Demostack Pricing vs Rep: Cost, Maintenance, and Results Compared

Executive Summary

- Demostack pricing starts at $55,000/year (Standard tier), scaling to $150,000+ for enterprise

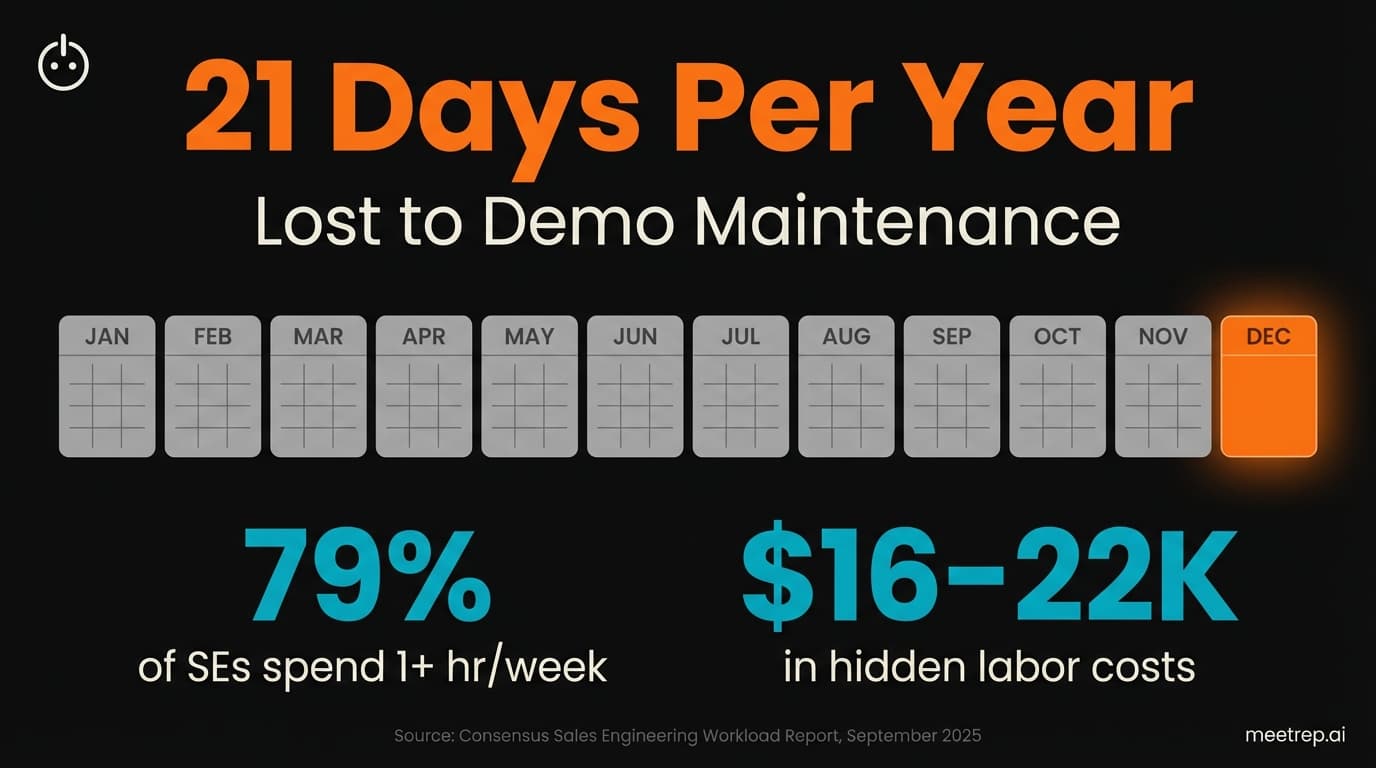

- The hidden cost: SEs spend 21 days per year maintaining demo environments—that's $16,800-$22,000 in labor

- True Year 1 TCO for Demostack: $73,000-$83,000 (not $55,000)

- Rep takes a different approach: live product navigation instead of cloning, which eliminates the rebuild-after-every-update problem

- Choose Demostack for offline demos with sensitive data; choose Rep for scaling live demos 24/7

Is your demo software costing you a month of productivity every year?

That's not a rhetorical question. When I started researching Demostack pricing for this comparison, I expected to write about the $55,000 annual license fee. But the real story isn't the sticker price. It's what happens after you buy.

I've built sales automation tools—first at GoCustomer.ai, now at Rep. And the pattern I see over and over is this: buyers focus on the license fee, then get blindsided by the operational cost. With demo automation tools, that operational cost is maintenance. And it's brutal.

Here's what you need to know before you commit $50K+ to either platform.

How Much Does Demostack Cost? (The Full Pricing Breakdown)

Demostack pricing starts at $50,000-$55,000 per year for the Standard plan, which includes 10 users and 1 application. This isn't speculation—I verified it across eight independent sources including Demostack's official pricing page, Navattic, Storylane, and SmartCue.

Here's the tier breakdown:

| Tier | Annual Price | Users | Apps | Mobile Demos |

|---|---|---|---|---|

| Standard | $50,000-$55,000 | 10 | 1 | No |

| Plus | $75,000 | 25 | 1 | No |

| Pro | $100,000 | 50 | 1 | Yes |

| Platinum | $150,000 | 100 | 2 | Yes |

Notice something? Mobile demos only unlock at the $100,000 Pro tier. If you need to demo on mobile devices—and in 2026, many buyers do—you're looking at six figures before you even talk about implementation.

And then there are onboarding fees. According to SmartCue's analysis, these range from $5,000 (Essentials) to $10,000 (Elite).

Common mistake: Most buyers accept list price without negotiating. But Vendr marketplace data shows the average negotiated deal is $32,000—not $55,000. That's a $23,000 difference. My recommendation: if you're going with Demostack, start your negotiation at $32K and work up.

The Hidden $18,000 Tax: Why Cloning Creates a Maintenance Nightmare

Here's where the math gets uncomfortable.

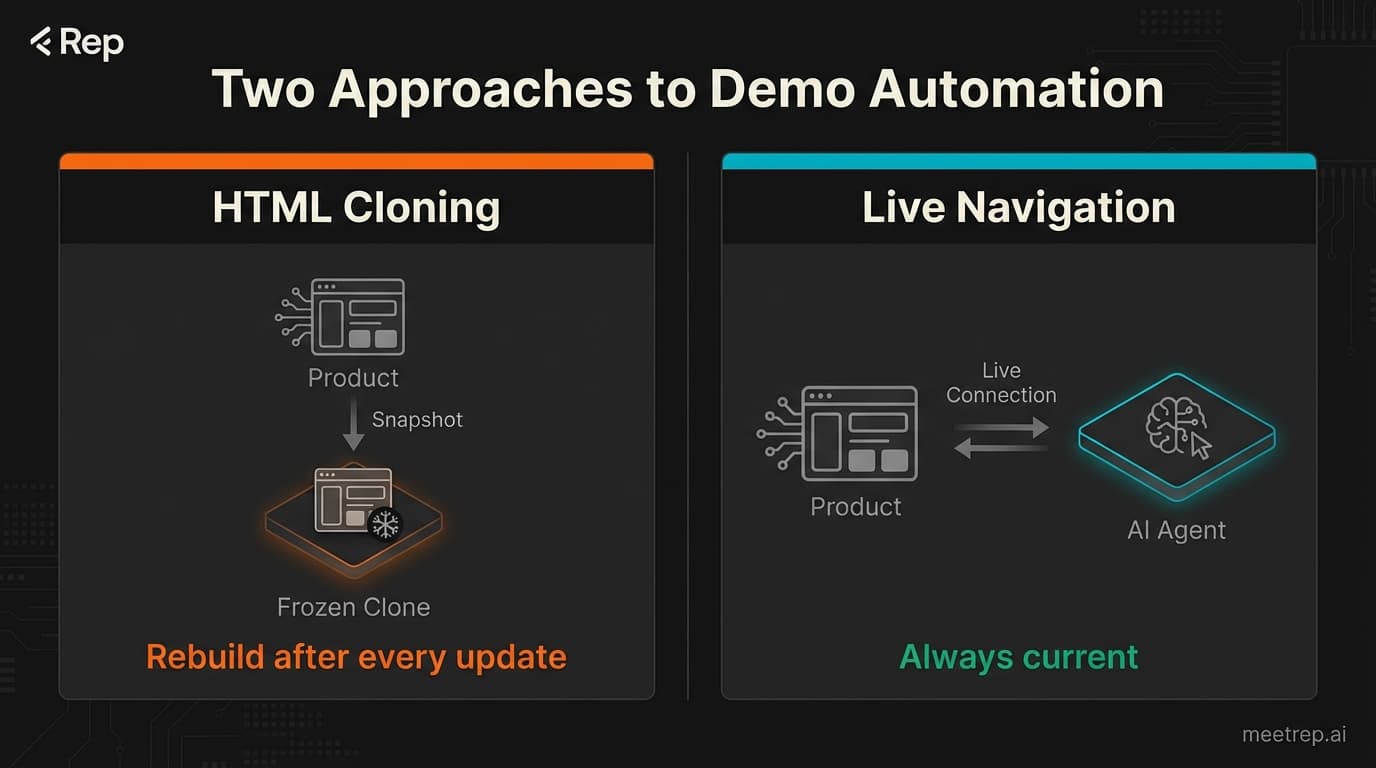

Demostack uses HTML cloning technology. It captures your product's frontend at a specific moment in time, creating a sandboxed replica. The clone looks and feels like your real product. That's the upside.

The downside? Every time your product updates, you need to rebuild your demos.

Don't take my word for it. Here's what Declan T., an Account Executive at an enterprise company, wrote in his G2 review on January 6, 2025:

"One another drawback is the ongoing maintenance required when using Demostack. Since it captures your product at a specific moment in time, any updates or changes made to the actual product necessitate recreating all existing clones from scratch."

Recreating all existing clones from scratch. Let that sink in.

The Data: According to the Consensus Sales Engineering Workload Report (September 2025), 79% of Sales Engineers spend more than 1 hour per week cleaning and maintaining demo environments. That adds up to 21 days per year of lost productivity—just on maintenance.

So what does that actually cost?

If your SE makes $120,000/year (fully loaded), that's roughly $800/day. Multiply by 21 days: $16,800 in maintenance labor. For a senior SE making $150K+, you're looking at $22,000+.

Your $55,000 license just became a $73,000-$83,000 commitment. That's the real TCO.

My take: Demostack's case studies emphasize initial time savings—Synack cut demo build time from 100+ hours to under 10. But those case studies don't mention the ongoing maintenance burden. The first month is fast. Month 12? That's when the clone drift catches up.

How HTML Cloning Demos Actually Work

Let me explain the technical reality, because it matters for your decision.

Demostack's cloning technology captures your product's Document Object Model (DOM)—the HTML, CSS, JavaScript, animations, iFrames, pop-ups, and tooltips. The cloner learns how your backend responds to browser requests, then simulates those responses during playback. According to Demostack's product documentation, this creates a "1:1 replica" separated from your production system.

Gartner's Market Guide for Interactive Demonstration Applications (July 2024) classifies this as "Front-End Cloning"—distinct from video-based demos, screen capture, or live product with simulated data.

The strengths are real:

- Demos work offline (trade shows, areas with poor WiFi)

- Sensitive data stays out of the demo environment

- Complex enterprise demo software products can be shown without production access

But the weakness is architectural. Clones are snapshots. Products change. The snapshot becomes outdated. You rebuild.

Why we built Rep this way: When we designed Rep's architecture, we made a deliberate choice: live product navigation instead of cloning. Rep joins your video call, shares its screen, and controls a real browser connected to your actual product. When your product updates, Rep's demos update automatically—because it's navigating the live product, not a frozen snapshot. No rebuilding. No clone drift. The trade-off? Rep requires your product to be accessible live. You can't demo offline at a trade show. But for the 90% of demos that happen over video calls, the maintenance math is dramatically different.

Rep vs Demostack: Head-to-Head on 8 Critical Factors

Let's compare directly. Honestly, I'll tell you where Demostack wins too.

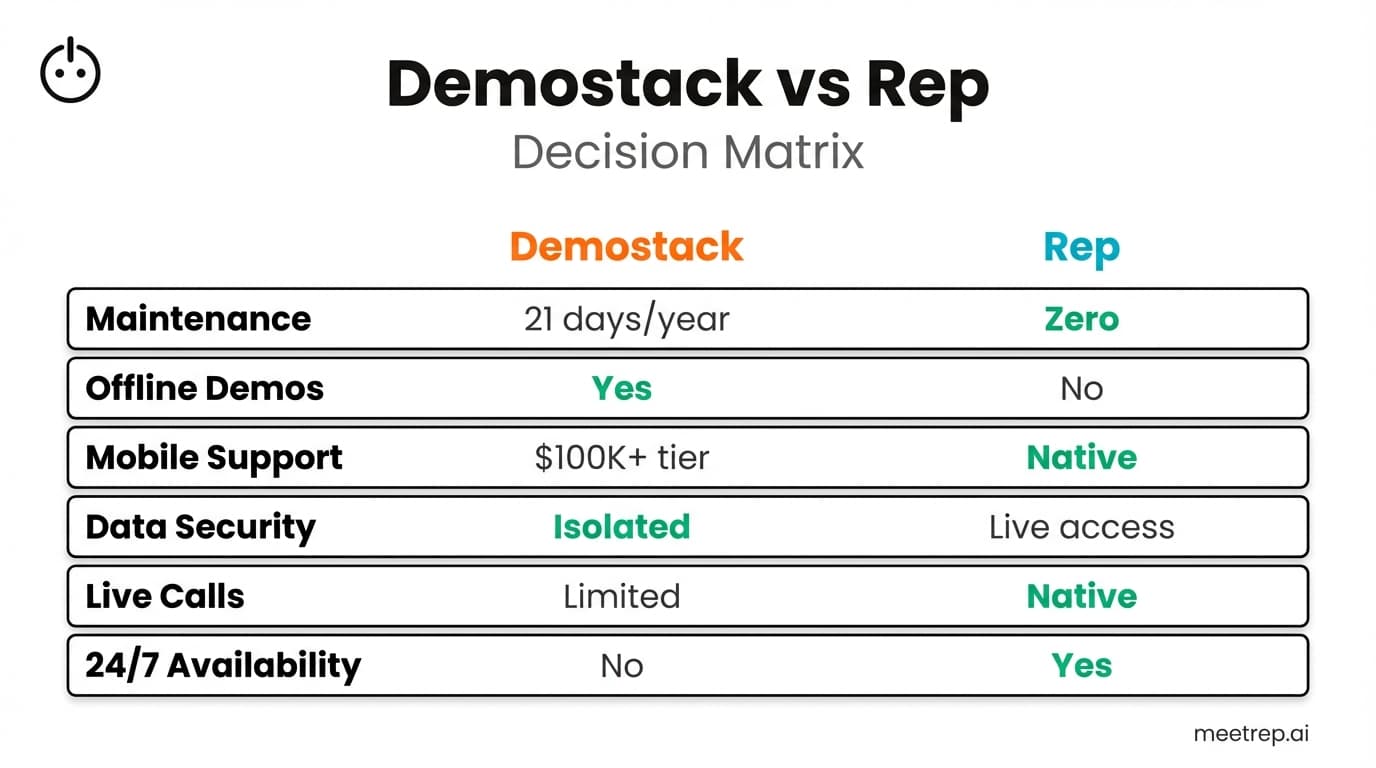

| Factor | Demostack | Rep | Winner |

|---|---|---|---|

| Base Price | $55,000/year | Contact for quote | Depends on scale |

| Maintenance Burden | 21 days/year (clone rebuilds) | Zero (live navigation) | Rep |

| Implementation Time | 4-6 weeks | Varies by training approach | Tie |

| Mobile Support | $100K tier only | Native browser (responsive) | Rep |

| Offline Demos | Yes | No | Demostack |

| Data Security | Sandbox isolated from production | Requires live product access | Demostack |

| Live Call Support | Limited | Native (joins video calls) | Rep |

| Proven Results | 8-50% cycle reduction | 25-37% revenue lift | Context-dependent |

A few things stand out.

Demostack wins cleanly on offline demos and data isolation. If you're at trade shows with spotty WiFi, or your product contains HIPAA/PCI-sensitive data that can't be exposed in live demos, Demostack's sandbox approach is the right architecture. Full stop.

Rep wins on maintenance and live engagement. If your product updates frequently—weekly deploys, monthly releases—the "rebuild from scratch" reality will eat you alive. And if you need demos to happen 24/7 without SE involvement, Rep's autonomous agent model fits better.

The results row is interesting. Demostack's case studies emphasize efficiency metrics: Gainsight saw 8% higher close rates, Hunters cut sales cycles by 50%. Rep's case studies emphasize revenue metrics: Satya Jewelry saw 37% higher AOV, Sydney Art Store saw 25% higher conversion. Different measures, different use cases.

What Demostack Gets Right (Fair Assessment)

Look, I'm not here to trash Demostack. They've built a legitimate enterprise demo solution, and for certain use cases, it's the right choice.

Here's what their customers genuinely appreciate:

According to G2 reviews, Yoni F., a Solutions Director, noted: "Within 10-15 minutes we can clone our entire environment." Thiely M., Head of Sales at a mid-market company, praised the "ability to modify everything from UI to data points."

The G2 scores tell a similar story:

- Quality of Support: 9.6/10 (vs Walnut 9.2)

- Live Demonstration: 9.1/10

- Demo Creation: 9.0/10

- TrustRadius Rating: 9.9/10

When the clone is fresh, it's excellent. The challenge is keeping it fresh.

Demostack's case studies are impressive for companies that fit their model:

- Gainsight: 25% win rate growth, 8% close-win increase

- Hunters: Sales cycle cut from 9 months to 4 months (50% reduction)

- Synack: Demo build time dropped from 100+ hours to under 10

But notice the pattern. All of these emphasize the initial efficiency gain. None of them quantify ongoing maintenance labor. That's not an accident.

When to Choose Demostack (Honest Recommendation)

Choose Demostack if:

- You need offline demos. Trade shows, conferences, customer sites with restricted networks—if internet access is unreliable, you need a sandbox.

- Your product contains sensitive data. Healthcare, financial services, any environment where showing real data (even demo data) creates compliance risk. Demostack's isolation model is built for this.

- Your product updates infrequently. Quarterly releases? Annual cycles? The maintenance burden stays manageable when you're not rebuilding monthly.

- You have SE bandwidth for maintenance. If your team has capacity for 21+ days/year of demo upkeep, and the alternative is hiring additional SEs, the math might work.

- You can negotiate the price. Remember: Vendr shows $32K average vs $55K list. Start low.

Don't choose Demostack if your product ships weekly updates, if you lack SE bandwidth for maintenance, or if you need mobile demos but can't justify $100K/year.

When to Choose Rep (Honest Recommendation)

Choose Rep if:

- You need 24/7 demo availability. Rep operates as an autonomous AI agent that joins video calls, shares its screen, and walks prospects through your product in real-time. No scheduling, no SE bottlenecks.

- Your product updates frequently. Weekly deploys? Monthly releases? Because Rep navigates your live product, updates happen automatically. No rebuilding.

- You want to cut your SE demo load by 60%+. According to Consensus research, Sovos achieved a 67% reduction in live SE calls with demo automation. That's time your SEs can spend on complex technical evaluations instead of repetitive first-touch demos.

- You prioritize revenue impact over demo fidelity. My take: our case studies show 25-37% lifts in conversion and AOV. The demos aren't pixel-perfect replicas—they're live product experiences with an AI guide.

Don't choose Rep if you require offline demos, if your product can't be demoed live (sensitive data restrictions), or if you need absolute control over every visual detail.

The Market Context: Why This Decision Matters Now

The demo automation market isn't slowing down. According to Grand View Research, the sales enablement platform market hit $5.23 billion in 2024 and is projected to reach $12.78 billion by 2030—a 16.3% CAGR.

But the bigger shift is buyer behavior.

Gartner's research (2024) found that 61% of B2B buyers prefer a rep-free experience. They want to evaluate on their own terms, on their own schedule.

And buying committees are getting bigger. The Consensus Sales Engineering Report (September 2025) documented a 19% increase in stakeholders—from 4.8 to 5.9 people involved in the average B2B purchase.

More stakeholders. Preference for self-serve. Limited SE time.

That's the equation you're solving. Both Demostack and Rep address it. They just approach it differently.

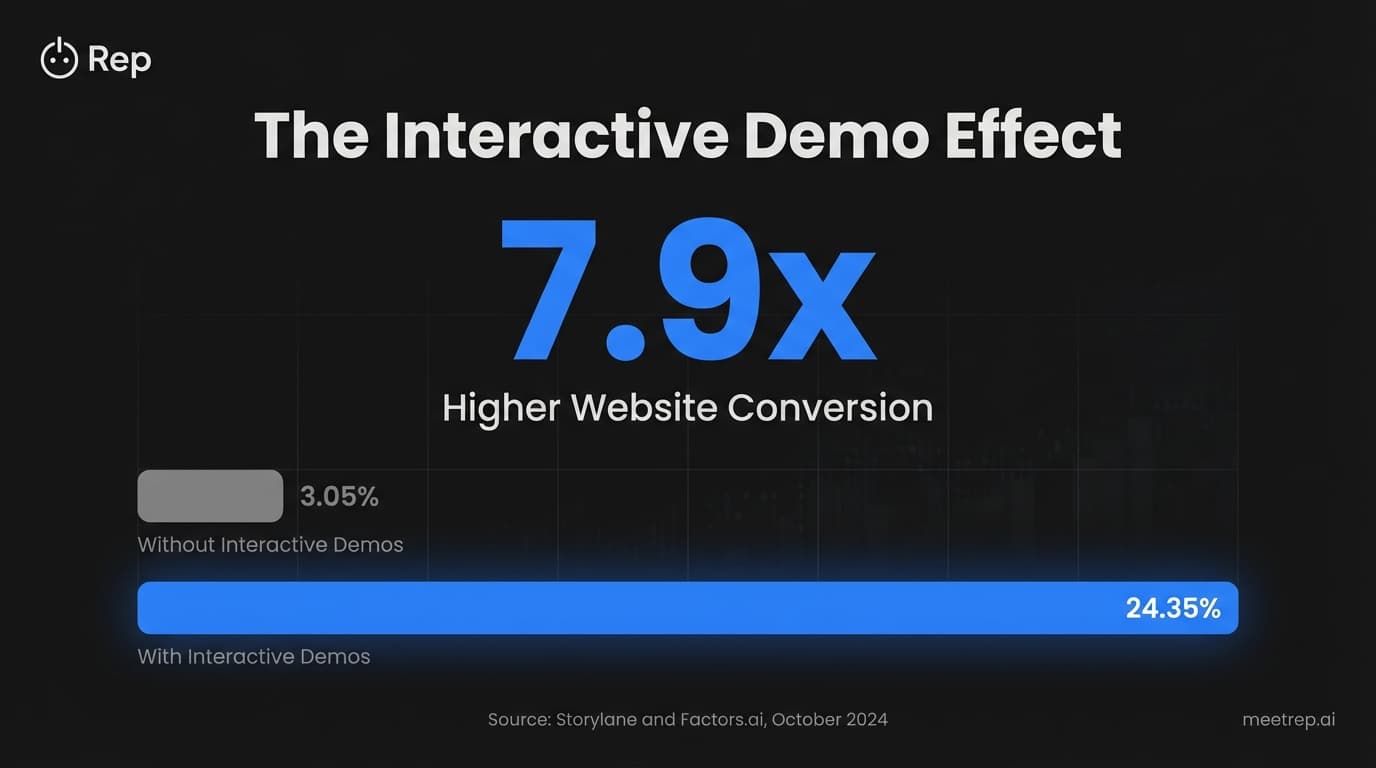

The Data:Storylane and Factors.ai research (October 2024) found companies with interactive demos see 7.9x higher website conversion rates (24.35% vs 3.05% baseline). The "should we automate demos" question is settled. The question now is how.

The demo automation decision isn't just about price. It's about maintenance philosophy, product update cycles, and what you're actually trying to achieve.

If you need isolated sandboxes for sensitive data or offline environments, Demostack's cloning model is purpose-built for that. But if you're like most B2B teams—shipping frequent updates, scaling demos across time zones, trying to reduce SE bottleneck—the maintenance tax matters more than the license fee.

We built Rep because we got tired of the clone-and-rebuild cycle. Frankly, your prospect doesn't care whether they're seeing a snapshot from last month or your live product. They care whether the demo answers their questions. And when your demos update automatically because they're running against your actual product, you stop spending 21 days a year on maintenance theater.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- How Much Does Demostack Cost? (The Full Pricing Breakdown)

- The Hidden $18,000 Tax: Why Cloning Creates a Maintenance Nightmare

- How HTML Cloning Demos Actually Work

- Rep vs Demostack: Head-to-Head on 8 Critical Factors

- What Demostack Gets Right (Fair Assessment)

- When to Choose Demostack (Honest Recommendation)

- When to Choose Rep (Honest Recommendation)

- The Market Context: Why This Decision Matters Now

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.