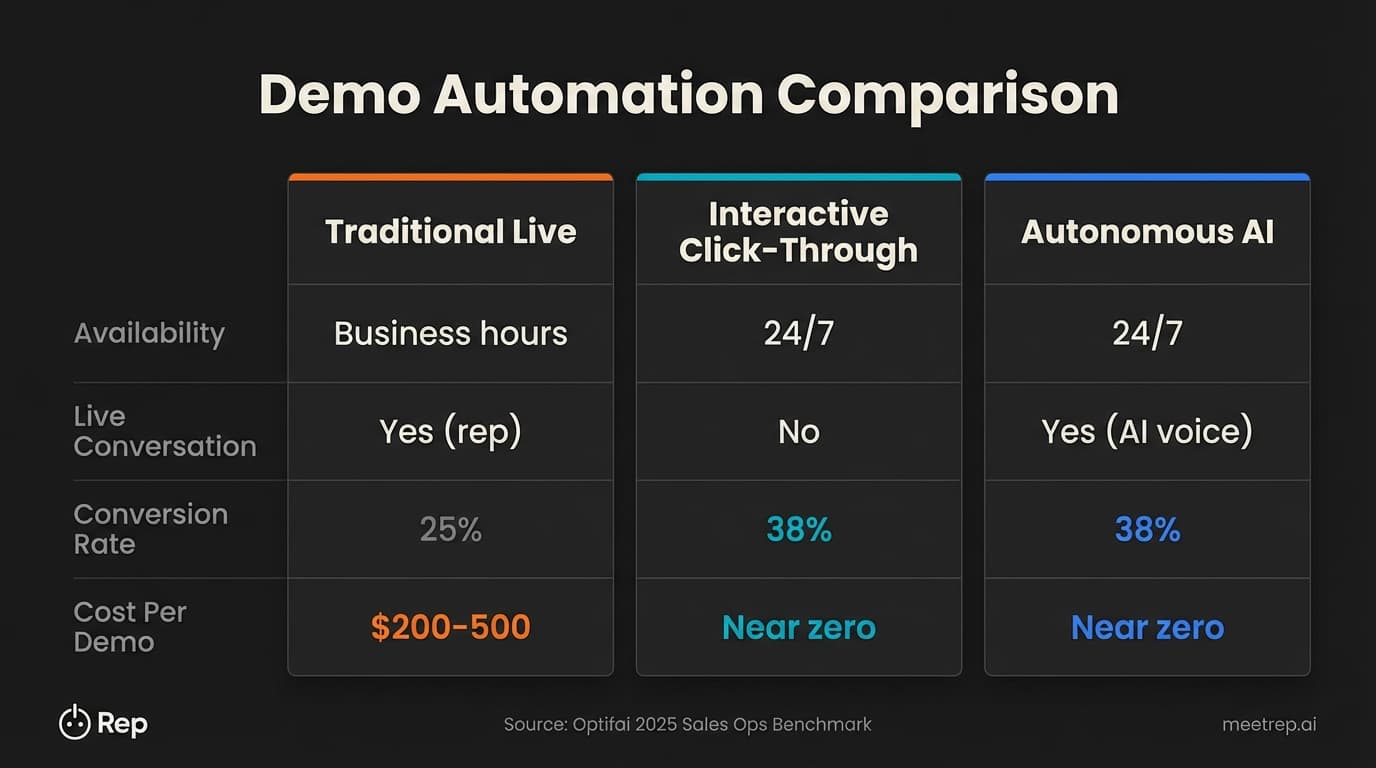

| Metric | Traditional Live Demos | Interactive Click-Through Demos | Autonomous AI Demos |

|---|---|---|---|

| Availability | Business hours only | 24/7 | 24/7 |

| Conversation | Yes—live rep | No—static paths | Yes—real-time AI voice |

| Question handling | Live answers | Pre-programmed responses | AI answers from knowledge base |

| Personalization | High (rep adapts) | Low (fixed paths) | High (AI adapts in real-time) |

| Cost per demo | $200-500 (rep time) | Near zero | Near zero |

| Screen sharing | Yes | Simulated/recorded | Yes—live browser navigation |

| SE time required | 100+ hours/quarter | 10-20 hours setup | Initial training only |

The key shift is from "generative AI" (which creates content) to "agentic AI" (which takes action). An autonomous demo agent doesn't just answer questions—it joins video calls, shares its screen, navigates your actual product, and responds to prospect questions in real-time.

Deloitte's 2025 Predictions Report estimates that 25% of enterprises will deploy AI agents this year, growing to 50% by 2027. This isn't speculative anymore.

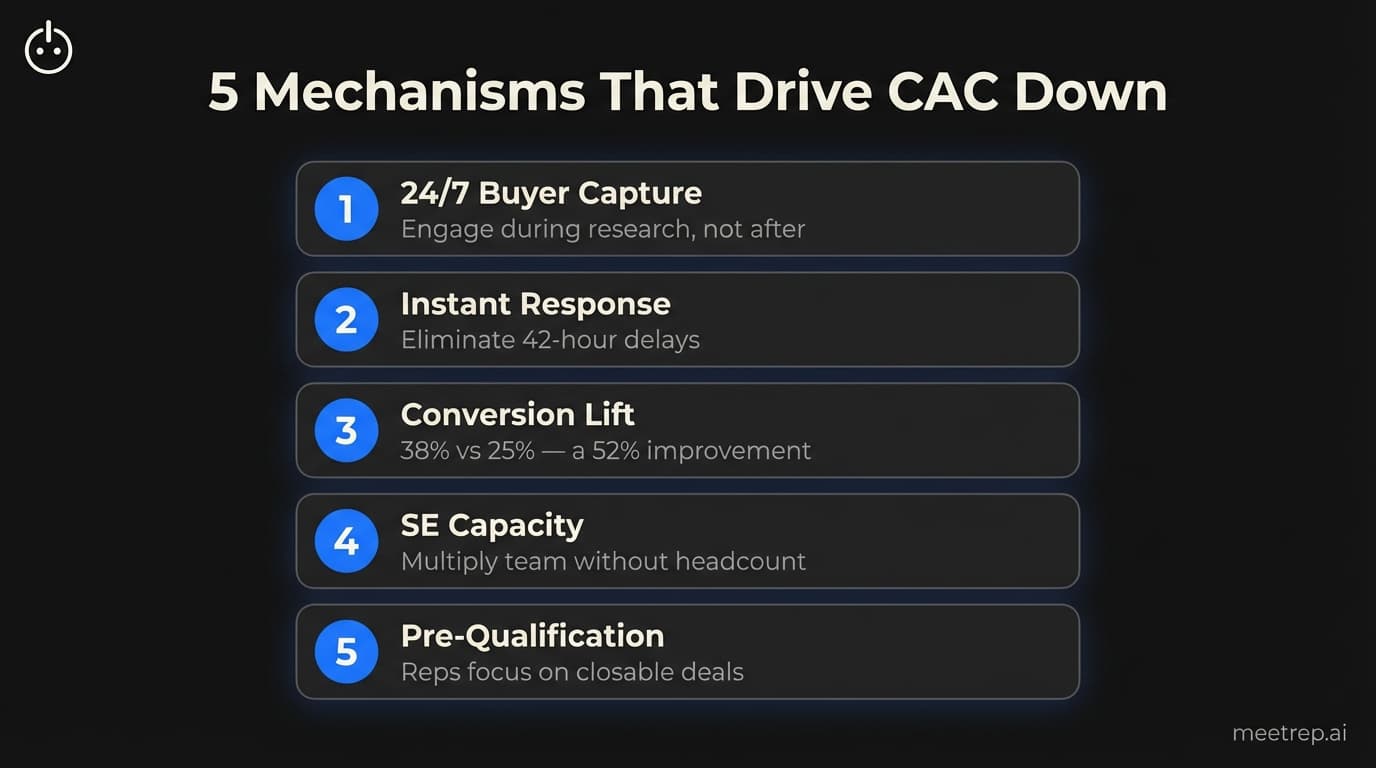

The 5 Mechanisms That Drive CAC Down

Autonomous demos reduce CAC through five specific mechanisms:

- 24/7 buyer capture. Your buyers research at night and on weekends. An autonomous agent captures the 92% of buyers who form vendor preferences during self-directed research—before they ever fill out a form.

- Speed-to-lead elimination. Instead of 42-hour response times, autonomous demos respond instantly. That alone protects you from the 80% drop in qualification odds that happens after 5 minutes.

- Conversion rate lift. Interactive and autonomous demos convert at 38% vs. 25% for screen share—a 52% improvement that directly reduces cost per closed deal.

- SE capacity multiplication. Your solution engineers are expensive and constrained. Wrike saved 2,100+ hours of SE time annually by automating repetitive demos, adding 15% capacity without new headcount.

- Pre-qualification filtering. When prospects self-serve through a demo, they reveal intent. Low-intent browsers drop off. High-intent buyers engage deeply. Your reps only spend time on closable deals.

The Data: Companies using AI-driven targeting and intent data have cut acquisition costs by 30–50% according to Martal Group's 2024-2025 research. Leadfeeder achieved a 60% CAC reduction—dropping from $400 to $160 per customer—through content automation and intent-based targeting.

The math compounds. Faster response × higher conversion × lower SE cost × better qualification = dramatically lower CAC.

Real Results From Companies Using Demo Automation

Let me share some verified case studies. These aren't hypotheticals—they're documented results from named companies.

My view on case studies: I'm always skeptical of vendor-sourced numbers. But when you see the same patterns across different platforms—Consensus, Demostack, Navattic—with consistent 25-50% cycle reductions and measurable pipeline impact, the signal becomes hard to ignore.

Bazaarvoice (Consensus Customer)

Bazaarvoice, with 21,000 employees and 40 AEs, deployed Consensus for automated overview demos. Results in one quarter:

- $3.5M pipeline influenced

- $100K time savings for presales

- 150 new stakeholders discovered

- 25% reduction in repetitive demos

- 33% shorter SMB sales cycles

Hunters Security (Demostack Customer)

This cybersecurity company implemented Demostack Sandboxes and saw:

- 50% shorter sales cycles (from 9 months to 4 months)

- Demo build time dropped from 100+ hours to under 10 hours

Gainsight (Demostack Customer)

The customer success platform reported:

- 25% growth in win rate

- 8% increase in close-win rate from Demostack-powered demos

- Demo response time cut from 48+ hours to under 1 hour

Wrike (Consensus Customer)

The project management platform documented:

- 2,100+ hours of SE time saved annually

- 15% more capacity added to solutions team

- 35% reduction in live demo calls

- 1,500+ new buying stakeholders discovered

- Implementation completed in just 6 days

Look, I want to call out that Wrike number: 6 days from onboarding to production. This isn't a 6-month enterprise deployment. It's a rapid time-to-value story.

Calculating Your Demo Automation ROI

Here's a simple framework to estimate your potential CAC reduction.

Step 1: Calculate current cost per demo

Take your SE team's fully-loaded cost (salary + benefits + tools) and divide by demos delivered per quarter.

Example: 4 SEs at $150K each = $600K/year. If they deliver 1,000 demos/year, that's $600 per demo.

Step 2: Calculate potential SE time savings

If demo automation handles 35% of demos (the Wrike benchmark), that's 350 demos × $600 = $210K in freed capacity.

Step 3: Factor in conversion rate lift

If your current demo-to-close rate is 25% and automated demos lift that to 38%, you're closing 52% more deals per demo.

On a $10M pipeline with 25% conversion, you're closing $2.5M. At 38%, you're closing $3.8M from the same pipeline. That's $1.3M in additional revenue.

Step 4: Account for speed-to-lead gains

If 78% of buyers choose the first responder and you're currently responding in 42 hours, you're losing deals before they start. Instant response captures deals you're currently hemorrhaging to faster competitors.

My recommendation: Start with your highest-volume, lowest-complexity demo type. Usually that's the intro/overview demo that gets repeated dozens of times per month. Automate that first, measure results for 30 days, then expand.

What About the Human Touch?

Honestly, I hear this objection constantly: "Our buyers need the human touch. They won't buy from a bot."

The data says otherwise.

Gartner research shows that 33% of all B2B buyers—and 44% of millennials—now prefer a seller-free sales experience. They don't want to wait for a rep. They want answers now.

And here's the thing: autonomous demos don't replace your sales team. They add to it.

Think about it this way. Your best AEs shouldn't be spending time on first-touch intro demos with unqualified prospects. They should be deep in negotiation with buyers who've already validated fit.

Demo automation handles the high-volume, repetitive top-of-funnel motion. Your humans handle the complex, relationship-driven close.

Gong's State of Revenue AI 2026 found that teams using AI generate 77% more revenue per rep. That's not because AI replaced the reps. It's because AI freed them to do what they're actually good at.

At Rep, this is exactly how we've built our product. Our AI agent joins video calls, shares its screen, navigates your product live, and answers questions using your knowledge base. But the moment a deal advances to serious negotiation, the human rep takes over. It's a handoff, not a replacement.

Implementation: Where to Start

If you're ready to explore demo automation, here's how I'd approach it:

Week 1-2: Audit your current demo motion

Map out how many demos you run monthly, who runs them, average scheduling time, and no-show rate. Identify the highest-volume demo types.

Week 3-4: Choose your automation approach

Options range from simple (interactive click-through demos like Navattic for self-serve exploration) to advanced (autonomous AI demos like Rep for live video conversations).

Consider: Do your buyers need to ask questions? Do they need to see specific features? How complex is your product?

Week 5-6: Create your first automated demo

Start with your intro/overview demo. This is typically the highest volume and most repetitive. Train the system, test with internal users, refine.

Week 7+: Launch and measure

Track: demos completed, conversion rate, time savings, lead response time, and pipeline influenced. Compare to your baseline.

The Data:Navattic research shows that interactive demos placed above the fold on landing pages see 3.5x higher engagement than those below the fold. Placement matters.

Frankly, one more thing: don't hide your automated demo behind a form. The whole point is to engage buyers during their research phase—before they're ready to talk to sales. Make it easy to find.

The CAC problem isn't going away. If anything, it's accelerating—14% increase in a single year, with cycles lengthening and quotas being missed across the board.

But here's what I've learned from building sales automation tools for years: the companies that win aren't the ones with the biggest marketing budgets. They're the ones who remove friction from the buyer's journey.

And right now, the biggest friction point is the demo. The scheduling delays. The timezone mismatches. The 42-hour response times while 78% of buyers pick the first vendor who shows up.

If you want to reduce CAC by 30-60%, start with your demo motion. Make it faster. Make it always-on. Make it scale without adding headcount.

That's exactly what we're building at Rep—autonomous AI agents that join video calls, share their screen, navigate your product live, and answer questions 24/7. It's how we're solving the demo bottleneck for good.

Want to see it work? Book a demo with Rep—and yes, you'll be talking to our AI.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- Why Traditional CAC Reduction Strategies Miss the Point

- The Demo Bottleneck Nobody's Measuring

- The "Silent Selection" Problem: Why Your "Book a Demo" Button Is Failing

- How Autonomous Demos Actually Reduce CAC

- The 5 Mechanisms That Drive CAC Down

- Real Results From Companies Using Demo Automation

- Calculating Your Demo Automation ROI

- What About the Human Touch?

- Implementation: Where to Start

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.