Enterprise Demos for Complex Products: Why Traditional Approaches Are Failing

Executive Summary

- 95% of winning vendors make the Day One shortlist—if buyers can't experience your product early, you're fighting for the remaining 5%

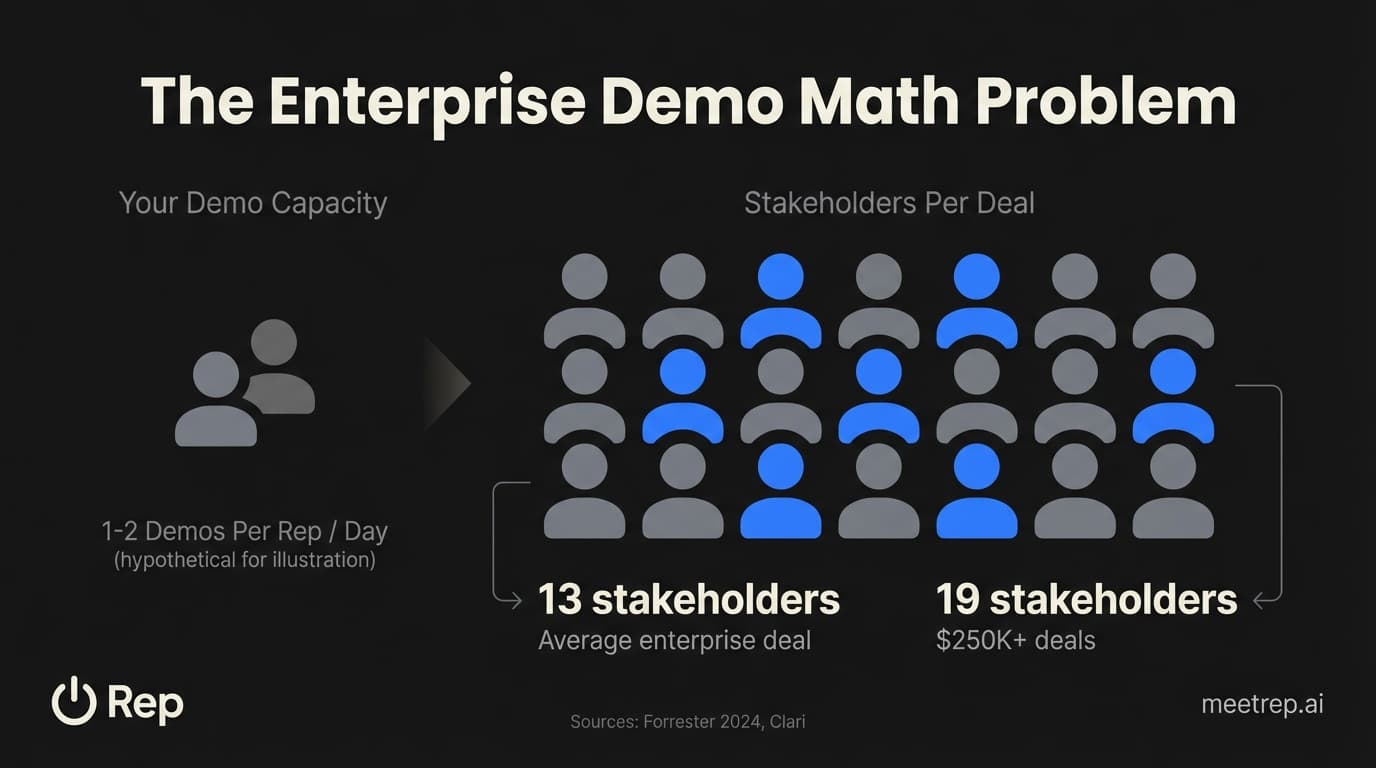

- Enterprise deals involve 13-19 stakeholders on average. Traditional 1:1 demos can't reach them all.

- The median wait time for demos is 5.6 days. That's an eternity when buyers are 80% decided before talking to sales.

- Autonomous AI demos are achieving 40% faster deal cycles—not by replacing salespeople, but by scaling the first touchpoint

Here's a stat that should keep every VP of Sales up at night: 95% of winning vendors are already on the buyer's Day One shortlist.

If you're not on that list? You've got a 5% shot. A coin flip would give you better odds.

And here's the gut punch: 80% of deals are decided before sales conversations even begin. Your buyers are researching, comparing, and shortlisting—all without talking to your team.

I've watched this pattern destroy pipeline at every company I've built. At GoCustomer.ai, we had prospects go dark simply because they couldn't experience the product fast enough. They found someone else who could show them value immediately.

This piece breaks down why traditional enterprise demos are failing, what's actually working in 2025, and how the shift to autonomous demos is changing the game for complex products.

Why Are Enterprise Demos Harder Than SMB?

An enterprise demo differs from SMB in three fundamental ways: stakeholder complexity, timeline, and depth requirements. Where an SMB deal might involve 3-4 people over 30-60 days, enterprise deals bring 13 stakeholders on average (according to Forrester's 2024 research) into buying decisions that stretch 90-180 days or longer.

For deals over $250,000? That number jumps to 19 stakeholders, according to Clari data.

Think about what that means for your demo strategy. You need to reach the CFO who cares about ROI, the IT security lead who wants to know about your architecture, the end users who need to see their daily workflow, and the procurement team who's comparing you to three other vendors. All of them need product exposure. All of them influence the decision.

Traditional 1:1 demos can't scale to this reality.

The Data: According to Gartner research, when buying groups expand to 11+ members, customers experience a 30% reduction in their ability to reach buying decisions. Larger committees don't just slow deals—they actively impair decision-making.

And there's another problem. Enterprise buyers have typically been through 8-9 similar purchase journeys before yours. They know the game. They can smell a generic "harbor tour" demo from a mile away—one that walks through every feature without addressing their specific needs.

So you're fighting on two fronts: reaching more people while delivering more personalized, relevant demonstrations. That math doesn't work with human-only resources.

The 5.6-Day Problem: Why Demo Lag Kills Deals

The median wait time for enterprise demos is 5.6 business days. 38% of prospects wait 6+ days. One in five waits two weeks or more.

That's not a minor friction point. That's a deal killer.

When we built GoCustomer.ai, demo scheduling was consistently the biggest bottleneck we heard about from sales teams. AEs would qualify a prospect, get them excited, then lose momentum waiting for an SE to become available. By the time the demo happened, the prospect had either gone cold or—worse—seen a competitor's product.

What we learned at GoCustomer: The deals we lost weren't usually to better products. They were lost to faster vendors. A prospect who experiences value on day one develops a mental anchor. Everyone else is playing catch-up.

Here's what's changed since then. 75% of B2B buyers now prefer a rep-free sales experience, according to Gartner research. They don't want to wait for your calendar. They don't want to schedule a 30-minute call to see if your product even does what they need.

They want to experience it. Now. On their terms.

Look, responding to leads within the first minute increases conversions by 391%. But with a 5.6-day median demo lag, most enterprise sales teams aren't responding in minutes—they're responding in days.

What Enterprise Buyers Actually Want (Hint: It's Not More Sales Calls)

Let me share something that might feel uncomfortable: two-thirds of buyers prefer to engage with sales only after doing their own research. They're not waiting for your SDR to educate them. They're educating themselves.

The data here is clear and directional. 100% of buyers now expect self-serve options for at least part of the buying journey, according to TrustRadius research. Not most buyers. All of them.

And this isn't a temporary blip. 73% of B2B buyers are Millennials or Gen Z. This generation grew up with Amazon and Netflix. They expect to try before they buy. They expect instant access.

Key Insight: Here's what this means for enterprise demos: your prospects are doing 61% of their buying journey before ever contacting sales (6sense 2025). If you're not giving them product exposure during that invisible phase, you're not on the Day One shortlist. And if you're not on that list, you've already lost.

But here's where it gets interesting for complex products. Enterprise buyers want self-service. But they also need depth. They need their specific questions answered. They need to see how your product handles their particular use case.

Simple click-through tours don't cut it. They work fine for straightforward SaaS products with obvious value propositions. For enterprise software with deep configurability, multiple modules, and complex workflows? Buyers need more.

They need something that can think.

Interactive Demos vs. Autonomous Agents: A Critical Distinction

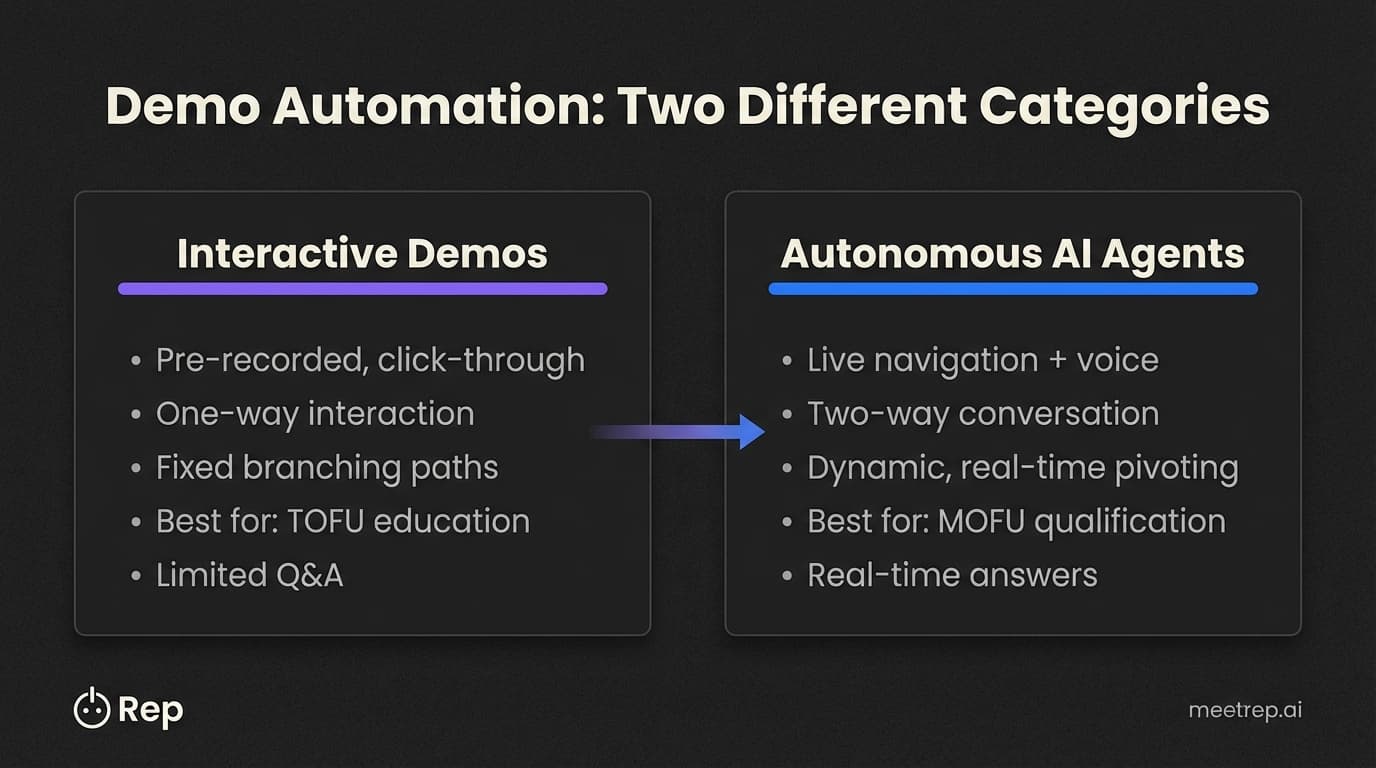

Not all demo automation is the same. And this distinction matters for enterprise sales teams.

Honestly, I see teams conflate these categories all the time. Interactive demos—tools like Navattic, Walnut, and Storylane—capture screenshots or HTML of your product and create guided, click-through experiences. They're fantastic for top-of-funnel education. According to GetContrast.io research with Factors.ai, prospects engaging with interactive demos achieve 24.35% website conversion versus 3.05% for traditional pages. That's a 7.9x improvement.

Navattic's 2025 State of Interactive Product Demos report shows these demos shorten sales cycles by 7 days on average and get prospects to sales calls 2 weeks faster.

Those are real wins. I'm not dismissing them.

But interactive demos have a ceiling. They're pre-recorded. They follow fixed paths. They can't answer the specific question your CFO asks about your pricing model. They can't pivot when a technical buyer wants to drill into your API architecture.

For complex enterprise products, you need something more.

| Factor | Interactive Demos | Autonomous AI Agents |

|---|---|---|

| Format | Pre-recorded, click-through | Live browser navigation + voice |

| Interaction | One-way (click-based) | Two-way (conversational) |

| Personalization | Branching paths | Dynamic, context-aware pivoting |

| Primary use case | TOFU education, website embed | MOFU qualification, discovery |

| Handles questions | Limited (pre-built FAQs) | Real-time (knowledge base) |

| Technology basis | HTML/CSS product captures | Agentic AI + browser automation |

Autonomous agents represent a different category. These are AI systems that can join video calls, share their screen, navigate your actual product in real-time, and hold natural conversations with prospects. Think of it as cloning your best SE—not creating a slideshow of your product.

Common mistake: Teams often assume "demo automation" means click-through product tours. That was the first generation. The technology has moved far beyond screenshots and branching logic. Autonomous agents can now do discovery, answer objections, and qualify prospects—all while navigating a live product environment.

The Economics of Autonomous Enterprise Demos

Let's talk numbers. Only 1 in 3 B2B sales reps consistently meet their quotas in 2025, according to Cloudapps research. Two-thirds of your expensive sales headcount is failing to return value.

Why? One big reason: lead qualification has become the #1 challenge for sellers in 2025, replacing opportunity management as the top pain point. AEs are drowning in unqualified leads while real opportunities slip away because nobody can get to them fast enough.

This is where autonomous demos change the math.

McKinsey research shows companies leveraging autonomous AI sales workflows experience up to 40% faster deal cycles and 50% higher conversion rates. That's not marginal improvement—that's transformation.

Look at what Hunters achieved with demo automation: they cut their sales cycle from 9 months to 4 months—a 50% reduction. Gainsight saw a 25% increase in win rates and 8% improvement in close rates.

The Data:Synack's solutions architecture team was spending 20% of their week—one full working day—on demo building and maintenance alone. After implementing demo automation, they reduced demo build time by 90% (from 100 hours to 10) and recovered that 20% for actual selling.

The enterprise demo problem isn't just about scale. It's about matching resources to where they create value. Your best SEs should be handling complex technical validation and negotiation support—not giving the same introductory demo for the 50th time this quarter.

How Complex Products Get Simpler: A Framework for Enterprise Demo Strategy

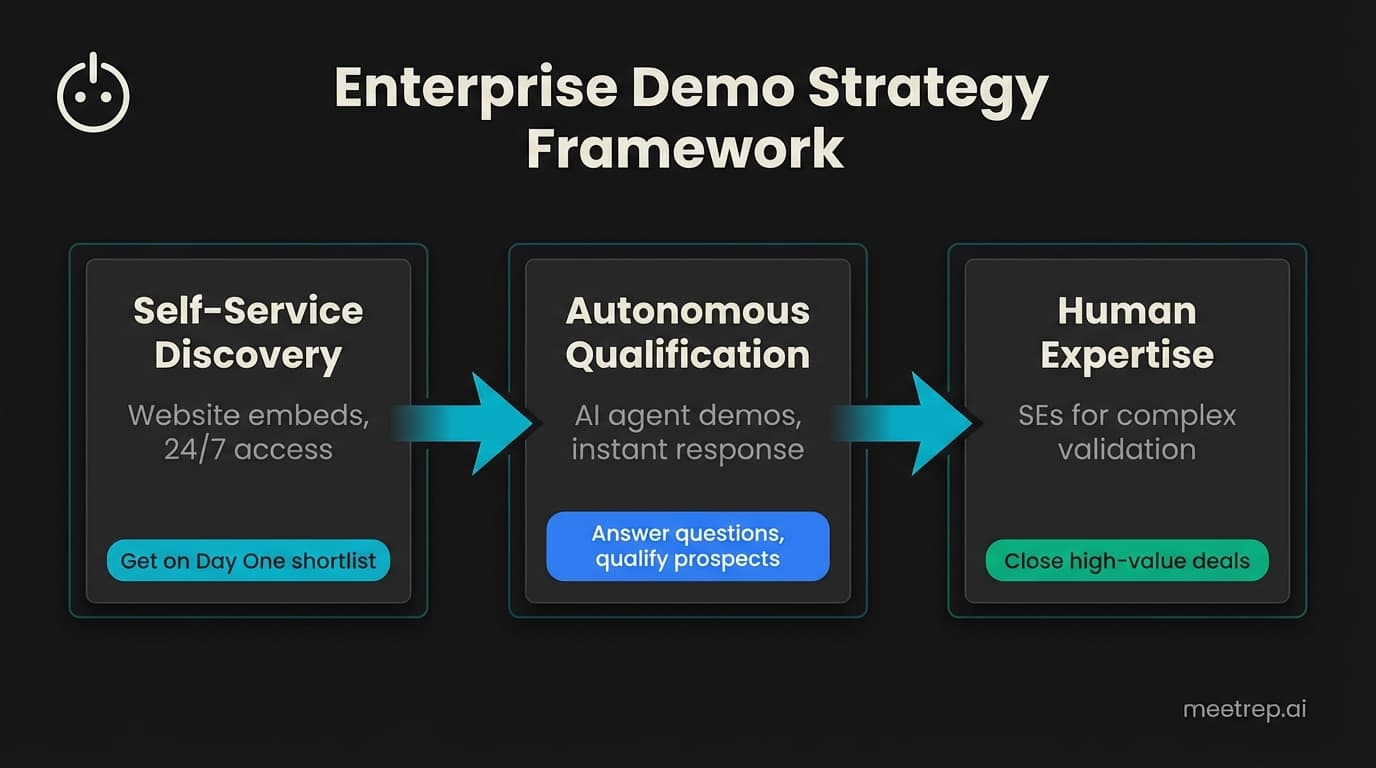

Here's how I think about building an enterprise demo strategy that actually works. My approach breaks down into three layers.

Layer 1: Self-Service Discovery

This is your website embed. Interactive demos that let any prospect explore your product at 2am if that's when they're researching. No scheduling, no friction. The goal here is getting on the Day One shortlist by giving immediate product exposure.

For complex products, this means creating persona-specific paths. The IT buyer sees the security dashboard and API documentation. The business user sees the workflow they'll actually use. The executive sees the ROI dashboard and high-level outcomes.

Layer 2: Autonomous Qualification

This is where autonomous agents earn their keep. A prospect requests a demo. Instead of waiting 5.6 days for a human, they get an AI agent that joins a video call within minutes. The agent shares its screen, walks through the product, and—critically—answers their specific questions.

At Rep, this is exactly what we built. Not a recorded tour, but a live AI participant that navigates your actual product interface. It conducts discovery, handles objections, and extracts insights like pain points and next steps automatically.

Layer 3: Human Expertise for High-Value Moments

Your SEs and AEs step in where human judgment matters most: complex technical validation, executive relationship building, negotiation, and custom solution design. They receive prospects who've already experienced the product and had their initial questions answered.

This isn't about removing humans. It's about deploying them where they're irreplaceable.

Why we built Rep this way: We saw too many deals die in the gap between "interested" and "scheduled demo." Interactive tours helped, but they couldn't handle the back-and-forth that enterprise buyers need. Building an agent that can actually navigate products and hold conversations—that's what closes the gap.

Getting Started Without Getting Stuck in Pilot Purgatory

Here's the thing: there's a warning in the McKinsey State of AI 2025 report: 88% of organizations use AI in at least one function, but only 6% are "high performers" capturing significant EBIT impact.

Why the gap? Most companies bolt AI onto broken processes instead of redesigning workflows around new capabilities.

For enterprise demos, that means you shouldn't just add demo automation to your existing sales motion. You need to rethink the handoff between digital and human touchpoints entirely.

Start with these questions:

What's your demo lag time? If it's over 48 hours, you're losing deals to faster competitors. Autonomous demos can reduce this to minutes.

How many stakeholders typically view your demos? If it's 2-3 but your deals involve 13-19, you have a coverage gap. Self-service and autonomous options let every stakeholder experience your product.

What percentage of demos are initial/discovery versus deep technical? If most demos are repetitive introductions, that's prime territory for automation.

75% of B2B automation decision-makers expect to invest in sales automation in the next 18 months, according to Forrester. By 2027, Gartner predicts 95% of seller research workflows will begin with AI.

The question isn't whether to adopt autonomous demos. It's how fast you can deploy them—and whether you'll be a leader or a follower in this shift.

Enterprise demos have shifted fundamentally. Buyers are 80% through their decision before talking to sales. They're researching at 2am. They're evaluating you against competitors you'll never know about.

My prediction: within 18 months, autonomous demos will be standard for complex enterprise products. Not because the technology is novel—but because the math doesn't work any other way. You can't reach 19 stakeholders with 1:1 human demos. You can't compete for Day One shortlists with 5.6-day response times.

If you're selling complex enterprise software and want to see how autonomous demos actually work, Rep is what we built to solve this problem. An AI that joins video calls, navigates your product live, and has real conversations with prospects—scaling your best SE to every demo request.

The vendors who figure this out first will own their markets. The rest will be fighting for the 5%.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- Why Are Enterprise Demos Harder Than SMB?

- The 5.6-Day Problem: Why Demo Lag Kills Deals

- What Enterprise Buyers Actually Want (Hint: It's Not More Sales Calls)

- Interactive Demos vs. Autonomous Agents: A Critical Distinction

- The Economics of Autonomous Enterprise Demos

- How Complex Products Get Simpler: A Framework for Enterprise Demo Strategy

- Getting Started Without Getting Stuck in Pilot Purgatory

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.