Demo Automation ROI Calculator: Why the Math Favors AI Over Headcount in 2026

Executive Summary

- A single SE costs $167K-$200K+ fully loaded; SDRs run $110K-$150K

- 78% of deals go to the first company that responds—and your average response time is probably 42+ hours

- Demo automation ROI comes from three places: headcount savings, speed-to-lead gains, and SE capacity recovery

- Real results: Gainsight saw 25% higher win rates; Hunters cut sales cycles by 50%

- The math favors AI when your deal sizes exceed $10K and you have repeatable demos

Your Sales Engineers cost $167,000 a year. Fully loaded, probably closer to $200K.

And right now, they're spending 30% of their time on demos that go nowhere—unqualified prospects who were never going to buy. Meanwhile, 44% of your inbound leads arrive outside business hours, when nobody's there to respond. Those leads? They're going to your competitor who responds first.

I've built sales automation products for years. At GoCustomer.ai, we learned a painful truth: the biggest revenue killer isn't bad demos. It's slow response. When we started measuring demo automation ROI, we realized most companies were calculating it wrong.

Here's how to calculate it right.

What Is Demo Automation ROI?

Demo automation ROI is the financial return from replacing or augmenting human-led product demos with AI-driven solutions. You calculate it by measuring headcount savings (what you don't hire), speed-to-lead gains (deals you win by responding faster), and capacity recovery (what your SEs do with freed-up time).

That's the textbook answer. But here's what it actually means.

Most ROI calculations focus on efficiency. "We'll save X hours per demo." That's fine, but it misses the bigger picture. The real ROI comes from three places:

1. Deals you're currently losing to slow response.According to MIT and InsideSales research, responding within 5 minutes makes you 21x more likely to qualify a lead compared to waiting 30 minutes. And LeadAngel's 2025 data shows 78% of customers buy from whoever responds first.

2. SE time recovered from unqualified demos.Consensus research shows 30% of demos go to prospects who were never going to close. That's your $80/hour SE sitting through harbor tours that waste everyone's time.

3. After-hours coverage.LeadAngel found that 44% of leads arrive outside business hours. If you're not covering that window, you're invisible to nearly half your prospects.

Key Insight: The biggest demo automation ROI driver isn't efficiency—it's capturing the 44% of leads that arrive when your team is asleep.

The True Cost of Human Demos (Most Leaders Underestimate This)

Let me break down what a human demo actually costs. Not the salary number. The real number.

Sales Engineers are your most expensive demo resource. The Bureau of Labor Statistics puts median SE salary at $121,520. But Consensus's 2025 SE Compensation Report shows the real picture: $123,946 base plus $43,337 in variable compensation equals $167,283 in total comp. RepVue's data puts OTE even higher—$140K base with $200K total.

Add benefits, tools, and overhead? You're looking at $200K+ fully loaded.

SDRs who handle initial demos aren't cheap either. Martal Group's June 2025 analysis shows fully loaded SDR cost hits $110,000-$150,000 annually. That's salary plus benefits, tools ($3-5K/year), training, and management overhead.

But the salary is just the start.

The 5 Hidden Costs of Human Demos

- Ramp time bleeds cash. SaaStr and Salesso's 2025 data shows SDRs take 3.2-5.7 months to ramp. That's 3-6 months of salary with zero productivity.

- Turnover compounds the problem. Average SDR tenure is just 14-18 months. You get maybe one year of full productivity before you're recruiting and ramping again.

- Selling time is shockingly low. Salesforce reports that sales reps spend only 28% of their time actually selling. The other 72%? Admin, prep, CRM updates, meetings about meetings.

- Unqualified demos burn SE hours. 30% of demos go to unqualified prospects. At $80/hour for SE time, that's real money walking out the door.

- Demo environments need maintenance. Industry data shows SEs spend 21 days per year just cleaning and maintaining demo environments. That's a month of your most expensive technical talent doing housekeeping.

The Data: A single SDR costs $110K-$150K fully loaded. With 14-18 month average tenure and 3-6 month ramp, you get less than one year of full productivity per hire. | Source: Martal Group 2025, SaaStr 2025

The Speed-to-Lead Crisis (This Is Where You're Bleeding Money)

Here's a number that should make you uncomfortable.

The average B2B company takes 42-47 hours to respond to an inbound lead. Not 42 minutes. 42 hours.

And the data on what this costs you is brutal.

InsideSales analyzed 55 million activities and found that only 0.1% of inbound leads get engaged within 5 minutes. One tenth of one percent. Amplemarket and Forbes found that 71% of B2B leads never get a response at all—30% are never even contacted.

Sound familiar?

So what does this actually mean in dollars?

If 78% of deals go to the first responder, and your competitor has an AI agent that responds in 60 seconds while your team takes 42 hours, you're not competing. You're donating leads to them.

What we learned at GoCustomer: When we built sales automation tools, the single biggest lift came from response time. Not email copy. Not sequences. Response time. Cutting response from hours to minutes moved pipeline more than any other change we made.

The math is simple. If you respond in under 5 minutes, you're 21x more likely to qualify the lead. If you wait 30 minutes, you've already lost most of them. Wait 42 hours? You're fighting over scraps.

And remember—44% of your leads arrive outside business hours. Unless you're staffing a night shift (you're not), those leads sit until morning. By then, they've already talked to someone else.

Headcount vs. AI Agent: The Side-by-Side Comparison

Let's compare what you get from a human hire versus an AI demo agent. No spin. Just the numbers.

| Metric | Human SDR/SE | AI Demo Agent |

|---|---|---|

| Annual Cost | $110K-$200K (fully loaded) | $6K-$100K (platform dependent) |

| Availability | 40 hrs/week (Mon-Fri) | 168 hrs/week (24/7) |

| Response Time | 42-47 hours average | Under 1 minute |

| Demo Capacity | 15-20 demos/week | Unlimited concurrent |

| Ramp Time | 3-6 months | Days to weeks |

| Consistency | Variable (good days, bad days) | 100% on-script |

| After-Hours Coverage | 0% (unless night shift) | 44% of leads captured |

| Turnover Risk | High (14-18 month tenure) | None |

But here's where I need to be honest. AI agents aren't magic. They handle initial discovery and qualification well. They can't close complex enterprise deals. They can't handle political dynamics or customize deeply technical proofs of concept.

The right comparison isn't "replace all humans with AI." It's "which tasks should AI handle so humans can focus on high-value work?"

Common mistake: Comparing AI demo agents to your best AE. That's the wrong comparison. Compare them to the repetitive intro demos your SEs hate doing—the ones that burn their time and rarely close.

The Demo Automation ROI Formula

Here's how to actually calculate your ROI. I'll give you the formula, then walk through an example.

Step 1: Calculate current demo cost (SE hourly rate × hours per demo × demos per month)

Example: $80/hr × 3 hours × 40 demos = $9,600/month

Step 2: Add unqualified demo waste (unqualified demo % × demos × hours × hourly rate)

Example: 30% × 40 demos × 3 hours × $80/hr = $2,880/month wasted

Step 3: Calculate speed-to-lead loss (after-hours leads × monthly lead volume × average deal value × win rate)

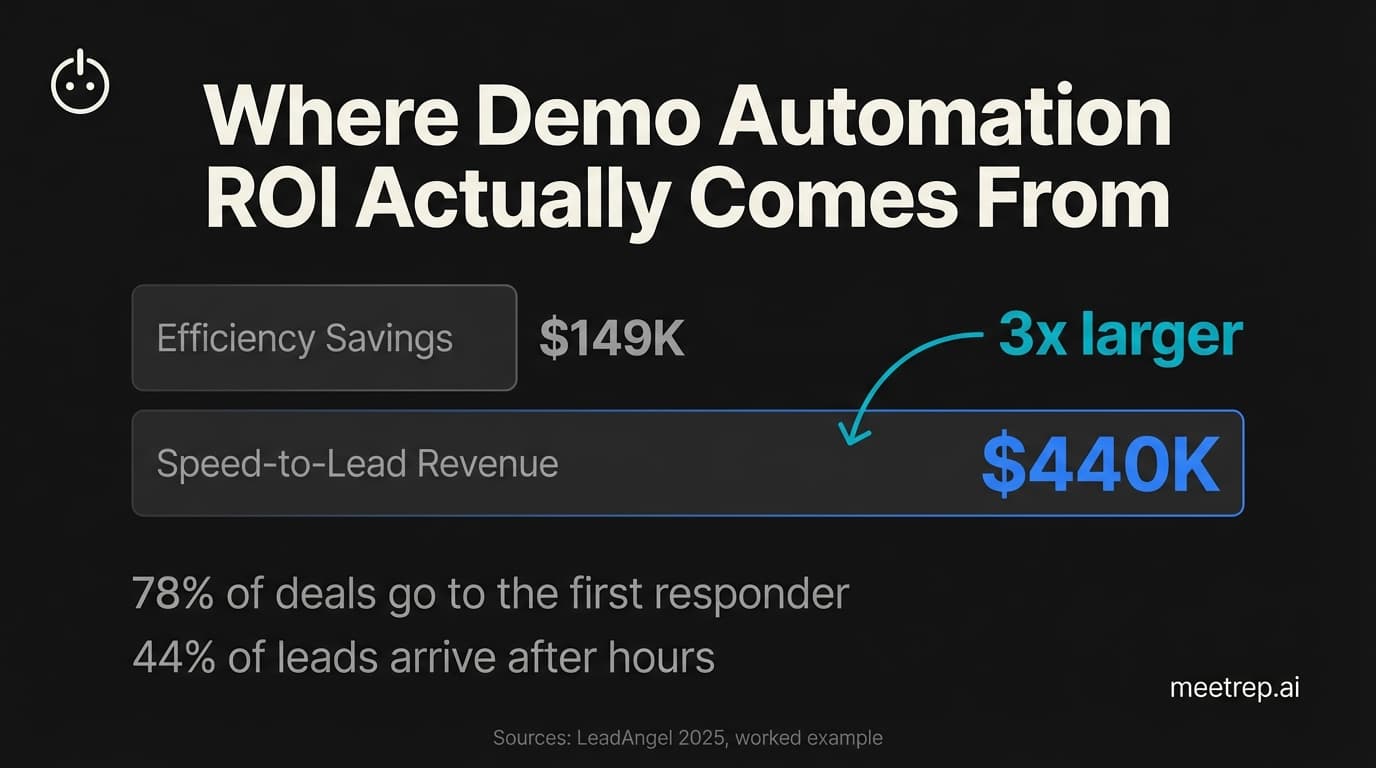

Example: 44% × 100 leads × $50K ACV × 20% win rate = $440,000/year in missed opportunity

Step 4: Subtract platform cost Monthly license fee

Example: $3,000/month = $36,000/year

Step 5: Calculate annual ROI Monthly savings × 12 + recovered revenue - platform cost

Example:

- Demo cost savings: ($9,600 + $2,880) × 12 = $149,760/year

- After-hours revenue recovered: $440,000/year

- Platform cost: -$36,000/year

- Net first-year ROI: $553,760

Now, your numbers will differ. Maybe your deal size is smaller. Maybe you have fewer demos. But the formula works regardless—plug in your actuals and see where you land.

Key Insight: Most ROI calculators only count the demo cost savings ($149K in this example). They completely miss the speed-to-lead revenue ($440K). That's where the real money hides.

Real Results: What Gainsight, Hunters, and Sovos Actually Achieved

Enough theory. What happens when companies actually implement this?

Gainsight (enterprise customer success platform) saw a 25% increase in win rates and 8% higher close-win rate using Demostack. Their response time went from days to under an hour. David Greene, their Sr. Manager of SC Enterprise, specifically called out the response time improvement as the driver.

Hunters (cybersecurity company) cut their sales cycle from 9 months to 4 months—a 50% reduction. When you're selling to enterprise security teams, that kind of acceleration changes your entire business model.

Sovos (compliance software) achieved a 67% reduction in live SE calls, 60% faster SMB sales cycle, and eliminated a 2-week demo lag. Duston Littlefield, their Director of Presales, noted that they freed up SE capacity for the deals that actually needed technical depth.

Coupa influenced over $10 million in ARR through interactive demos using Navattic. That's not incremental improvement. That's material pipeline impact.

Trainual saw a 450% lift in free trial signups—nearly 5x improvement from adding self-serve demos.

The pattern? Companies that implement demo automation well see three outcomes: faster response times, higher conversion rates, and freed-up SE capacity for complex deals.

The Real Price Tag: Demo Automation Platform Costs

Let's talk about what this actually costs. Vendors don't always make this clear, so here's what the market looks like:

The range is massive—from $500/year for basic tools to $100K+ for enterprise platforms with live environment cloning.

Here's the key comparison: even the most expensive platform (Demostack at $75K+) costs less than half of a single SE's fully loaded compensation ($167K-$200K). And that platform can run unlimited concurrent demos, 24/7, without vacation days or sick leave.

Industry data suggests companies using sales automation see $5.44 return for every dollar spent. That's not a typo. Five to one.

When Demo Automation Doesn't Make Sense (Honest Assessment)

I could tell you demo automation is perfect for everyone. But that would be wrong.

Don't automate if your deal sizes are under $10K. The math doesn't work. Platform costs of $6K-$20K/year need deal flow to justify them. If you're closing $5K deals, the ROI gets thin fast.

Don't automate if your product requires hands-on physical demos. Hardware companies, manufacturing equipment, anything that needs to be touched—automation can supplement but not replace.

Don't automate if you're still finding product-market fit. Your demo script will change weekly. You'll spend more time updating the platform than actually demoing.

Don't automate if your sales process has zero repeatability. Every demo completely custom? No standard flow? Automation needs patterns to work.

And here's the uncomfortable truth: 95% of enterprise AI initiatives fail, according to MIT research. The failures usually come from:

- Trying to automate too much too fast

- No clear success metrics before launch

- Lack of ongoing optimization

- Forcing AI into processes that need human judgment

The solution? Start small. Pilot on one product line or region. Measure for 90 days. Then decide whether to expand.

The Data: According to Forrester's October 2024 survey, two-thirds of organizations would consider an AI investment successful with less than 50% ROI. The bar is lower than you think—but you still need to clear it.

Making the Business Case to Your CFO

Your CFO doesn't care about "efficiency." They care about revenue impact, cost reduction, and risk mitigation.

Frame demo automation in those terms:

Revenue protection: 78% of deals go to the first responder. If your competitors respond faster, you lose those deals. Demo automation makes you the first responder, always.

Cost reduction: One SE costs $167K-$200K+ fully loaded. One platform costs $6K-$100K. Even at the high end, you're buying 3-4x the demo capacity for half the price.

Capacity multiplication:70% of sales deals need presales support. Your SEs are the bottleneck. Automation handles the repetitive demos so SEs focus on technical deep-dives that actually close deals.

Risk mitigation: Unlike a new hire who might not work out (remember that 14-18 month tenure), platforms can be piloted, measured, and adjusted. Lower commitment, faster feedback.

Track these metrics post-implementation:

- Response time (target: under 5 minutes for 90%+ of leads)

- Demo-to-meeting conversion rate

- SE time allocation (strategic vs. repetitive demos)

- Sales cycle length

- After-hours lead capture rate

The first 90 days matter most. Month one: implement and baseline. Month two: optimize and A/B test. Month three: calculate actual ROI against projections.

The efficiency mandate isn't going away. Gartner's Robert Blaisdell said it clearly: "CSOs must contend with significant headwinds... increased productivity demands... and effectively managing or even reducing costs."

At Rep, we built our autonomous demo platform because we saw the same patterns at GoCustomer. Speed wins deals. Coverage beats capacity. And your best SEs shouldn't waste time on intro demos that go nowhere.

The math is straightforward. Run the numbers with your own data. If the ROI is there—and for most B2B companies with $10K+ deal sizes, it is—don't hire another SDR until you've tested automation first.

Nadeem Azam

Founder

Software engineer & architect with 10+ years experience. Previously founded GoCustomer.ai.

Nadeem Azam is the Founder of Rep (meetrep.ai), building AI agents that give live product demos 24/7 for B2B sales teams. He writes about AI, sales automation, and the future of product demos.

Frequently Asked Questions

Table of Contents

- What Is Demo Automation ROI?

- The True Cost of Human Demos (Most Leaders Underestimate This)

- The Speed-to-Lead Crisis (This Is Where You're Bleeding Money)

- Headcount vs. AI Agent: The Side-by-Side Comparison

- The Demo Automation ROI Formula

- Real Results: What Gainsight, Hunters, and Sovos Actually Achieved

- The Real Price Tag: Demo Automation Platform Costs

- When Demo Automation Doesn't Make Sense (Honest Assessment)

- Making the Business Case to Your CFO

Ready to automate your demos?

Join the Rep Council and be among the first to experience AI-powered demos.

Get Early AccessRelated Articles

Hexus Acquired by Harvey AI: Congrats & What It Means for Demo Automation Teams

Hexus is shutting down following its acquisition by Harvey AI. Learn how to manage your migration and discover the best demo automation alternatives before April 2026.

Why the "Software Demo" is Broken—and Why AI Agents Are the Future

The traditional software demo is dead. Discover why 94% of B2B buyers rank vendors before calling sales and how AI agents are replacing manual demos to scale revenue.

Why Autonomous Sales Software is the Future of B2B Sales (And Why the Old Playbook is Dead)

B2B sales is at a breaking point with quota attainment at 46%. Discover why autonomous 'Agentic AI' is the new standard for driving revenue and meeting the demand for rep-free buying.