Discovery Call Questions: The Ultimate Framework for 2026

Executive Summary

- The sweet spot is 11-14 questions per discovery call—not 20+

- Won deals feature reps talking 57% of the time; lost deals hit 62%

- Top performers ask 39% more questions than average—but they're asking different questions

- AI should handle "Level 1" data gathering so you can focus on impact questions

- 72% of closed-won deals include a demo during discovery—momentum matters

Here's a stat that should keep every sales leader up at night: 87% of enterprises missed their 2025 revenue targets. Not because they lacked tools. Not because they lacked leads. Because they lacked execution—and that execution gap starts with discovery.

I've spent years building sales automation tools, first at GoCustomer.ai and now at Rep. And I keep seeing the same pattern: teams ask too many questions, talk too much, and fill their pipelines with deals that were never going to close. The data backs this up. But the solution isn't what most sales content tells you.

This guide breaks down exactly how many discovery call questions to ask, what to ask, and how AI is changing the game in 2026—all backed by research from Gong Labs analyzing over 519,000 recorded calls.

What is a discovery call?

A discovery call is the first real conversation between a rep and a prospect who's shown interest. Its purpose is to understand challenges, goals, timeline, and buying process—while figuring out if there's mutual fit. Typically lasting 15-30 minutes, a good discovery call qualifies leads and moves the relationship forward.

But here's what's changed in 2026: buyers don't need information anymore. They've done their research. 80% of B2B sales interactions now occur in digital channels, and prospects are often 70-80% through their buying journey before they ever talk to you.

So discovery isn't about gathering basic facts. It's about diagnosing problems. It's about uncovering the cost of inaction. And it's about doing this without sounding like you're running an interrogation.

Key Insight: Discovery in 2026 isn't about learning what AI could have told you. It's about understanding what only a human conversation can reveal—the business impact, the internal politics, the real urgency.

Why discovery questions make or break your pipeline

67% of buyers rank discovery as the most important part of the sales process. Yet 22% of salespeople say it's the hardest part of their job. That gap explains a lot.

Here's the math that should worry you: 32% of cold calls convert to discovery calls, but only 19% of discovery calls become closed-won. That means 81% of your discovery effort leads nowhere.

Bad discovery doesn't just waste time. It creates a pipeline full of "non-decisions"—deals that sit in your forecast, get pushed quarter after quarter, and never close. I saw this constantly when building GoCustomer. Teams would celebrate booking discovery calls, but the pipeline quality was garbage because reps were qualifying on interest, not pain.

The Data: According to Clari Labs, 64% of sales leaders report losing up to 30% of pipeline due to handoff gaps and data silos. Much of that leakage starts with poor discovery.

The fix isn't asking more questions. It's asking the right questions in the right way.

The 11-14 question framework: what Gong's data actually shows

So what's the magic number? Gong Labs analyzed 519,000+ discovery calls and found that 11-14 questions per call correlates with the greatest success.

But here's where it gets interesting. Won deals averaged 15-16 questions. Lost deals averaged ~20 questions.

Wait—more questions in lost deals? That seems backwards.

It's not. The problem isn't volume. It's approach. When reps fire off 20+ questions back-to-back, prospects shut down. I've heard sales leaders call this "interrogation mode." It kills trust.

| Question Count | Outcome Correlation |

|---|---|

| Under 11 | Too surface-level; insufficient pain uncovered |

| 11-14 | Optimal range; balances depth with conversation |

| 15-16 | Won deals average; questions are spaced and targeted |

| 20+ | Lost deals average; interrogation mode kicks in |

My recommendation: Aim for 11-14 well-placed questions spread throughout the conversation. If you're consistently asking 18-20, you're probably front-loading questions and triggering prospect fatigue.

Top performers ask 39% more questions than average reps—but they distribute them differently. They don't dump questions at the start. They create a tennis match, not a firing squad.

Talk less, win more: the 57% rule

Here's data that might hurt: in closed-won deals, reps talk 57% of the time. In lost deals, they talk 62%.

Five percentage points. That's the difference between winning and losing.

Most reps have the opposite instinct. They think enthusiasm means talking more. They think showing expertise means explaining more. They think "premature pitchulation"—jumping into product pitches before fully understanding pain—shows confidence.

It doesn't. It shows you're not listening.

| Metric | Closed-Won Deals | Lost Deals |

|---|---|---|

| Rep Talk Time | 57% | 62% |

| Prospect Talk Time | 43% | 38% |

| Questions Asked | 15-16 | ~20 |

The sweet spot is roughly 50/50 to 57/43. Top performers hover between 46-57% talk time. And here's what they're doing with that talking time: they're not pitching. They're summarizing what they heard, confirming understanding, and asking follow-up questions.

Key Insight: If your talk ratio is above 60%, you're almost certainly pitching too early. The prospect hasn't told you their real problem yet—you're just guessing.

The Level 1, 2, 3 questioning framework

This framework, popularized by Kyle Asay and the Sales Introverts community, changed how I think about discovery. It's especially relevant in 2026 because it accounts for what AI can (and should) handle.

Level 1: Facts These are data points AI should have already provided: company size, tech stack, the prospect's role, recent funding rounds. If you're asking "Tell me about your role" in 2026, you've already lost. LinkedIn, ZoomInfo, and your CRM should have this.

Level 2: Impact These questions uncover how problems affect daily operations. "How is [Problem X] affecting your team's throughput?" "What happens when that process fails?" "How much time does your team spend on [manual task]?"

Level 3: Business Case These reveal revenue and cost implications. "If you don't solve this by Q3, what's the revenue impact?" "What happens if you do nothing for the next six months?" "What strategic priority is at risk if this project fails?"

| Level | Purpose | Example Question |

|---|---|---|

| Level 1 | Facts (AI should handle) | "How big is your team?" |

| Level 2 | Impact | "How is slow follow-up affecting your conversion rates?" |

| Level 3 | Business Case | "What revenue is at risk if this doesn't improve by Q3?" |

Here's my take: most reps spend 70% of their discovery time on Level 1 questions. That's backwards. AI should gather Level 1 data pre-call. Your job is Level 2 and Level 3.

Gong's research shows that effective discovery uncovers 3-4 business problems—not more, not fewer. Fewer means you haven't found real pain. More means the prospect has too many priorities and nothing will get done.

35 discovery call questions organized by category

Based on Gong's research, the Level 1/2/3 framework, and what we've seen work at Rep, here are questions that actually move deals forward.

Opening questions (build trust first)

Don't start with an interrogation. Start with a conversation.

- "What prompted you to take this call today?"

- "I noticed [company news/achievement]—how has that changed your priorities?"

- "Before we dive in, what would make this a good use of your time?"

Pain and challenge questions (Level 2)

Uncover 3-4 business problems. Go deep, not wide.

- "What's the biggest challenge your team is facing right now?"

- "Walk me through what happens when [process] fails."

- "How is [problem] affecting your ability to hit your goals?"

- "If you could fix one thing about your current process, what would it be?"

- "What have you tried so far? What worked and what didn't?"

- "How much time does your team spend on [manual task] each week?"

Business impact questions (Level 3)

This is where average reps stop and top performers push forward.

- "If this problem doesn't get solved in the next 6 months, what happens?"

- "What revenue is at risk if [situation] continues?"

- "How does this affect your ability to hit your targets this quarter?"

- "What's the cost of doing nothing?"

Budget and authority questions

Multi-threading matters. Closed-won deals have 2x as many buyer contacts as lost deals.

- "Have you allocated budget for solving this problem?"

- "Who else needs to be involved in this decision?"

- "Walk me through your typical buying process for solutions like this."

- "Who would implement this if you moved forward?"

Timeline and urgency questions

- "When do you need this solved?"

- "What's driving the timeline?"

- "Is this a problem you're committed to solving now, or something you're exploring for later?"

Disqualification questions (often skipped)

Look, don't be afraid to qualify out. It saves everyone time.

- "If we can't deliver [key requirement], is that a dealbreaker?"

- "On a scale of 1-10, how committed are you to making a change?"

- "What would cause you to decide not to move forward?"

Next steps questions

- "What would make this a successful next conversation?"

- "If everything aligns, what does your ideal timeline look like?"

- "What information do you need from me before our next call?"

How to structure your discovery call

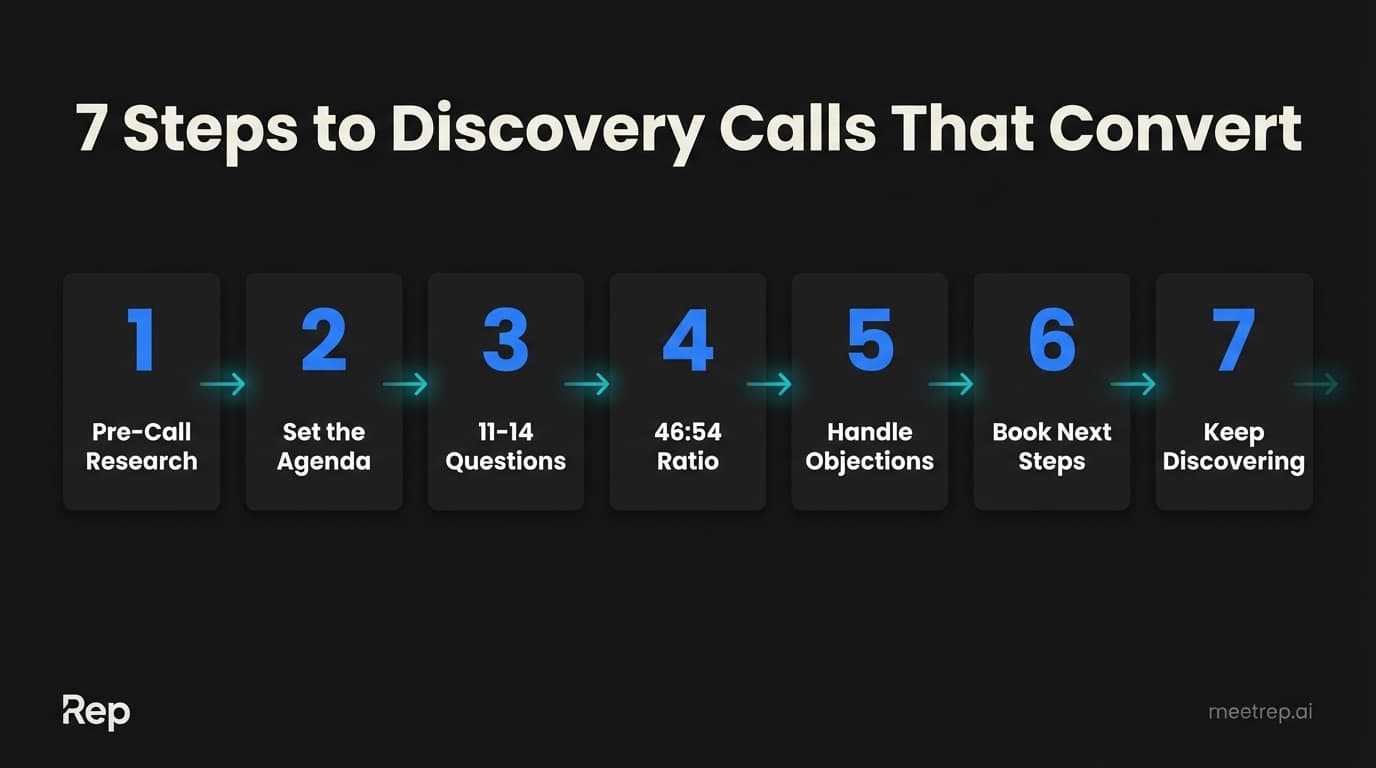

Based on Gong's research and what we've seen work, here's a 7-step structure:

- Open with purpose (2 min) — State the agenda, confirm time, build rapport

- Understand context (3-5 min) — High-level situation (skip if AI provided via pre-call research)

- Uncover challenges (8-10 min) — Level 2 questions; identify 3-4 business problems

- Quantify impact (5-7 min) — Level 3 questions; connect to revenue/cost

- Explore solutions tried (3-5 min) — What's worked, what hasn't

- Map decision process (3-5 min) — Budget, authority, timeline, buying committee

- Establish next steps (2-3 min) — Clear action with specific date

The Data:72% of closed-won deals include a demo during the discovery call, averaging 29 minutes total. If discovery is going well, don't wait to schedule another meeting—show the product while the pain is fresh.

And this is actually why we built Rep. The handoff between discovery and demo is where momentum dies. Prospects wait 5-7 days for a scheduled demo, urgency fades, other priorities take over. Rep's AI agent can deliver a live, interactive demo 24/7—so when a prospect is engaged after discovery, they can see the product immediately.

Discovery call vs. demo call: when to blend

| Aspect | Discovery Call | Demo Call |

|---|---|---|

| Primary Purpose | Understand needs, qualify fit | Showcase capabilities |

| Talk Ratio | 50/50 to 57/43 | 70% rep / 30% prospect |

| Questions Asked | 11-14 strategic | 5-8 confirmation |

| Tone | Exploratory, consultative | Presentational |

| Duration | 15-30 minutes | 30-60 minutes |

But here's the thing—that 72% stat tells you these calls often blend together. For transactional deals with high buyer intent, combining discovery and demo makes sense. For enterprise deals with multiple stakeholders, separate them but don't let too much time pass.

The worst outcome? A great discovery call followed by a demo a week later where you repeat everything because the momentum is gone.

Coaching that actually improves discovery

When managers listen to discovery calls, reps see 30% higher win rates. Yet most managers never listen to calls.

Here's a simple scorecard we use:

| Criteria | Target | Did They Hit It? |

|---|---|---|

| Questions asked | 11-14 | Yes / No |

| Talk ratio | Under 60% | Yes / No |

| Business problems identified | 3-4 | Yes / No |

| Level 1 questions asked | 0-2 max | Yes / No |

| Level 2-3 questions asked | 8+ | Yes / No |

| Multi-threading attempted | Yes | Yes / No |

| Clear next steps secured | Yes | Yes / No |

Tools like Gong and Chorus make this easy. But even without conversation intelligence software, managers can listen to 2-3 calls per week and see patterns.

The Data:Teams using AI-assisted selling achieved 35% higher win rates, according to Gong's analysis of over 1 million opportunities. The AI isn't replacing discovery—it's making it better by surfacing insights and automating the follow-up.

Common discovery call mistakes

1. Interrogation Mode Firing 15+ questions back-to-back. The prospect shuts down. Solution: Space questions throughout. Create a tennis match, not a firing squad.

2. Premature Pitching Jumping into product features before understanding pain. Your 62% talk time means you're not listening. Solution: Don't pitch until you've identified 3-4 business problems.

3. Level 1 Question Dependency Asking "Tell me about your role" when LinkedIn already told you. It signals you didn't prepare. Solution: Use AI enrichment pre-call. Start with Level 2.

4. Single-Threading Only engaging one stakeholder when B2B decisions involve 6-10 people. Solution: Always ask who else needs to be involved.

5. Momentum Killers Great discovery call... demo scheduled for 8 days later... deal stalls. Honestly, this happens more than it should. Solution: Demo while the pain is fresh. This is exactly what Rep helps with—instant, AI-powered demos when the prospect is engaged.

The data is clear: 87% of enterprises missed 2025 targets. The ones who hit their numbers weren't doing anything magical. They were qualifying better, talking less, and moving faster from discovery to demo.

I've seen this pattern over and over building sales tools. The best discovery calls don't feel like discovery calls. They feel like problem-solving sessions between two people trying to figure out if they can help each other.

Start with the 11-14 question framework. Watch your talk ratio. Skip the Level 1 questions. And don't let momentum die between discovery and demo—that's exactly why we built Rep to deliver live AI-powered demos 24/7, so prospects can experience your product while their pain is still fresh.

Your pipeline quality—and your 2026 targets—depend on getting this right.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- What is a discovery call?

- Why discovery questions make or break your pipeline

- The 11-14 question framework: what Gong's data actually shows

- Talk less, win more: the 57% rule

- The Level 1, 2, 3 questioning framework

- 35 discovery call questions organized by category

- How to structure your discovery call

- Discovery call vs. demo call: when to blend

- Coaching that actually improves discovery

- Common discovery call mistakes

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.